October will be remembered as a pivotal month in the crypto space despite the greatest 1011 market crash, as the Bitcoin spot volume skyrocketed to a yearly peak. This astonishing surge above $300 billion is not just a fleeting moment of market enthusiasm but signals a profound shift in investor sentiment. This notable change in the trader behaviour is a key catalyst that could redefine the trajectory of the global crypto market.

As the market recalibrates in response to a series of record-breaking liquidation events, traders are abandoning the treacherous waters of leveraged positions in drives, opting instead for the relative safety of spot trading. Now the question on everyone’s mind is- What triggered this dramatic change, and what does it mean for the future of Bitcoin? In this article, we’ll delve into the story behind the numbers and explore the potential implications of this shift in the crypto market.

Bitcoin Spot Volume Spikes

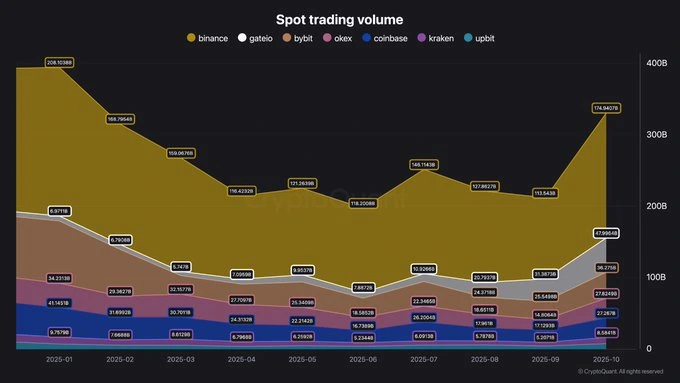

In a recent X post, analytics platform CryptoQuant revealed a significant milestone for the Bitcoin spot volume as it hit a yearly high of $300 billion in October. This shift is primarily driven by traders moving away from their leveraged positions following the October 11 market crash and the record-breaking liquidation.

CryptoQuant analyst Darkfost commented that the pivot towards spot trading and away from high-risk derivatives indicates a decline in speculative activity and a renewed focus on long-term accumulation. Addressing this development as a “highly constructive signal,” he noted,

“A market driven more by spot trading rather than derivatives is generally healthier, more stable, as it is less vulnerable to extreme volatility driven by excessive open interest expansion. It also reflects a stronger organic demand and greater overall market resilience.”

According to market experts, Binance dominated the BTC spot trades in October with $174 billion, driven by increased activity from both retail and institutional traders.

What’s the Key Catalyst Here?

Notably, the primary catalyst for this significant sentiment shift is a series of liquidation events that followed the biggest market crash on October 11, 2025. As the US-China trade tensions escalated with Donald Trump imposing a 100% tariff on Chinese imports, the crypto market reacted adversely, with top cryptocurrencies facing huge losses. The crash resulted in major liquidations across multiple exchanges, with Hyperliquid and Binance leading the charge.

For a vast number of traders, these forced liquidations served as a stark and painful reminder of the inherent dangers and risks associated with crypto. In simple terms, liquidations occur when a trader’s collateral falls below a specific threshold, compelling their exchange to close their positions to prevent further catastrophic losses automatically. This mechanism serves as a powerful reminder about the risks of excessive leverage in the market.

As a result of this liquidation, traders and investors were prompted to re-evaluate their risk management strategies. Many recognised the critical need to adapt their approach, shifting towards more stable and sustainable trading practices. This change in behaviour is reflected in the surge of Bitcoin spot volume, as traders seek to mitigate risk and focus on long-term accumulation.

What Does This Surge in Bitcoin Spot Volume Mean for the Market?

Significantly, analysts warn that the current market bounce may be fragile, citing retail traders’ heightened optimism as a potential red flag. According to Santiment, such enthusiasm often precedes further declines, as true accumulation typically occurs when sentiment turns pessimistic. Adding more to this pessimism, analysts like Ali Martinez sparked caution, highlighting the TD Sequential indicator that flashed a sell warning.