XRP, the cryptocurrency of the XRP ledger, is up 3% during Monday’s U.S. market hours. Despite the intraday uptick, the daily candle shows a notable rejection wick around the psychological level of $3. This overhead supply raises market concern about whether the recent rally has pushed the Ripple crypto to an overbought region.

XRP Derivatives Market Data Backs Bullish Rally

Since last week, the XRP price has bounced from $2.14 to a recent high of $3.03, registering a nearly 35% surge. The bullish upswing was likely triggered by investors’ optimism on the upcoming ‘Crypto Week,’ where the U.S. House of Representatives will debate on a series of crypto-related bills.

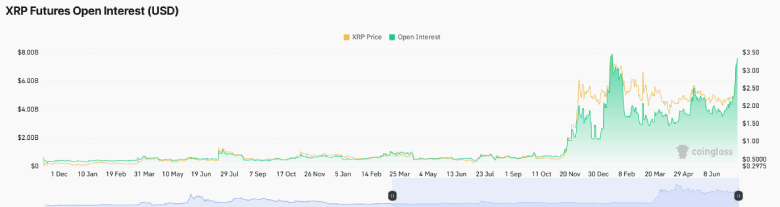

Along with the price rally, the XRP futures open interest recorded a parabolic surge from $4.42 billion to $7.63 billion, marking a 72% growth. This surge implies that traders are increasingly speculating on XRP’s price momentum and potential on the buy side during the current market recovery.

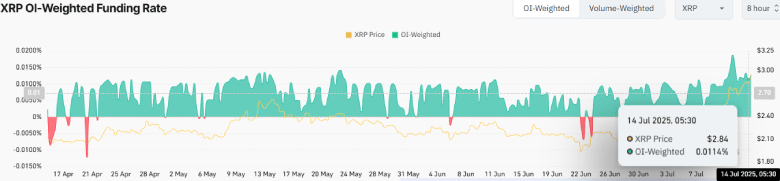

Simultaneously, the XRP OI-weighted funding rate also bounced to a recent high of $0.0187. The positive value indicates that long positions are now dominating the price movement and traders are paying a premium to keep their bullish bets open.

The two metrics highlight a bullish outlook for Ripple cryptocurrency, signaling a sustained market sentiment for a continued uptrend.

XRP Price To Enter Post-Rall Correction

A deeper analysis of XRP’s daily chart shows its price facing overhead supply at the $3.00 psychological level. A long way rejection candle at this resistance signals a risk of a bearish reversal for a week-long recovery.

The coin price currently stretched far from the daily exponential moving averages (20, 50, 100, and 200) to accentuate an overextended rally.

Thus, if the price reverts, the $2.667 level stands as suitable pullback support for buyers to maintain bullish momentum. Generally, the post-rally correction allows buyers to replenish the exhausted bullish momentum to prepare for its next breakout.

If the theory holds, the XRP price with renewed momentum could break past the $3 barrier and surge another 14% to hit $3.41.