- Bitcoin price is under bearish pressure as the market struggles below its all-time high of $123K.

- Futures Taker CVD data shows an increase in seller dominance, meaning there is more downside risk to BTC.

- Analyst Ali foresees BTC price falling as low as $95K, a possible 24%-30% decrease.

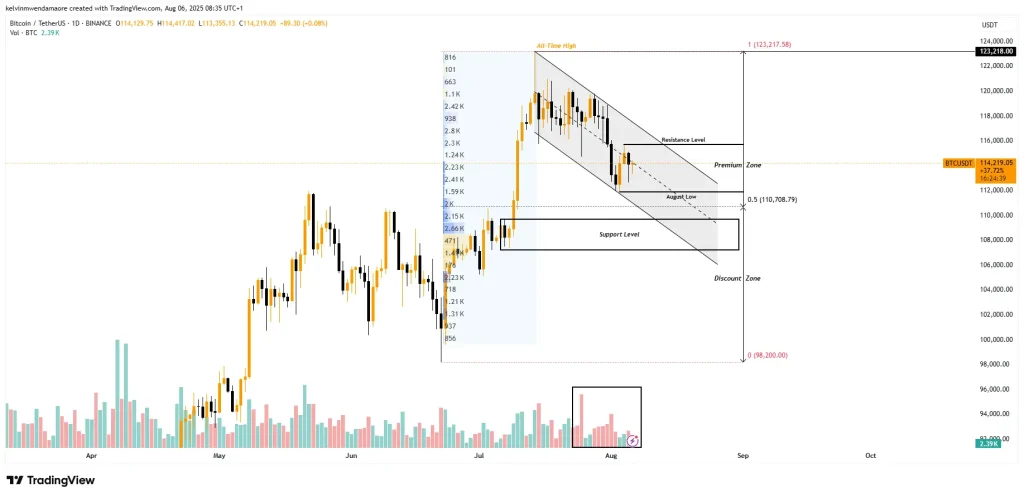

Bitcoin price has been navigating a bearish market since hitting its all-time high of nearly $123K, with recent price action taking it as low as $111K in early August. Nevertheless, the token has been able to recover a little bit as it is now trading at $114K, which is a slight 2.02% recovery from its August dip. This temporary profit aside, BTC is still in the red, with a loss of more than 9% since its peak.

The market’s attention is now squarely focused on Bitcoin’s next move, especially after MicroStrategy’s significant $786 million Bitcoin purchase, which has reignited some optimism in the market. However, as the coin remains in the clutches of the bears, the big question still remains: what’s next for BTC?

BTC Price Outlook: Bearish Momentum with a Bullish Twist

At present, Bitcoin resides in the middle of a bearish channel, a critical juncture that signals a continued bearish trend is more probable. The immediate risk for the token is revisiting the August low of $111,920.

If the token drops below this level, it would lend credence to the negative sentiment and push its price into the $109K-$107K range, which is seen as a key support area by the fixed-range volume profile, where many long positions were taken.

Also, Bitcoin’s current state in the premium zone provides short-term traders with an opportunity to exploit a possible drop, which can exacerbate the downward pressure on the token.

Bitcoin Price Chart (Source: TradingView)

Besides, market analysis indicates that the volume of bearish candlesticks is growing, which supports the notion that BTC is still in the distribution stage. This implies that, unless there is a significant change in mood, the path of least resistance in Bitcoin is probably down.

With that said, the Bitcoin price has not completely lost hope of bullish prospects. A slight increase in market sentiment may drive BTC to the $115,720 resistance point. Should the token overcome this critical price point, there is a chance that it may rally to the upper trendline of its bearish channel at around $118K, which has limited bullish momentum since mid-July.

A breakout above this resistance would indicate a change in market dynamics, which could trigger a bullish rally. However, the possibility of this breakout is questionable, and the present downward pressure is yet to weaken.

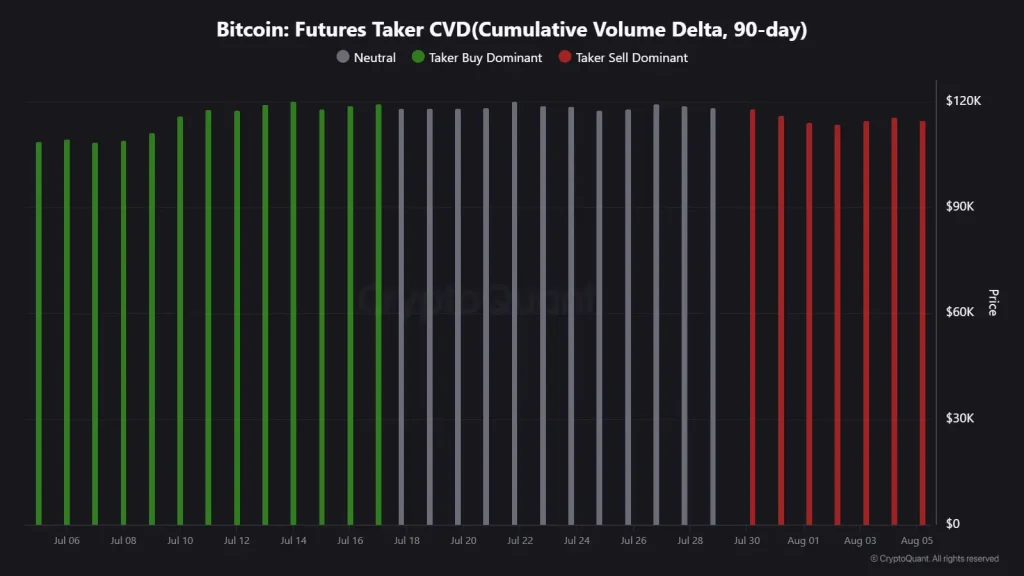

Bitcoin’s Price Struggles as Sellers Gain Dominance

According to the latest data from the Futures Taker Cumulative Volume Delta (CVD), sellers are firmly in control of the Bitcoin market. The 90-day CVD chart indicates an increasing dominance of Taker Sell periods, indicating that there is more selling pressure than buying pressure, which has made it more difficult for the cryptocurrency to break key resistance levels.

Bitcoin Futures Taker CVD (Source: CryptoQuant)

Further contributing to this bearish sentiment, analyst Ali notes that Bitcoin has recently seen its weekly RSI fall below its 14-day SMA, a dynamic that has historically preceded a sharp price correction, generally in the range of 20-30%. Assuming that the current trend persists, Ali estimates that the Bitcoin price may decline to as low as 95,000, which would represent a potential 24%-30% decline relative to the current position.

Bitcoin Price Chart (Source: X)

Historical data can confirm this forecast: in the past, when the RSI dropped below the SMA, Bitcoin fell to approximately $75,000. If this trend is repeated, the price of Bitcoin may challenge the support at $95,000 within the next few months, especially as the RSI is still indicating weakness.