- The Ethereum price is less than 2% away from challenging the multi-month resistance of the falling wedge pattern.

- BitMine’s wallet received a fresh inflow of 41,946 ETH from Bitgo and FalconX today, worth roughly $130 million.

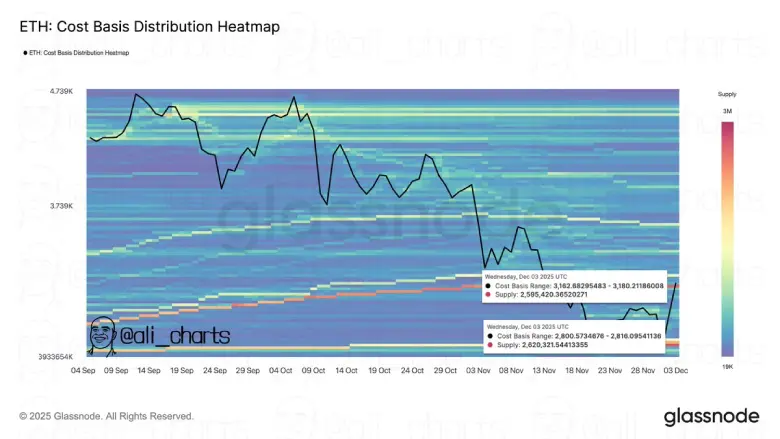

- Recent on-chain data highlights $3,180 and $2,800 as immediate resistance and support for ETH traders, respectively.

Ethereum, the second-largest cryptocurrency by market capitalization, slips over 1.74% on Thursday, December 4th. This intraday selling came as a temporary halt for buyers to recoup exhausted bullish momentum after a notable price spike earlier this week. Amid this decline, BitMine Immersion Technologies accumulated more ETH, projecting its conviction for the asset’s long-term growth projection.

Bitmine Adds to Large Ether Position Amid Market Dip

In the last two weeks, the Ethereum price has shown a bullish rebound from $2,621 to its current trading value of $3,193, accounting for a 22% jump. The upswing was fueled by several factors, including macroeconomic events in the U.S., the recently activated Fusuka upgrade, and whale accumulation.

Adding to the bullish note, Bitmine has increased its holdings of Ethereum once more, as blockchain records indicate new inflows of the cryptocurrency, which were routed through custodial platforms Bitgo and FalconX. Around 41,946 ETH have been collected in the latest session, which is around $130 million at the current market levels. The rate of accumulation over this week indicates that the full accumulation amount will be close to 97,649 ETH, which is equal to roughly $296 million.

The wallet attributed to the firm has been active for months. Transfers started in June at a time when Ether was trading at nearly $2,800. Purchases were made almost every week during succeeding rallies and never changed as prices moved to $4,600. Buying activity did not slow as the asset retreated, with more inflows being recorded during the slide to $3,100.

The presence of a large buyer throughout the rising and declining phases has become a recurring pattern in the recent on-chain data, with the flows closely monitored by market participants and analysts.

Traders are now watching two price areas that are still defining the short-term structure. The $3,180 level has been a ceiling, which has stopped several attempts to gain upward momentum, while the zone near $2,800 has seen consistent demand.

Analyst Ali Martinez pointed out that around 2.6 million ETH of these are seemingly accumulated around each of these areas, creating concentrations of buying interest that market participants now track closely.

Ethereum Price To Exit 2-Month Correction With This Breakout

Earlier today, the Ethereum price witnessed an intraday sell-off of nearly 4.86% following the broader market pullback. However, the coin price immediately reversed to show resilience above the $3 psychological level and reclaimed the 20-day exponential moving average.

These levels now bolster the Ethereum price to stabilize and recoup exhausted bullish momentum for further rallies. With the current trading price of $3,173, the altcoin is less than 2% away from challenging the key resistance trend and a falling wedge pattern.

Since October 2025, the ETH price has been strictly resonating between the two converging trendlines of the wedge pattern as they offer dynamic resistance and support. A potential breakout from this barrier would accelerate the buying pressure and indicate a change in market dynamics.

The post-breakout rally could bolster the price for an initial surge of 15% to hit a key horizontal resistance at $3,600.

On the contrary, if the sellers continue to defend the overhead trend, the coin price could face an overhead supply and prepare another bearish cycle within the wedge pattern.