- Chainlink’s price breakdown from the triangle pattern signals a risk of a prolonge correction.

- On-chain data highlights the strong conviction from large holders, as a market analyst highlights that over 5.5 million LINK tokens have been moved off exchanges since yesterday.

- LINK price correction gains momentum from a 30% drop in open interest, indicating a diminishing speculative force.

LINK, the native cryptocurrency of the decentralized oracle network Chainlink, plunged over 5.7% on Monday to trade at $21.5. The selling pressure likely followed a broader market pullback as Bitcoin dropped below the $113,000 mark. However, the Chainlink price shows notable resilience above the $20 level amid whale accumulation. While the decline in open interest value from LINK’s futures contracts may hint at a continued correction, the bottom demand at the psychological level hints at an opportunity for a bullish turnaround.

Chainlink Price Dips as Futures Open Interest Falls

Chainlink’s price performance in recent times has shown a significant downturn, losing value drastically in the past month. After hitting highs around $27.8, the token steadily fell to around $21.62 at the time of writing, a drawdown of over 22%.

The retreat gained momentum after the failure of the U.S. Federal Reserve’s 0.25% cut in interest rates to stimulate the expected market-wide rebound, leaving the mood of investors low.

In derivatives, futures positioning has followed the slump in the spot market. Chainlink’s open interest across exchanges decreased statistically, with a decline in open interest from around $1.91 billion to $1.31 billion. This 31.9% reduction is a very large exit of leveraged traders and a cooling of speculative appetite. With this decline, the coin price could struggle to gain bullish momentum for a potential rebound in the near future.

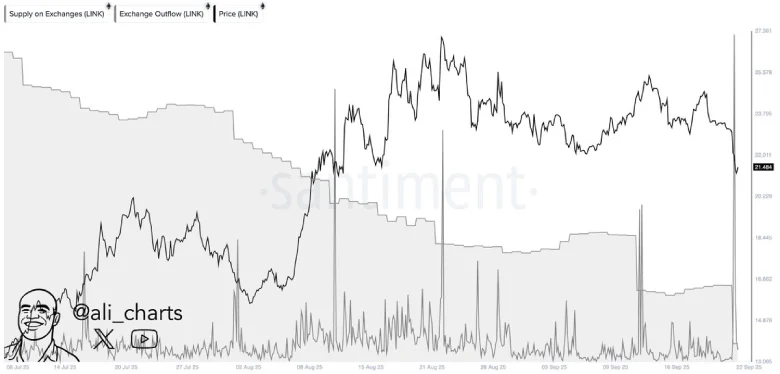

Amidst the general weakness, a large token holder movement has turned heads. Market analyst Ali Martinez highlighted the large withdrawal of LINK tokens from centralized exchanges, according to on-chain data acquired from Santiment. Some 5.5 million LINK tokens worth above $118 million at current prices were moved off trading platforms in a 24-hour period. This activity is an indication that whale wallets are offloading their holdings out of the public order books to private or cold wallets, possibly to hold their assets for longer..

Such strong conviction from large investors has often bolstered the bullish recovery in price. despite potential pullbacks in the near term.

Key Support in Chainlink Price Consolidation

The daily chart analysis of Chainlink price shows a short-term consolidation trend resonating within the formation of a triangle pattern. Typically, the chart setup reflects a short-term pause in an established trend as price fluctuates within two trendlines to regain its exhausted bullish momentum.

While the price typically follows the prevailing trend in the market, which leads to the upside breakout of the triangle structure, this time, Chainlink price has offered a bearish breakdown from the bottom trendline, signaling a change in market dynamics. This breakdown signals the accelerated selling pressure in the market and risks for a prolonged correction in the near term.

If the selling pressure persists, the LINK price could plunge another 7.3% and test the 50% Fibonacci Retracement Level at $19.8. The FIB level stands as a crucial floor for buyers to maintain their control over this asset.

Under a pessimistic condition, the coin price could breach the $19.8 support to further extend the ongoing correction trend.

On the contrary, if the coin price manages to hold the $19.9 support, the Chainlink price could switch to a sideways trend and recuperate its bullish momentum for the next breakout.

Also Read: $1.7B Wiped Out in 24H as 404K Traders Liquidated, ETH and BTC Lead