Key Highlights:

- $5.7 billion in Bitcoin (BTC) and Ethereum (ETH) options will expire today. Volatility expected.

- Bitcoin spot ETFs post $536 million in net outflows on October 16.

- Crypto Fear & Greed Index drops down to 22 from 64.

The crypto market is currently experiencing increased volatility and sharp declines as almost $5.7 billion in Bitcoin (BTC) and Ethereum (ETH) options are set to expire today, October 17, 2025 as per crypto influencer Ash Crypto. This back-to-back expiry is increasing the downward pressure amid the already shaken investor sentiment. When this situation is coupled with significant outflows from Bitcoin spot ETFs and a sharp drop in the crypto Fear and Greed Index, the developments clearly indicate panic and increased risk across the entire crypto ecosystem.

Bitcoin Spot ETFs See Massive Outflows Amid Market Weakness

Coinciding with the options expiry, Bitcoin spot ETFs experienced significant net outflows on October 16. According to SoSoValue data, these ETFs recorded a total net outflow of $536 million, with no inflows reported. The largest single-day outflow was seen coming from the ARKB ETF, which is managed by Ark Invest and 21Shares, which lost $275 million, followed by Fidelity’s FBTC ETF with $132 million in redemption.

These outflows signal heightened risk aversion among institutional investors amid broader market downturn, adding more pressure to the price of BTC.

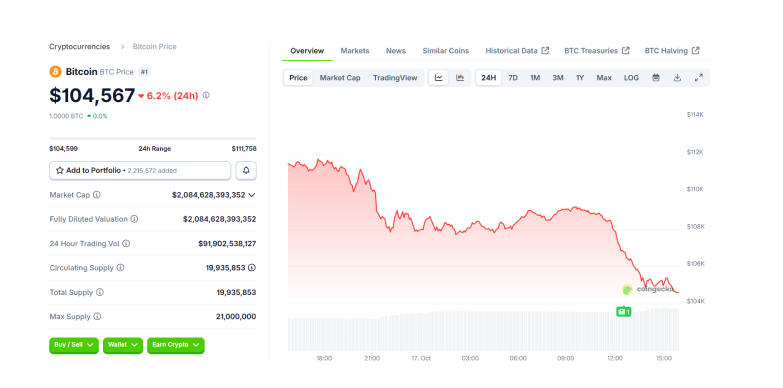

Bitcoin and Ethereum Slide Amid Intensifying Market Fear

Market prices clearly indicate that the crypto crashed through significant margins. Bitcoin has dropped sharply and is said to be trading below the $105,000 mark. At press time, the price of BTC token stands at $104,567 with a decline of 6.2% in the last 24 hours as per CoinGecko.

According to an analyst on X, if the current support range of $101,000 to $102,000 fails, Bitcoin could revisit June lows which were somewhere about $93,000, which will further amplify the bearish momentum.

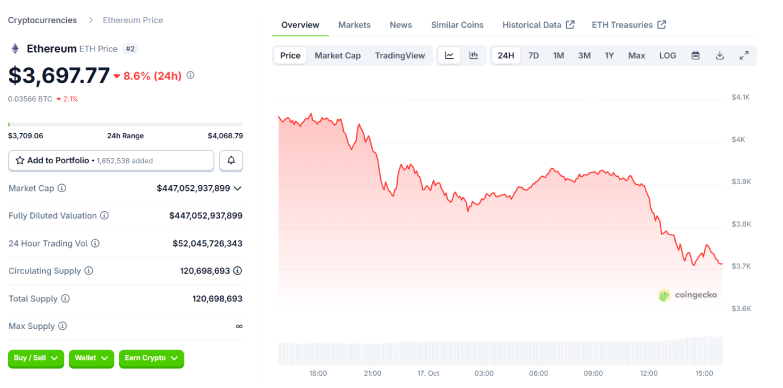

Ethereum’s price has also dropped down significantly. At press time, the price of the token stands at $3,697.77 with a decline of 8.6% in the last 24 hours as per CoinGecko.

Fears from troubled U.S. regional banks have rattled equity markets, sending panic into the crypto market leading to crypto crash.

Crypto Fear & Greed Index Hits Extreme Fear

Investor sentiment is generally measured through the Fear & Greed Index, which has currently dropped down to 22 from 64 just a week ago. This decline indicates the panic that is spread across the crypto market and amongst the investors and traders. Social media is also flooded with panic-selling narratives and dire predictions, further amplifying volatility and accelerating price declines.

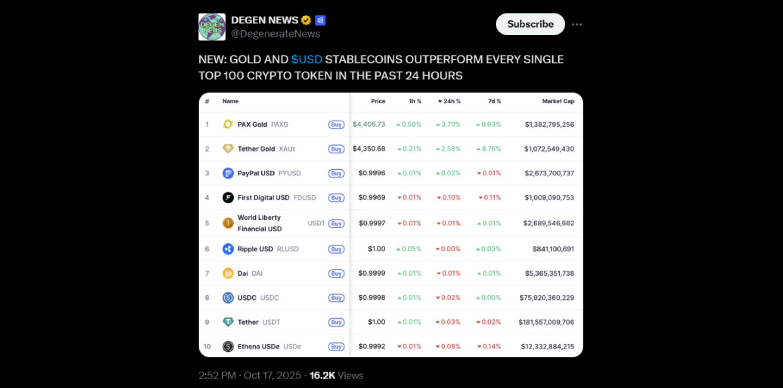

Flight to Safety: Gold and Stablecoins outperform Amid Crypto Crash

Amid the current crypto crash, safer assets like gold and USD-backed stablecoins have gained attention and have outperformed major cryptocurrencies over the past 24 hours. Increased volatility and uncertainty in the crypto market has pushed the traders towards traditional safe havens.

Gold prices have also surged amid this crypto crash, solidifying its reputation as a stable store of value, while USD-backed stablecoins have gained favor for preserving capital and providing liquidity without crypto’s typical price swings.

This flight to safety highlights growing risk aversion in the market, as concerns over banking sector stability and geopolitical tensions is pushing the traders to prioritize capital preservation over speculative gains. The trend indicates a shift from risk-on to risk-off sentiment, with investors waiting for clearer signals before re-entering the crypto market.

Potential Stabilizing Factors Could Offer Relief

Despite the near-term bearish outlook, some experts point to potential stabilizing factors ahead. The Federal Reserve’s anticipated rate cut at the upcoming FOMC meeting, along with easing geopolitical trade tensions, could also act as a catalyst, and the market could possibly rebound.

Historically, such easing can weaken the U.S. dollar and redirect investment flows into riskier assets such as cryptocurrencies. However, with current extreme fear and massive outflows, a sustained recovery remains uncertain until clearer macroeconomic improvements emerge.

Also Read: Polygon (POL) Drops 9% Amid Coinbase Migration and Market Fear