Key Points:

- Bitcoin volatility is being caused by short-term holders (STHs) selling at high prices, and long-term holders (LTHs) accumulating.

- The market structure of Bitcoin is bullish and will continue accumulating as long as LTHs continue accumulating.

- Inflows of Bitcoin ETFs are indicating that more institutions are showing interest.

Bitcoin (BTC) is moving in a typical cycle pattern, and short-term holders (STHs) have demonstrated indications of distribution, while long-term holders (LTHs) are still assimilating supply. This trend contains indications of a contractionary period, but not a climax to be understood in the price movement of Bitcoin in the medium term.

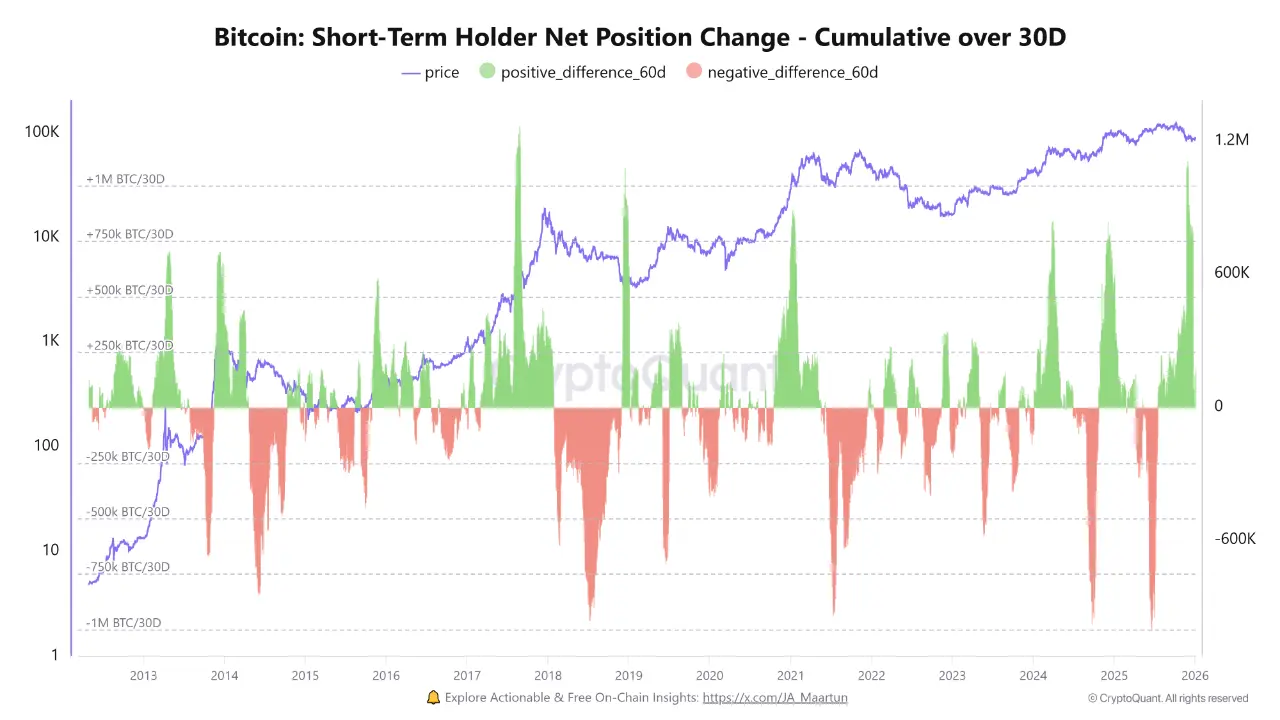

The recent on-chain data shows a common game between STHs and LTHs who are involved in determining the market cycles in Bitcoin. At high prices, STHs usually tend to distribute and sell their positions after some duration of price growth. This can be observed in the change in the net position in 30 days on a cumulative basis, where spikes in STH net outflows tend to be associated with short-term overheating of the market. These flows by short-term traders will mitigate exposure following significant price changes, a factor that causes volatility and is a correction period.

