Dogecoin (DOGE) may be gearing up for its most significant move yet—and if history is any guide, fireworks could be on the horizon. According to popular crypto chart analyst Trader Tardigrade, DOGE is flashing the same signals it showed just before its previous epic rallies. This time, he’s eyeing a massive price target: $10.

Dogecoin Chart Repeats Historic Rally Setup

In a recent monthly chart shared on social media, Tardigrade illustrates a familiar pattern: Dogecoin enters a steady, upward-sloping accumulation channel… and then explodes. This setup has occurred twice before—once before the 2017 spike and again ahead of the legendary 2021 rally. Both times, the cryptocurrency rocketed to new all-time highs.

Now, we’re seeing it again.

The chart shows the token quietly building strength since mid-2023, hugging the same kind of rising channel. Below that, a subtle but steady uptrend in a volatility-based indicator hints that momentum is brewing, just like before.

Dogecoin Price Chart (Source: X Post)

What makes this setup compelling is its consistency. Every few years, DOGE forms a similar base before liftoff. The current structure mirrors those past moments almost perfectly, and if it continues to play out the same way, a massive breakout could be just beginning.

Following the setup, Tardigrade projects Dogecoin’s path to $10, which would represent an approximate 6,000% gain from current levels. Adding to the bullish momentum, Bitwise’s recent DOGE ETF filing signals growing institutional interest and potential mainstream acceptance. For a detailed technical and fundamental analysis, check out our full Dogecoin price prediction. With a history of turning sideways moves into vertical runs, the meme coin might be writing the next chapter in its unlikely legacy.

On-Chain Metrics Signal Fuel for DOGE’s Next Leg Up

Backing the bullish case further, Dogecoin’s on-chain data is starting to heat up.

Funding rates, a key metric reflecting trader sentiment in perpetual futures, have remained generally positive. At press time, the OI-weighted funding rate value is 0.0055%, which means that long traders are paying a premium to maintain their positions.

Dogecoin OI-Weighted Funding Rate (Source: CoinGlass)

Although not spectacular, positive, sustained funding suggests sustained buying pressure on the long side, which in many cases is a harbinger of a sustained trend. Even more revealing is the liquidation data.

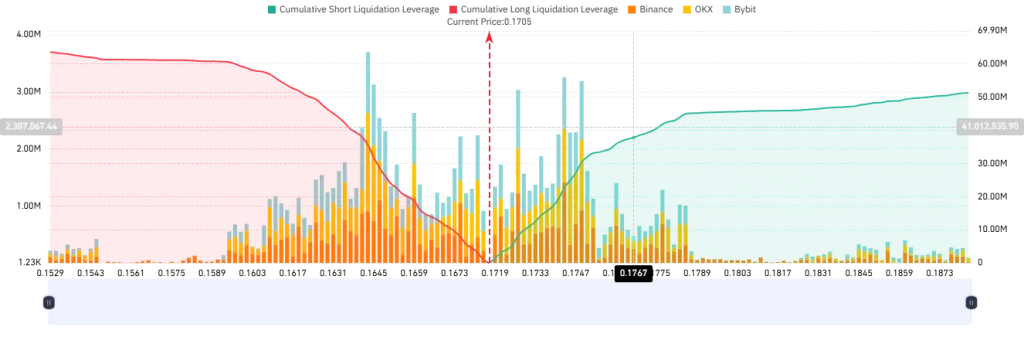

Based on the aggregate order book and liquidations maps, there have been a cumulative 63.55 million worth of long liquidations, with the largest group of liquidated longs being around $0.1643. These flush-outs usually eliminate weak hands, allowing greater movement in prices.

Dogecoin Liquidation Map (Source: CoinGlass)

Conversely, short liquidations currently amount to 51.27 million, contracted around 0.1882. With the price of DOGE close to hitting this price, any breakout above it would initiate a cascade of forced short-sized cover, which would lead to a rapid rise.