Could Dogecoin be gearing up for another historic breakout? According to crypto chartist Trader Tardigrade, history may be repeating itself—and it’s pointing toward a massive move up to $4. Tardigrade’s analysis compares two distinct market cycles.

In the first, DOGE climbed from $0.0003 to $0.0026, then launched to $0.009—an explosive rally fueled by pattern-driven momentum. Now, Tardigrade sees a familiar structure forming:

- First stop: $0.42

- Then: $1.46

- Final target: $4

DOGE Price Chart (Source: X Post)

For a deeper technical outlook and potential future targets, explore this detailed Dogecoin price prediction analysis.

This advantage may reflect an 850%+ upside of the base price. The price structure reflects a staircase of rounded bottoms and breakout surges, which is in similar rhythm to its earlier bull run. Key trendlines and support levels are aligning almost identically to the 2015–2018 pattern, suggesting the token might be quietly building energy for another liftoff.

Analyst Maps DOGE’s $20 Setup

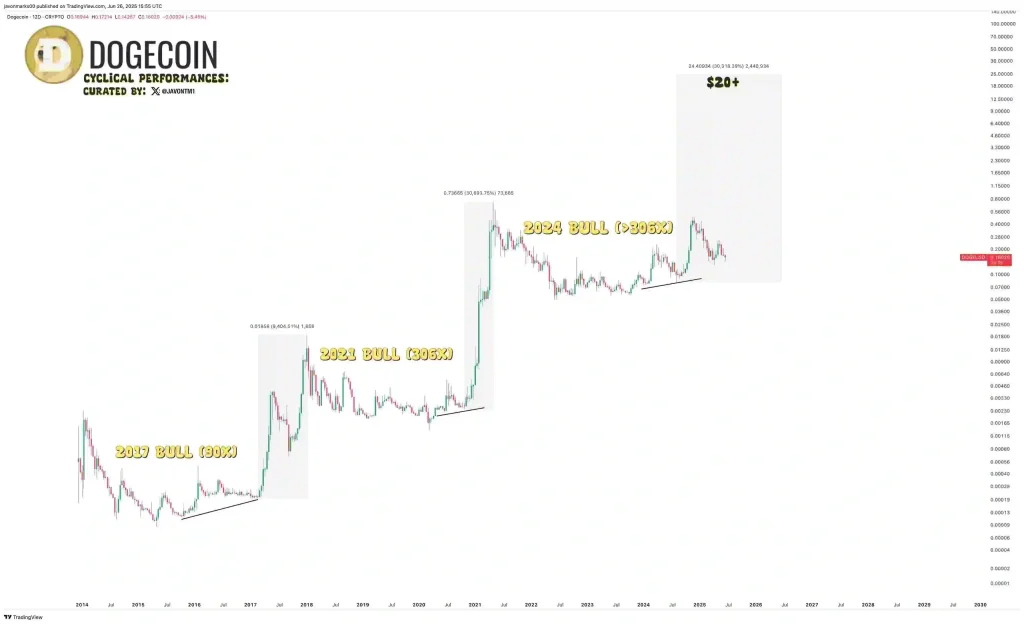

Supporting this bullish case, chart analyst Javon Marks notes that DOGE has followed a nearly perfect pattern of multiplying its returns in each major bull cycle—and the next leap could send it soaring to over $20.

Marks breaks it down:

- In 2017, DOGE climbed 90x.

- In 2021, it exploded 306x.

Now in 2024, the setup appears even bigger, with projections topping a 120x gain from today’s prices. If the trend holds, the cryptocurrency could move from its current range (around $0.16 at the time of analysis) to $20+, marking one of the largest rallies in crypto history.

DOGE Price Chart (Source: X Post)

The chart tells the story: clean accumulation, rising support lines, and parabolic breakouts—all repeated across multiple market cycles. Each rally has built on the last, growing in scale and magnitude. Marks isn’t promising a miracle; he’s pointing to a structure that’s already happened twice before.

Traders Still Bet Big on Dogecoin’s Rise

Fueling the bullish story further, Dogecoin OI-weighted funding rate stood modestly at 0.0021% on June 26, 2025, with the price unchanged at $0.16. This long and steady funding rate indicates a steady preference toward long positions amongst leveraged traders, a non-verbal vote of market confidence.

That might seem uneventful, but beneath the surface, it tells a story of quiet conviction. Since late March, funding has hovered above zero almost consistently. In crypto derivatives, that means long traders—those betting on price going up—are dominant enough to pay a premium to keep their positions open.

DOGE OI-Weighted Funding Rate (Source: CoinGlass)

It’s not a euphoric surge but a steady signal: confidence hasn’t flinched, even as the price cooled from its $0.26 peak. Each funding spike, particularly in mid-May and early June, aligned closely with upward momentum in DOGE’s spot price, suggesting this isn’t noise but a reflection of real trader intent.

And right now? No funding crashes, no rush to short. Just calm, persistent optimism. In markets, silence can be powerful—and in DOGE’s case, it may be the calm before the next leg up.