BTC STH | Source: CryptoQuant

Long Term Holders Pumping Bitcoin

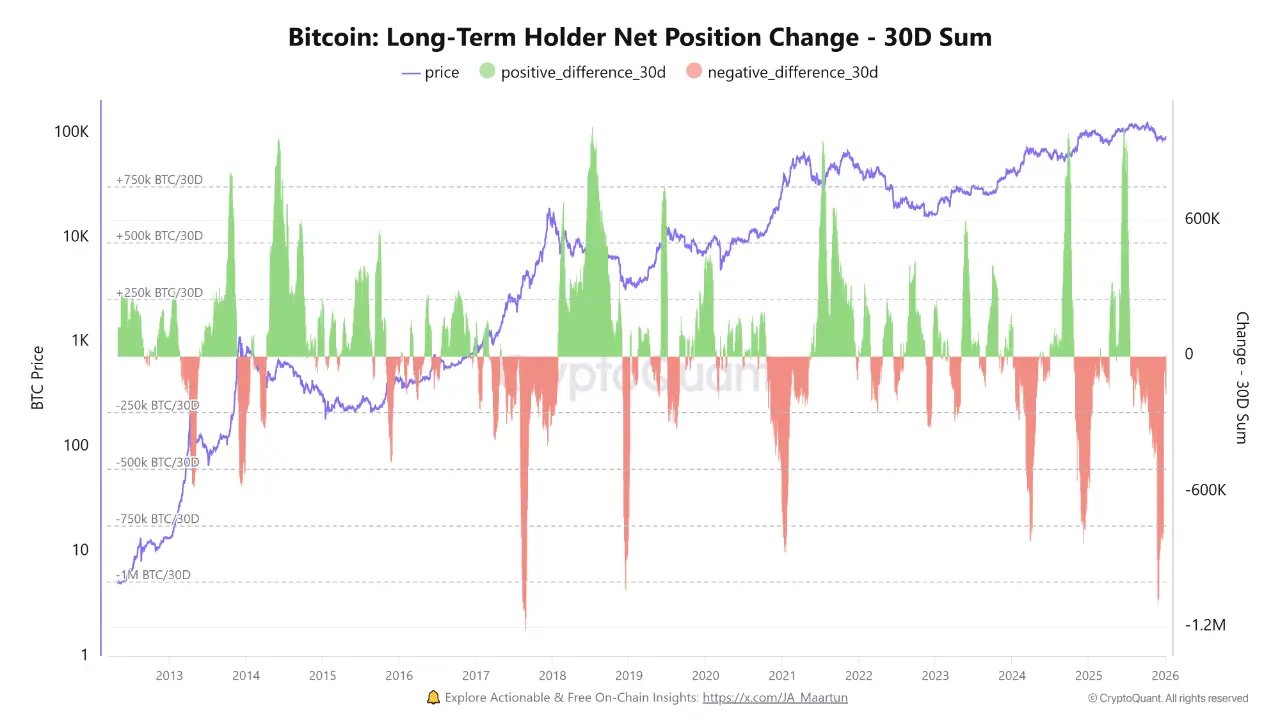

Conversely, on the other side of the coin, long-term investors are still pumping Bitcoin, especially when it goes on a pullback and consolidation. Although this is volatile in the short term, this is actually the cause of the long-term accumulation, indicating the growing confidence of investors who are convinced about the future value of Bitcoin.

The information illustrates that the price performance is likely to go into the process of consolidation following strong rallies. Nonetheless, LTHs do not change to net distribution. This continuous growth of BTC in the hands of long-term investors is likely to establish a solid and robust base, which contributes to the long-term optimistic views.

BTC LTH | Source: CryptoQuant

The net position changes also captured the changes in prices that represent how the market is still structurally constructive. The aggressive selling by the short-term holders is often countered by the long-term holders, which makes it impossible to plunge the Bitcoin value.

Instead of spelling the climax of a market cycle, this action is indicative of a continuation stage, implying that Bitcoin is still in its hegemony. Although the short-term price action may change, the macro market picture remains optimistic, provided that LTHs retain their accumulation plan.

Short-Term Volatility and the Impact of Bitcoin ETF Inflows

There is also a notable ETF inflow, as the present surge in BTC is also linked to the presence of price fluctuations. The inflows of BTC ETFs amounted to $697 million on January 5, 2026, which was the second day of positive inflows, according to a tweet of an analyst. Such huge inflows have been a good pointer towards institutional interest, which is yet another way of reassuring the bullish posture of the market.

ETF Data | Source: X

When considering the trend of prices of BTC, it is obvious that the growth of ETF inflows is aiding it to soar to new heights. The BTC price took off on January 5 to an amount that aligns with the new ETF information, indicating increased institutional involvement. The steady rise in institutional capital flows into BTC is a factor that argues long-term holders are not just buying it during the consolidation periods, but also that large-scale institutional investors are also placing their money on it

Specifically, the cumulative change in net position during the last 30 days of both short-term holders and long-term holders indicates that Bitcoins are undergoing a transition toward stronger hands, and short-run traders are withdrawing from the market after a long time of heightened speculation. Institutional investors, on the other hand, are buying in, which is absorbing the supply and contributing to the existing bullish trend.

The short-run profit-seeking behaviour of retail holders of stocks and the long-run hoarding of stocks by institutional and retail investors is an indication of a healthy bull-market structure. Short-term distributors are supplying the liquidity required by long-term distributors and institutional participants to accumulate positions in Bitcoin. The stable market remains, in spite of the volatility that occurs occasionally.

Also Read: Strategy Adds 1,287 Bitcoin, Raises USD Reserves Amid Rally