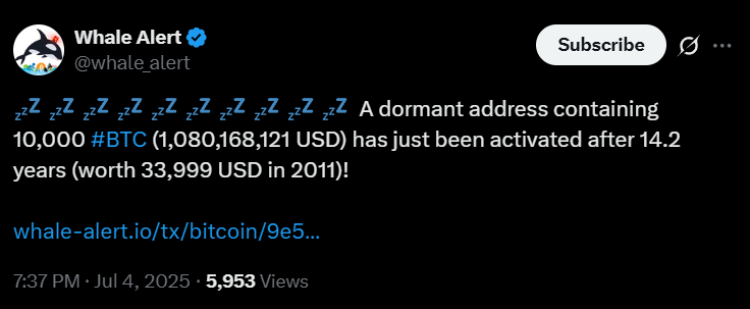

(Source: Whale Alert on X)

According to the latest post on X by Whale Alert, the last whale has transferred 10,000 Bitcoins (worth $1.08 billion) to an unknown wallet, which has been activated after 14.2 years. This whale acquired these Bitcoins in 2011, whose cumulative value was around $33,999.

Similar patterns were observed in the entire day, where 5 different inactive wallets moved Bitcoins they were holding for a long time.

The transaction has started a discussion in the community about its potential impact on the crypto market. At the time of writing, BTC has slipped below the $108,000 mark with a 1.68% drop in a single day, according to CoinMarketCap. However, trading experts shared a positive outlook for July.

Will Bitcoin Hit $120,000 in July?

Amid growing market confidence and institutional demand, the leading crypto service provider, Matrixport Official, predicted that BTC could rally to $120,000 as early as July. Despite strong ETF inflows and steady institutional accumulation, BTC has mostly traded within a tight range.

However, its volatility has hit multi-year lows, which shows market maturity as a possible precursor to a major breakout.

Historically, July has been a bullish month for BTC, averaging 9.1% returns, which could further fuel upward momentum.

If seasonal trends hold and capital inflows persist, Matrixport suggests that BTC may shatter key resistance levels, with a potential price range of $116,000 to $120,000.

The combination of institutional demand and historical performance could create the perfect conditions for a major surge in Bitcoin’s price. Traders are closely watching these developments, as a breakout above current levels is expected. It could show the start of a new bullish phase for BTC.

“ETF inflows have been surprisingly resilient. Nearly $14 billion has flowed into Bitcoin ETFs since April, roughly $4 billion more than the spot price would have suggested. This “real demand” is largely sticky, with little indication of speculative intent. The implication is that Bitcoin is becoming an asset held for long-term allocation purposes, rather than for short-term gain,” the Matrixport team writes in a post on X.

Apart from institutional demand, impressive progress in the regulatory framework through legislative efforts under US President Donald Trump’s pro-crypto administration is opening the door for Bitcoin’s widespread mainstream adoption.

Also Read: US House Announces ‘Crypto Week’ Starting July 14