Key Highlights

- The partnership directly tackles the extremely high cost and slow speed of transactions into Africa, which sees over $100 billion in annual remittances

- The integration will be launched in three clear stages, starting with large businesses in early 2025 and expanding to all consumers by 2026

- Flutterwave is leveraging Polygon’s established blockchain network, which already powers billions of dollars in transactions for major fintechs

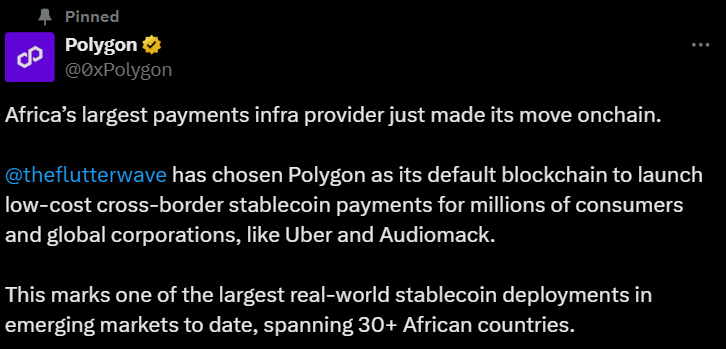

Flutterwave has chosen the Polygon blockchain network to run its new stablecoin payment system, according to the latest post on X (formerly on Twitter).

(Source: Polygon on X)

Flutterwave is the biggest payments company in Africa. This decision will allow for fast and very cheap cross-border money transfers using stablecoins. The news was shared today by Flutterwave and Polygon.

This is one of the biggest real-world uses of stablecoins in developing markets. It aims to serve millions of people and large global companies like Uber, Netflix, and Microsoft across more than 30 African countries.

Founded in 2016 by Olugbenga “GB” Agboola, Flutterwave has become a leading payment company in Africa. The company processed over $40 billion in transactions in 2024. It helps over one million businesses, including names like Booking.com and American Airlines, accept digital payments.

But this new announcement is different. It moves beyond traditional payment systems to use blockchain technology to finance on a massive scale.

Solving a $100 Billion Remittance Problem

Sending money across borders into Africa is known for being slow and costly. The World Bank reports that the average fee for sending $200 to sub-Saharan Africa is 8.0%. This is much higher than the global average of 2.6%. In some cases, fees can be over 12%, and the transfer can take up to a week. This is a huge problem for a continent that receives $100 billion in remittances each year. For many families, this money is a lifeline. These high fees act like a multi-billion-dollar tax on the poor.

Flutterwave’s answer to this problem is stablecoins on the Polygon network. Stablecoins are digital currencies pegged to stable assets like USD. The Polygon network can handle many transactions quickly and for a very low cost. By using it, Flutterwave will make international settlements nearly instant and cost just fractions of a cent. This technology is already proven, as Polygon supports over 100 other finance technology companies.

“Thriving African businesses lose revenue each year to slow, expensive cross-border payments. Flutterwave saw what we see: stablecoins on Polygon can advance settlement times from days to seconds, and high fees into pennies. It’s a massive vote of confidence in stablecoins as the future of cross-border payments,” said Marc Boiron, CEO, Polygon Labs.

“Businesses in emerging economies process billions in cross-border payments annually, yet still face high costs and slow settlement times. By partnering with Polygon, we’re introducing a solution that makes international payments even more simple and affordable than many local ones. This revolution will unlock new economic opportunities across the continent.” said Olugbenga “GB” Agboola, CEO and Founder, Flutterwave.

Roadmap to Launch

The new system will be introduced in 3 main stages. In the first quarter of 2025, it will start with business-to-business pilots for large companies. By the middle of the year, it will expand to smaller businesses and big merchants like Uber. By 2026, the service will be fully available to all consumers through the Flutterwave Send App, allowing person-to-person remittances for millions.

This plan builds on Flutterwave’s existing work with USDC, a popular stablecoin. However, choosing Polygon as its main blockchain shows a deep, long-term commitment to this technology.

Africa is gradually adopting blockchain-based innovations to reshape its economy. Several factors make the continent ideal for blockchain-based finance. First, a large number of people do not have bank accounts. Over 370 million people in sub-Saharan Africa are unbanked. However, mobile phone use is very high. Services like M-Pesa in Kenya have already shown that people are comfortable using mobile phones for money.

Second, stablecoins are already being used as digital cash. Africa is one of the fastest-growing regions for cryptocurrency adoption. In 2024, Nigeria saw $20 billion in stablecoin inflows alone. People use them for remittances, business, and to protect their savings from inflation.