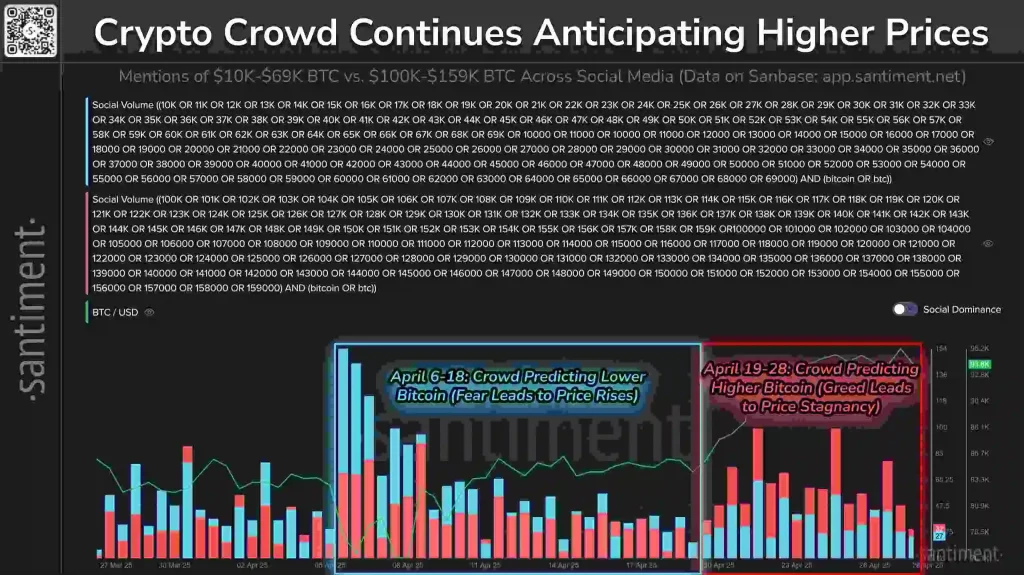

Bitcoin’s strong rally to $95.5K has sparked a surge in overly optimistic sentiment, which Santiment analysis warns could stall further gains. Between April 19 and 28, social media mentions predicting the token would soar between $100K and $159K greatly exceeded the mentions forecasting a drop to $10K–$69K.

The sharp shift towards bullish predictions indicates what analysts call a ‘greed phase’ among retail traders. Historically, such periods of high confidence coincided with price stagnation and reversals, as fewer market participants are on the sidelines, pushing prices higher.

Just weeks earlier, from April 6 to 18, sentiment was much more cautious. Most mentions during that window predicted lower BTC prices—a classic “fear phase.” According to Santiment, that fear helped fuel the cryptocurrency’s rally, as negative sentiment often sets the stage for upward moves.

The trend shows that Bitcoin’s price tends to stall when the crowd bets big on it continuing to rise. Santiment analysis further warns that such evident optimism, albeit emotionally satisfying, is likely counterproductive in the short run, as it can go against market momentum, as highlighted in a recent Bitcoin price prediction.

