Key Highlights:

- Ethereum (ETH) remains stable above its $2,300 Realized Price.

- MVRV (Market Value to Realized Value) ratio is around 1.67, which indicates confidence and controlled profit-taking.

- Whales are actively accumulating ETH.

Ethereum is holding strong even though the recent price rally has slowed down. As per CryptoQuant, the investors are taking profits, but it is in a way that it does not affect the price of the token. It has also been observed that whales are also buying, which indicates an increased interest in Ethereum at the current price.

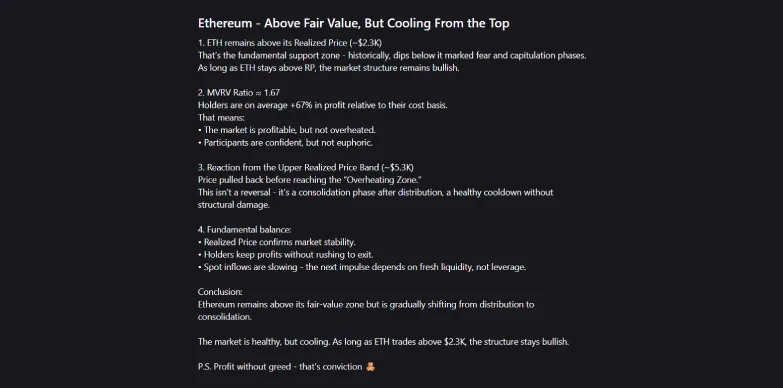

Holding Above Realized Price Support

At press time, the price of the token stands at $3,903.74 with an uptick of 1.5% in the last 24 hours as per CoinMarketCap.

On-chain data from CryptoQuant indicates that Ethereum is safely above its Realized Price, which is around $2,300. This figure indicates the average price that all ETH holders paid, acting as an important support level. In the past, when ETH dropped below this level, the market experienced a state of panic and big sell-offs were seen.

As of now, ETH is trading above this key level, the market structure looks strong and positive. This also indicates that the investor confidence is healthy. As long-term holders and whales buying ETH, it will keep the economy of the network stable.

MVRV Ratio Indicates Stability

On-chain data also shows that Ethereum’s MVRV ratio is nearly about 1.67. This figure indicates that the holders are 67% in profit, which is a clear sign of market stability rather than speculative overheating.

The MVRV ratio compares Ethereum’s current market value to the average price investors paid for their coins. When the ratio is above 3, it means that the market is overheated, prices are high and many investors are sitting on big profits, which usually leads to selling.

The current MVRV ratio is a clear indication of steady, moderate confidence in place of a hype. This means that the investors are more confident in Ethereum’s long-term strength and do not want to chase quick gains. As the net inflows slow down, the market seems to be taking a break, waiting for fresh momentum before making its next big move.

Cooling Near the Overheating Zone

Ethereum’s price has recently pulled back a little from the upper Realized Price Band which is around $5,300. The upper Realized level is at which the market usually reaches its peak and some investors start taking profits. This small dip, however, does not affect the positive trend. Instead, it looks more like a much needed pause.

If you look in the past, such cooling-off periods have come before the next strong upward move when new buying interest comes back. As of now, Ethereum is staying above the key fair-value levels which simply indicates market stability.

Whale Activity Signals Renewed Accumulation

Even though spot inflows have slowed down, on-chain data shows that large investors are quietly buying more Ethereum.

According to Spot On Chain, several major wallet movements have been recorded in the past 24 hours. A few of them have been listed below:

- Whale 0x395 withdrew 12,000 ETH worth $46.3 million from cryptocurrency exchange Binance. The tokens were withdrawn at an average price of $3,854. This wallet now holds almost 68,000 ETH, worth $264 million. The wallet is said to have a history of smart trading, buying between $3,027 in June to August and selling somewhere about $4,218 in September and October.

- Another whale, 0x86E also withdrew 8,491 ETH (worth $32.5 million) from OKX at approximately $3,824 per ETH, indicating a well-timed accumulation before possible market catalysts.

- The Radiant Capital exploiter also swapped 9.7 million DAI for 2,550 ETH (worth $9.7 million) through three wallets. Then the exploiter moved part of the funds via Tornado Cash, showing ongoing activity among sophisticated players.

Apart from one exploit-linked wallet, the overall trend shows strong accumulation from major investors in the $3,800 -$3,900 range. This indicates a steady confidence and a typical mid-cycle consolidation phase rather than weakness. From this data it is clear that the market is actually pausing before its next growth phase.

Also Read: Meteora (MET) Token Launch Kicks Off with Airdrops & Major Exchange Listings