Key Highlights

- On December 5, Bitcoin soared to around $94,000 with 2.89% hike amid the ongoing global tension, including the U.S.-Venezuela tensions

- Analyst Tom Lee of Fundstrat predicted Bitcoin could reach $250,000 by late 2026, while Strategy disclosed a major new purchase of 1,287 BTC, bringing its total holdings to over 673,000 coins valued at roughly $50.55 billion

- The rally is supported by technical factors like reduced miner selling and liquidated short positions, but uneven performance in smaller cryptocurrencies shows potential for a near-term market pullback despite the strong momentum

On the first Monday of 2026, Bitcoin witnessed an impressive rally, which pushed its price above $93,000 amid the rise in the ongoing tension.

According to CoinMarketCap, Bitcoin is trading at around $93,800 with a 2.89% hike in 24 hours after seeing a high of $93,100 earlier today. At the time of writing, the market capitalization of BTC also holds around $1.8 trillion.

While numerous factors are behind this surge, some experts believe that the ongoing tension between the U.S. and Venezuela has sparked a rally in the cryptocurrency.

U.S. Captures Venezuela’s President, North Korea Fires Ballistic Missile Toward Japan

As 2026 starts, the world is facing a rapidly worsening geopolitical situation around the world, which is growing risk of intense instability.

In the Americas, U.S.-Venezuela relations have reached a boiling point. On January 3, U.S. defense forces conducted airstrikes on Caracas and captured President Nicolás Maduro and his wife in a quick operation, calling it an operation against narco-trafficking.

This attack comes after months of military buildup, boat strikes, and oil tanker seizures. The action has also received international condemnation for violating sovereignty, with the UN warning of a “dangerous precedent,” while sparking protest and celebrations among the Venezuelan diaspora.

In the Indo-Pacific, China has also conducted large-scale “Justice Mission 2025” drills in late December, where the Chinese military performed a simulation of a Taiwan blockade with live-fire exercises, warships, and aircraft encircling the island.

Beijing framed it as a warning against “separatist forces” amid U.S. arms sales to Taipei, which raises fears of invasion rehearsals.

Northeast Asia has also witnessed a provocation after North Korea launched multiple ballistic missiles toward the Sea of Japan on January 4, its first tests of 2026. These missile launches have violated the UN resolution.

In the Middle East, Iran grapples with country-wide protests sparked by economic collapse. This chaos has rapidly turned into clashes, deaths, and regime-building attacks since December 2025.

UK and French aircraft jointly struck an underground ISIS weapons facility near Palmyra, Syria, on January 3, which shows counterterrorism efforts amid the group’s resurgence.

Bitcoin Witnesses Breakout, Tom Lee’s Bullish Forecast for BTC

Amid the global tension across the globe, the cryptocurrency market has witnessed an upward momentum. The rising global tensions have rattled traditional financial markets, leading some investors to treat Bitcoin as a modern safe haven, similar to digital gold.

Analysts note that institutions and hedge funds, worried about instability in conventional systems, are increasingly turning to Bitcoin’s fixed supply and decentralized structure for diversification.

JUST IN: Bitcoin could reach $250,000 in 2026 if the 4-year cycle breaks, according to Tom Lee

2026 tailwinds include:

– Wall Street adoption

– U.S. government support

– Gold rallies typically lead Bitcoin rallies pic.twitter.com/xzE3ft4bgB— Bitcoin Archive (@BitcoinArchive) January 5, 2026

While BTC is growing with bullish sentiment, a prominent analyst, Tom Lee of Fundstrat, issued a new prediction today. He forecast that Bitcoin could reach $250,000 by the end of 2026. Lee cited the potential for the traditional 4-year market cycle to break amid strong institutional adoption and supportive regulations.

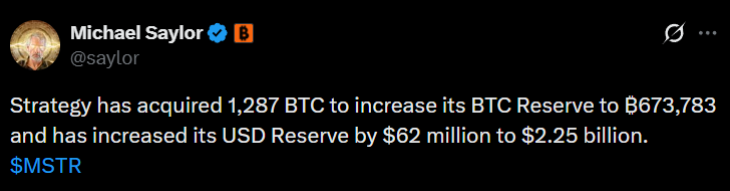

(Source: Michael Saylor on X)

Strategy (formerly Microstrategy) confirmed that it continues to aggressively buy BTC. The company purchased 1,287 more BTC for $116 million between January 1 and January 4. This acquisition brings Strategy’s total BTC treasury to 673,783 coins, worth approximately $50.55 billion at current prices. The company’s approach highlights continued corporate confidence in the asset.

Some technical factors are supporting the current rally, as market observers point to reduced selling pressure from Bitcoin miners, the return of liquidity after the holidays, and the forced closure of over $400 million in leveraged short positions recently.

Despite the positive momentum, notes of caution remain. The performance of smaller alternative cryptocurrencies has been uneven, which suggests the market could be due for a short-term pullback.

Also Read: Strategy Adds 1,287 Bitcoin, Raises USD Reserves Amid Rally