LINK, the native cryptocurrency of Chainlink network, witnessed low volatility trading on Saturday, January 10th, to reach $13.13. With an insignificant loss of 0.08%, the coin price is testing the $13 floor as potential support, preparing for a post-breakout rally. However, the on-chain data shows a renewed selling pressure from whales, signaling a risk of prolonged correction ahead.

Key Highlights:

- Chainlink price recovery is poised for another 10% surge before challenging the key resistance trendline at $14.5.

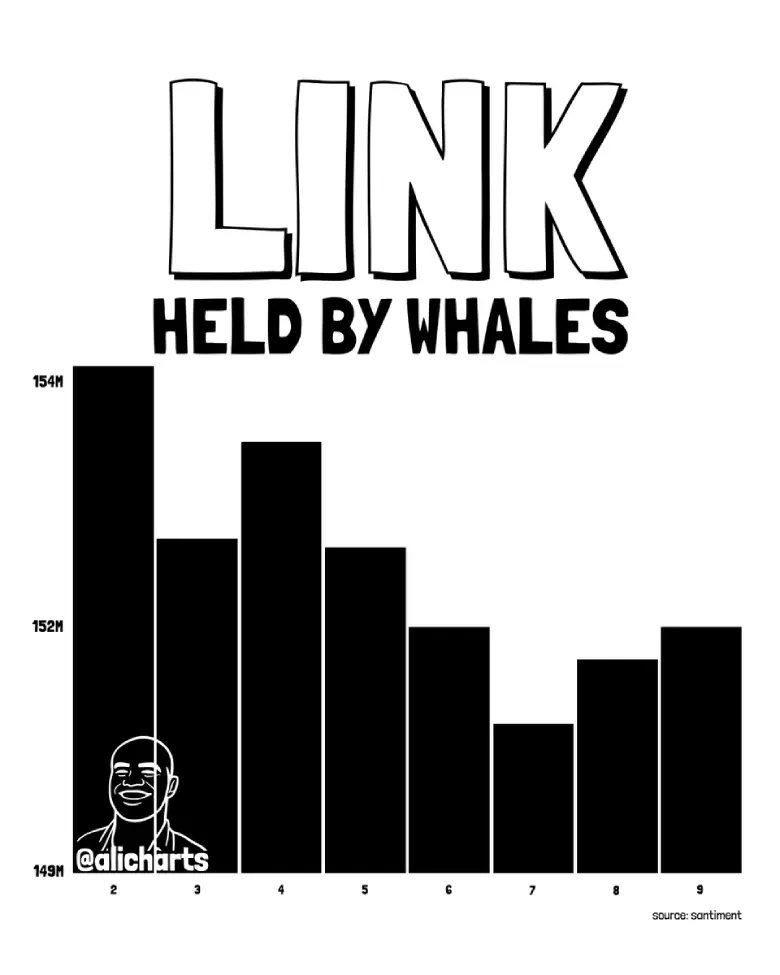

- Crypto whales offloaded more than 2 million LINK over the past week.

- The LINK price above the 20-day exponential moving average indicates an initiate switch in market sentiment to renewed bullish recovery.

LINK Price Pulls Back as Whales Dump 2M Tokens in a Week

In the last four days, the Chainlink witnessed a brief pullback from $14 to $13.14, registering a 6.4%. The bearish momentum aligns with broader market correction as Bitcoin struggles to sustain above the $90,000 mark.

However, the LINK price faced additional pressure during this period as on-chain data showed renewed selling pressure from large investors. In a recent tween market analyst, Ali Martinez highlighted that crypto whales sold over 2 million LINK in the last seven days.

The attached chart shows that the large-holder balance has plunged 154 million to 152 million LINK. Typically, the whale selling creates a downward pressure on price, as large holdings control significant portions of the supply.

When they offload substantial amounts, its increasing available supply on exchange, often triggering retail pain selling. Historically, the whale distribution has often coincided with major market tops or continued correction in price.

In addition, the open interest tied to LINK’s futures contacts has experienced a notable dip since last week. According to Coinglass data, the OI value has dropped from $708 million to $644 million today, accounting for 9% loss.

This indicates a reduction in overall market participation and leverage in LINK derivatives, as traders close out positions rather than opening new ones—often a sign of de-risking, profit-taking after recent volatility, or waning short-term conviction amid whale selling pressure.

Decreasing open interest in crypto futures typically signals that the prevailing trend (in this case, the recent consolidation around $13) may be losing momentum, as money flows out of the market rather than fresh capital entering to sustain or amplify moves.

Chainlink Price Poised for Key Breakout

Since mid-November, the Chainlink price has been consolidating within two horizontal levels of $14.7 and $11.9. The altcoin retested each level at least twice indicating uncertainty among market participants to drive a directional trend.

Currently, the LINK price trades at $13.16 and seeks bullish support from $13 level. If the support holds, the coin price could jump 10% and challenge a long-coming resistance trendline at $14.5.

The dynamic resistance, intact since last August 2025, maintains a sell-the-bounced sentiment in this asset. If the resistance holds, the coin price could witness renewed selling pressure and enter a prolonged correction trend.

The Chainlink price poised below the 100-and-200-day EMA slope indicates the broader market sentiment in LINK is bearish.

On the contrary, if the price breaks above the overhead resistance with daily candle closing, the buyers would acquire a suitable support to strengthen its position for recovery. The post-breakout rally could push the price to around $18 mark.

Also Read: Ethereum On-Chain Metric Highlights Strong Holder Conviction at $2.7K–$2.8K