Key Highlights:

- ENSO experienced a 30.7% jump after being listed on Upbit.

- ENSO has also partnered with USD1, which boosted the momentum.

- Trading incentives increased buying pressure.

ENSO (ENSO) has jumped 30.7% in the past hour after getting listed on Upbit, the biggest cryptocurrency exchange in South Korea by trading volume, as per CoinGecko. The price rise fits the common trend that is being seen with new Upbit listings, where Korean traders quickly move funds into newly available tokens. Such listings usually lead to a significant price increase because the visibility of the token increases.

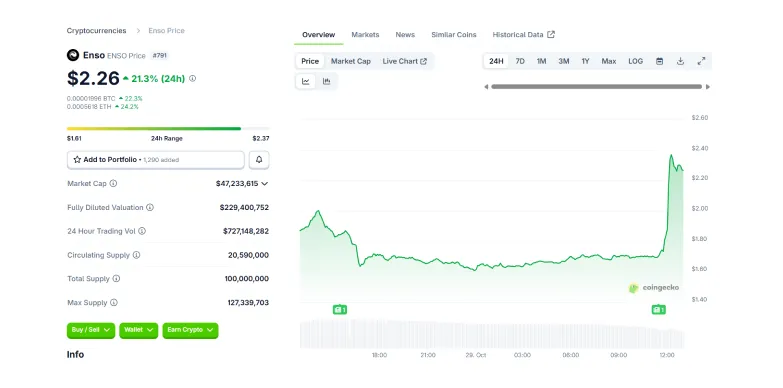

At press time, the price of the ENSO token stands at $2.26 with a rally of 21.3% in the last 24 hours as per CoinGecko.

Upbit Listing Leads to Breakout Rallies

If you have a look at the tokens that have been listed on Upbit recently, you will observe similar breakout rallies. These rallies indicate the exchange’s influence within Asia’s digital asset markets. Analysts note that Upbit’s concentrated liquidity, combined with the scarcity of alternative domestic trading options, tends to magnify short-term demand.

The traders who get on early capitalize on hype-driven entry points before global markets adjust to the elevated price levels. ENSO’s rapid price surge today reflects the same scenario, with volumes jumping sharply within minutes of trading activation.

Other Developments that Led to this Jump

Other than the Upbit listing acting as a catalyst, Enso’s strong rally has also come from other developments. On October 27, the project revealed a partnership with USD1, which is a $3 billion stablecoin linked to Trump-aligned groups that is rapidly gaining adoption in compliant DeFi platforms.

With this partnership, Enso’s cross-chain technology will be used to expand USD1 liquidity across the major networks that include Dolomite, BNB Chain, and Ethereum. As stated in the update, 70% of USD1’s liquidity is on BNB Chain and 25% is on Ethereum, both the networks where Enso already operates actively.

The partnership puts Enso in an important role as infrastructure for regulated stablecoin, a space that is growing day by day, along with the DeFi space. With stablecoin market value rising more than 50% this year, the integration increases ENSO’s real utility by linking it directly to USD1’s liquidity. For institutional investors watching regulation, these kinds of partnerships signal strong, compliant DeFi growth.

Analysts believe that ENSO is becoming more and more important as well as popular in the market, and there is a possibility that even big financial institutions may start paying attention too.

At the same time, ENSO’s price also recently moved upwards because many of the traders are trying to earn rewards. Binance has recently offered a big reward pool of 500,000 ENSO tokens, which ended yesterday, October 28. Due to this deadline, many of the traders increased their buying and selling activity so that they could win rewards. Interest from Upbit users also grew during this time, due to which more buying pressure was added in a short period.

On the other hand, people are also excited about the Katana x Enso demo that is happening on October 29. Developers and investors expect this event to show new ways Enso can work across different blockchains.

If the demo manages to show real, useful features, then the project can also be seen as something that can be used by the developers to build new DeFi products.

However, analysts warn users that the price may drop once the hype ends and the early excitement cools off. Reward campaigns usually create short-term trading spikes, but activity tends to return to normal once profit-taking gets over.

Also Read: Sui Price Risks $2 Breakdown as Futures and DeFi Activity Shrink Sharply