Key Highlights

- Bitcoin whales have accumulated over 30,000 BTC in the last two days.

- The aggressive acquisition has added to the ongoing bullish sentiment in the market.

- However, the forecasts aren’t as bullish since analysts are skeptical on Bitcoin achieving a fresh high this year.

Large Bitcoin investors are again taking action in the market. Whale addresses purchased over 30,000 BTC in under 48 hours, according to crypto analyst Ali Martinez, and this is a significant contribution to the ongoing discussion in determining the next major price point in Bitcoin.

Market Expectations Shift for Bitcoin Price

The hope that Bitcoin will record new heights in 2025 is not as hot as it was earlier in the year. Some major analysts originally estimated that the BTC price in the world would be around the $200,000 mark by December. Such expectations have been toned down, and trading predictors reveal that traders are lowering their price targets.

Whales bought over 30,000 Bitcoin $BTC in 48 hours! pic.twitter.com/6KDywEzo7R

— Ali (@ali_charts) October 3, 2025

Although the estimates of $200,000 seem to be dwindling, business analysts are still leaving room for new heights before the end of the year. The present trading window of Bitcoin remains strong, despite the waning interest in the excessive price ranges.

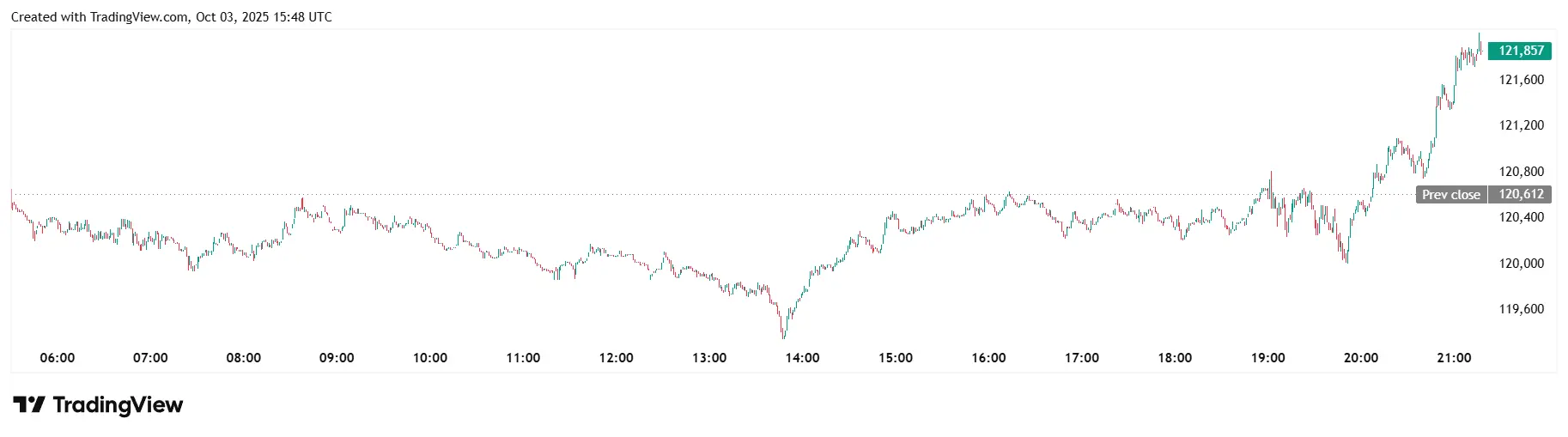

BTC Price Breaches $120,000 Barrier

Bitcoin has just crossed over the level of 120,000, which served as a ceiling over the past several months. Analysts believe the movement of the price within this area will be conclusive because a weekly close above this level sustained may give a better ground for further increase.

In addition to the technical aspects, macroeconomic expectations are also contributing to it. According to the CME FedWatch Tool, a near certainty of 99% now indicates that the Fed will reduce interest rates by 25 basis points on October 29. This is a severe increase over the 86% likelihood that was registered a week ago, and this is even more speculative demand fuel.

Analysts Look Toward $150,000

Financial media outlet Motley Fool research teams have proposed an estimate of as high as $150,000 per bitcoin by early 2026. They base their argument on the fact that the cryptocurrency is prone to reporting large profits during the last quarter of the year.

This view is supported by historical performance information. Bitcoin has returned an average of 85% in the fourth quarter since 2013. The best years were in 2013 (480% growth), 2017 (215% growth), and 2020 (168% growth) when BTC surged over the same quarter.

The historical market trends indicate that October and November tend to be very critical to the Bitcoin trend. The highest average return of about 46% is in November, and in October, the average is about 22%. Traders are keeping an eye on these months so as to determine whether such tendencies can be repeated this cycle.

BTC’s Probability Models

Probability ranges are becoming the norm of forecasting platforms as opposed to fixed forecasting. According to the current estimates, Bitcoin currently stands at a 63% probability of reaching the $125,000 level by the end of 2025. In early 2026, the chance of achieving $130,000 will be 47%, and it is estimated that it will achieve $140,000 with a probability of 32.%

Moreover, the road to $150,000 is less definite. Those who analyze the market give a 22% probability of that target being reached this year and only a 5% probability of Bitcoin reaching $200,000.

Despite bullish whale behaviors, there are still risk scenarios that play. Prediction markets now indicate a 6% possibility that Bitcoin would fall below $70,000. The probability of the BTC price plunging below $50,000 is also very low at 2%.

The sentiment movements are slowing down since the end of summer, with traders weighing optimism of new highs against the likelihood of severe corrections.

Also Read: Is XRP Price Set to Repeat Its Historical October Gains?