- 172 public firms now hold 1.02M BTC worth $117B, marking a 40% quarterly increase.

- Strategy tops with 640K BTC as rising corporate demand reshapes the Bitcoin market.

- Policy support and tight supply could push Bitcoin toward higher levels by the end of 2025.

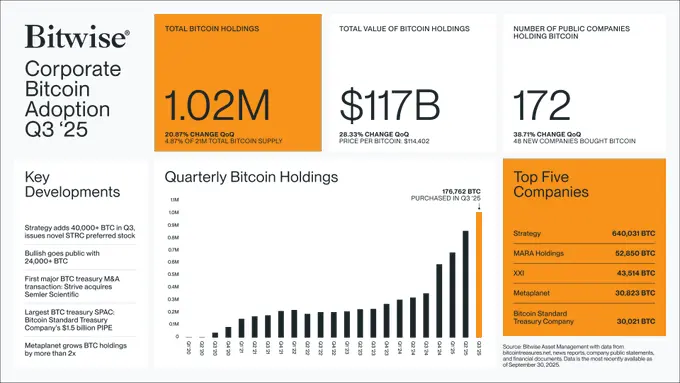

Corporate ownership of Bitcoin has reached a historic peak, signaling a new chapter in institutional finance. Bitwise’s Corporate Bitcoin Adoption Report for Q3 2025 shows that 172 publicly traded companies now hold Bitcoin on their balance sheets, up almost 40 percent from the previous quarter.

Together, these companies own 1.02 million BTC, roughly 4.9 percent of the entire supply, worth about $117 billion at quarter’s end. That value jumped more than 28 percent in just three months. Analysts say the growth underscores a shift in perception: Bitcoin is no longer a speculative bet but an accepted treasury reserve.

Corporate Bitcoin Boom with 40% More Firms Adding BTC in Q3 2025 (Source: X)

Bitwise chief executive Hunter Horsley described the trend as “absolutely remarkable,” adding that demand from both individuals and institutions continues to strengthen as digital assets mature into a recognized financial category.

Strategy Dominates the Corporate Leaderboard

The charge is led by Strategy, the firm headed by Michael Saylor, which now controls 640,031 BTC, more than any other company worldwide. MARA Holdings follows it with 52,850 BTC, XXI Corp. with 43,514 BTC, Metaplanet with 30,823 BTC, and the Bitcoin Standard Treasury Company with 30,021 BTC.

Those five firms together hold the majority of corporate Bitcoin. During the quarter, companies added 176,762 BTC, equal to roughly $20 billion at the average market price of $114,400. Strategy alone bought over 40,000 BTC while introducing a preferred-stock class to support future purchases.

“This is not a short-term play,” said Rachael Lucas, senior analyst at BTC Markets. She added that corporate treasuries are locking in exposure for the long haul, the same way they hold gold or sovereign bonds.

Mergers, SPAC Deals, and Expanding Balance Sheets

The third quarter was one of the busiest on record for institutional Bitcoin activity.

- Bullish Exchange entered the public markets with 24,000 BTC on its balance sheet.

- Strive Asset Management completed the first Bitcoin-based merger by acquiring Semler Scientific.

- The Bitcoin Standard Treasury Company finalized a $1.5 billion SPAC deal, the largest yet tied to the asset.

- Metaplanet, often called Japan’s MicroStrategy, more than doubled its Bitcoin holdings.

Bitget CEO Gracy Chen stated that the wave of adoption reflects a broader reevaluation of digital assets. Bitcoin has moved beyond being an “inflation hedge,” she said. It’s now viewed as a “long-term reserve asset.”

According to CoinShares, Bitcoin-linked funds attracted $3.17 billion in Q3 inflows, including $2.67 billion during the final week alone. Total inflows this year have reached $48.7 billion, the highest on record for digital assets.

Policy Shifts and a Tightening Supply

Analysts attribute the surge to favorable policy changes and the growing scarcity of Bitcoin. Recent measures by U.S. regulators, including the establishment of U.S. Bitcoin Reserves and revised SEC standards for commodity trusts, have given listed firms a more straightforward path to hold Bitcoin directly.

At the same time, supply is tightening. Miners produce about 900 BTC a day, while corporations are acquiring an estimated 1,755 BTC daily, according to River Financial. That imbalance means businesses are buying almost twice as much as the network can generate.

Lucas explained that most corporate Bitcoin purchases occur quietly through over-the-counter channels. She added that this gradual buying does not affect prices immediately but builds pressure over time.

Bitcoin’s Next Phase: From Experiment to Standard

With almost five percent of Bitcoin’s total supply now sitting on corporate ledgers, 2025 may mark the moment digital assets entered mainstream finance for good.

Analysts agree that this quarter’s boom reflects more than market enthusiasm. It signals a structural transformation, one in which Bitcoin is no longer a fringe idea but a cornerstone of 21st-century treasury management.