Bitcoin Finds Support Zone, But Overconfidence Clouds Outlook

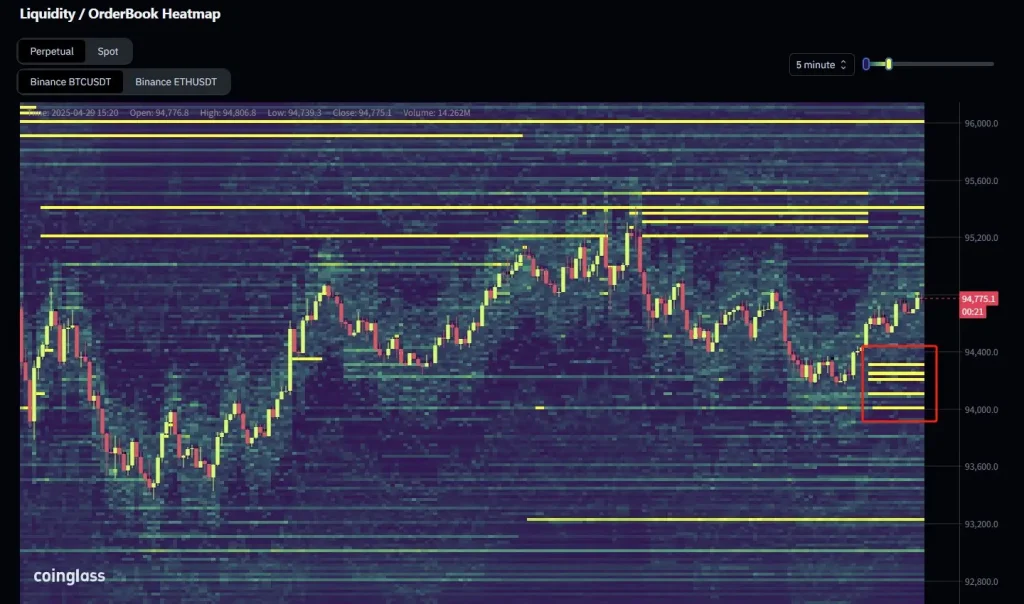

This outlook was further bolstered by a CoinGlass on-chain analysis, which found a buy wall on Binance futures concentrated between the $94,000 and $94,300 price levels. At press time, over 2,500 BTC of cumulative buy orders are stacked within this range, representing a zone of strong support located just below current price levels of $94,775.

The band shows dense liquidity on the order book heatmaps, which means that institutional or large-scale traders could be in the process of buying any near-term price dip. This indicates a buffer against imminent downside, but caution clouds in as such walls serve as a magnet, pulling prices back to these high-demand areas before any further upside breakout.

While overall sentiment is currently heavily bullish, which adds complexity to short-term forecasts, CoinGlass chart analysis displays that the levels of support are solid. In tandem with Santiment’s observations of crowd greed, this setup may result in the token consolidating or even testing lower liquidity pools before resuming any upward trend.

Short-Term BTC Outlook Hinges on $95K Level

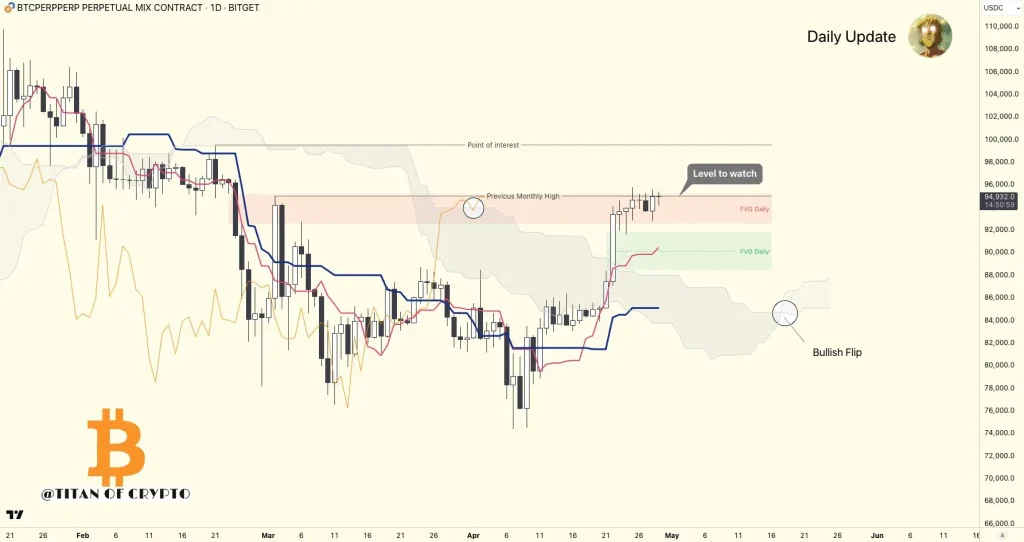

On a technical front, analyst Titan of Crypto notes that the Bitcoin cryptocurrency has a key resistance that could dictate its short-term direction. According to the analyst, the key price level of $95,040, marking the previous month’s high, comes into play as a crucial level to keep eyes on.

While the token traded above this level on its recent move to $95.5K, Titan of Crypto notes that a daily close above $95,040 is required to confirm any potential bull break. At the time of writing, the BTC cryptocurrency was trading at nearly $94,775, a territory that kept it within striking distance of this critical barrier.

However, without a definite daily candle close above the threshold, rejection and eventual consolidation may ensue, especially if crowd sentiment remains high and dense order book liquidity remains below current levels.

Santiment and CoinGlass data also support Titan of Crypto’s cautious analysis. What is apparent is that buy-side liquidity between $94,000 and $94,300 acts as near-term support, whilst retail optimism indicates confidence, but a lack of confirmation through key resistance creates short-term risk. Until bulls secure that daily close, the market remains technically unconfirmed for further upside.

Also Read: Robert Kiyosaki Ties US Bond Crash to Bitcoin Surge As US Dominates BTC Mining