- Bitcoin price holds above a confluence of support of $100,000 and the bottom trendline of the expanding wedge pattern.

- BTC reversal from the 75th percentile cost basis (~100k) is heading to the next crucial resistance of the 85th percentile cost basis at $108,500.

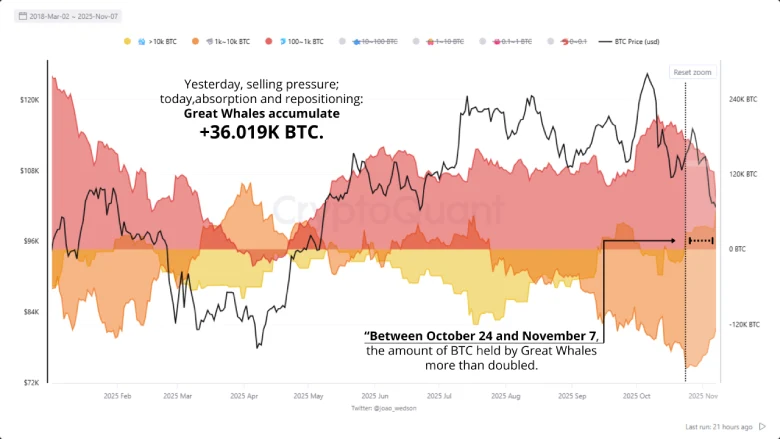

- Great Whales, owning over 10,000 BTC, expanded their positions by more than 36,000 coins between late October to early November.

The pioneer cryptocurrency, Bitcoin, attempts to extend its renewed recovery after $100,000 support reversal on Monday. Despite an initial intraday gain of 1.86%, Bitcoin reverted during the U.S. market hours to currently trade at $105,600. While the overhead supply may create concern among retailers over continued correction, the large investors project a strong conviction in BTC, accumulating more at a discounted price.

Large Holders Absorb Supply as BTC Stabilizes Near $106K

Bitcoin’s recent rebound came after its price retested the 75th percentile cost-basis, which is just above $100,000, and has since trended into a range of consolidation below $106,200. Glassnode data points to $108,500 as the next crucial area to monitor, as it represents a threshold that has previously served as a resistance level in rebound phases.

While the upswing is yet to project a conversion to sustainable recovery, on-chain analysis from GugaOnChain reveals a significant change in capital allocation by Bitcoin holders in the last half of October through the beginning of November.

Mid-range investors who controlled between 100 and 1,000 BTC drastically decreased their accumulation, and these investors lowered their holdings from approximately 174,000 BTC to 81,000 BTC. In contrast, entities with over 10,000 BTC – so-called Great Whales – greatly increased their reserves, adding more than 36,000 coins and increasing their total to close to 63,000 BTC. Meanwhile, selling pressure from whales in the 1,000-10,000 BTC bracket has softened, pointing to a softening of distribution in this area from this segment.

This shift signals that larger players are absorbing the supply that was released by the smaller investors, trying to stabilize the price above the six-figure mark even as the short-term traders are taking profits. However, the short-term trend (1 to 4 weeks) could continue to face highlighted volatility as mid-sized investors take profit amid “extreme fear” sentiment.

“Bitcoin’s circulating supply increased slightly during the analyzed period, from 19,772,071 BTC on October 24 to 19,778,709 BTC on November 7, a change that had little impact on price,” the analyst highlighted.

In the medium term (1 to 6 months), a moderate rally is projected, supported by seasonality and monetary policy. Accumulation by large entities reinforces the thesis of new peaks in this cycle.

Thus, the Bitcoin price is expected to drive a mid-term rally in the coming months, supported by seasonal patterns and supportive monetary policies. The ongoing accumulation from large investors strengthens the outlook of this asset to reach a new high within the current cycle.

Bitcoin Price Spark Fresh Reversal Within Channel Pattern

Last week, Bitcoin registered a short-term consolidation around the $100,000 support, with multiple lower-wick rejection candles indicating the intact demand pressure. The resulting upswing, when analyzed in the daily chart, shows a renewed recovery within the formation of an expanding channel pattern, a.k.a. megaphone.

With today’s jump, the BTC price is likely to challenge the overhead resistance of $106,500, which is also the opening level of the sharp sell-off recorded on November 4. A potential breakout will reclaim the 20-day exponential moving average slope, strengthening the buyer’s grip over this asset for further recovery. With sustained buying, the post-breakout rally could drive another 9.5% surge and challenge the next key resistance, $116,500.

On the contrary, if the price shows a renewed selling pressure at the 200-day exponential moving average, which currently wavers around the $108,000 mark, BTC could revert to the lower boundary of the channel pattern for a potential bearish breakdown and drive an extended correction.