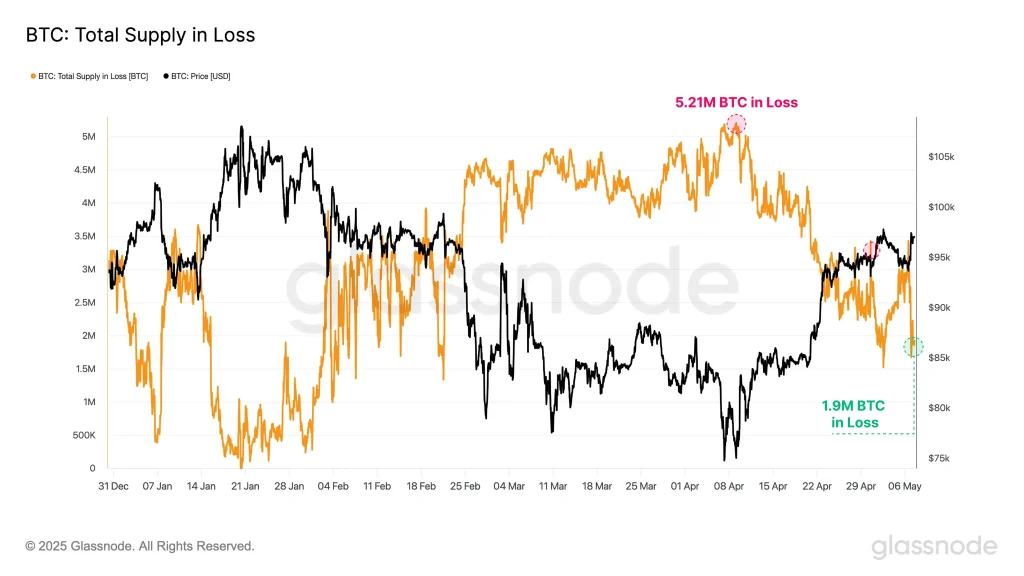

Analysts at Glassnode have projected a notable shift in Bitcoin investor sentiment as over 3 million BTC have transitioned from a loss-making to a profitable position amid a recent market recovery. As per the latest data, when the Bitcoin token approached its local low near $74,000, approximately 5.21 million BTC were held at a loss.

However, this figure has since fallen sharply to around 1.9 million BTC, signaling renewed confidence in the market. The on-chain data visualized by Glassnode illustrates a steep decline in the total BTC supply in loss as Bitcoin’s price rebounded above $95,000.

Bitcoin Total Supply in Loss (Source: Glassnode)

The chart highlights a correlation between the price recovery and the dramatic decrease in underwater BTC positions.

While early April saw the supply in loss stabilize above 5 million coins, the recent reversal and bullish Bitcoin price prediction suggest that many long-held positions have returned to profitability.

Glassnode analysis emphasizes that this on-chain metric often serves as a proxy for investor psychology—fewer coins in loss generally reflect increased holder optimism and reduced sell pressure. The move from 5.21M to 1.9M BTC in loss reinforces the narrative of a strengthening market as traders respond to favorable price action.

Bitcoin Price Breakout Clears $100K; $110K Now in Focus

Building on this recovery narrative, technical analysts are now pointing to key breakout levels that may shape the cryptocurrency’s next price targets. Larry Tentarelli, Technical Strategist at Blue Chip Daily, highlighted Bitcoin’s decisive break above the $90,000 range as a crucial bullish signal.

As Tentarelli puts it, any need to break above the $100,000 level confirms the breakout, and he estimates $110,000 as the next resistance point on the price ladder. On the 8th of May, BTC/USD closed at $101,178, up over 2% since its opening.

Bitcoin Price Chart (Source: X Post)

This push came after several weeks of consolidation in a narrow band and is a sign of revived technical strength, particularly as we have the increasing bullish volume with the advance. The chart shows a clean breakout from the multi-week range, when $90K has been a solid ceiling.

Tentarelli’s projection corresponds to the more general change in sentiment that has been variously noted by Glassnode—the combination of on-chain sentiment and chart-based confirmation. As the cryptocurrency is reverting to a profitable state and the price continues rising, analysts believe the market is exiting recovery and entering possible expansion.

With fewer coins underwater, less sell pressure, and a bullish breakout above resistance, the argument for continuation upwards is reinforced. All eyes are now on the $110K mark as the next major test for the token’s momentum.

Also Read: XRP History Repeats: Analyst Predicts Incredible 50X Surge to $123