FTX has unlocked over $21 million worth of Solana (SOL), sparking investor concerns across an already shaken crypto market. The company made this move after a month without operations and before it started reimbursing its creditors in the upcoming weeks. Market analysts observe the potential effects of this action on short-term market prices.

The FTX Chapter 11 proceedings allow the asset release at the same time as the broader repayment schedule commences. Given the market volatility in cryptocurrencies, investors evaluate the upcoming sell-off effects. The upcoming distribution will speed up investor liquidations while shaping the market mood for the May period.

The cryptocurrency market waits for potential further impacts while creditors start collecting their payment amounts. The recent unlocking events heightened market anxiety, so assets might enter the market rapidly, creating sell-off concerns within the major crypto token space.

Solana Unlock Spurs Market Caution

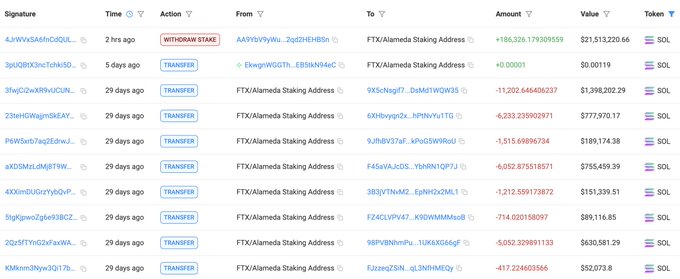

Lookonchain data revealed that FTX and Alameda performed an SOL token unlocking operation, which produced 186,326 SOL tokens, equivalent to $21.5 million. SOL has experienced its biggest movement since March when reimbursement procedures were underway.

Market analysts indicate that rapid token supply growth causes market imbalances, especially in financial organizations that experience difficulties. Solana’s turbulent market environment enables more investors to sell their assets. A decrease in token price occurs in the short run after major holders spend their token assets.

Early warning signs developed in SOL as the market uncertainty in cryptocurrency caused its price decline. Market pressures from creditor sales likely worsen when there is intense selling activity. The market looks at support levels and liquid zones to discover investment entry points for SOL.

Ethereum Holdings Under Watch

Solana is the major crypto asset at FTX, along with Ethereum’s remaining $650 million worth of assets. Market users maintain antipathy toward Ethereum blockchain transactions because of past large ETH transfers. Market volatility tends to surge when ETH enters the market quickly.

Ethereum features high market liquidity that protects against sudden price fluctuations but becomes exposed if there are large-scale selling events. The token’s value decreases when creditors quickly cash out their positions following compensation. A number of market analysts assume that a sustained distribution of the sale period can decrease the market response magnitude.

Staff from FTX have not validated upcoming ETH transfers, so investors are enjoying brief safeguards. However, the risk remains since Ethereum will be included in the repayment arrangement.

FTX Repayments Could Shake Markets

FTX maintains TRON tokens on its asset list alongside notable cryptocurrencies, although repayment details potentially affect them. Although TRON’s new supply releases are at lower levels than its competitors, the price disturbance remains possible because of its limited market position. American digital asset traders experience escalating doubt about market conditions.

Creditors’ future repayments will occur through BitGo and Kraken communication channels. BitGo and Kraken financial service users benefit from implementing crypto and fiat transaction abilities that shorten transaction durations. Better trading liquidity for tokens improves the chance of extensive bulk sales made by holders.

The public keenly focuses on the upcoming May 30 distribution date as authorities investigate FTX further. A market reaction will occur following any new unlock action on assets or wallet transactions.