- The Bitcoin price poised for a 10% drop as overhead supply at $90,000 hints an intact sell-the-bounce sentiment in the market.

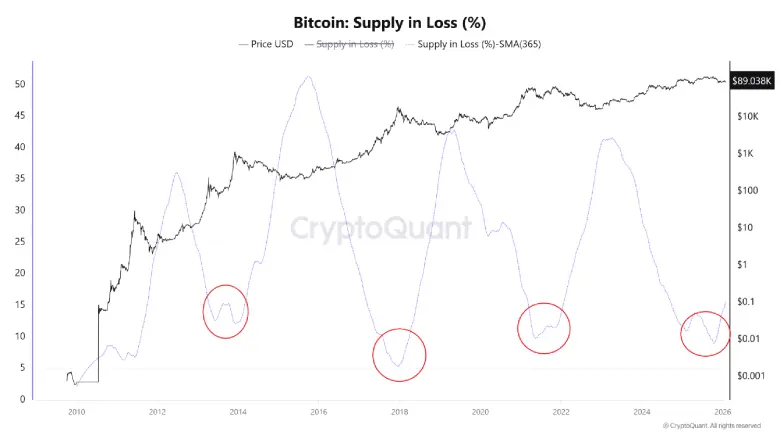

- As of late January 2026, roughly 15–20% of circulating BTC is held below the purchase price.

- The declining nature of trend-defining moving averages 100-and-200 indicate the broader market trend in bearish.

The pioneer cryptocurrency Bitcoin shows an insignificant gain of 0.15% during Wednesday’s U.S market hours to trade at $89,302. The low volatility trading can be attributed to unchanged Federal Reserve interest rates at 3.5-3.75% in today’s FOMC decision. While the reduced uncertainty favors risky assets like cryptocurrencies, the Bitcoin price faces overhead supply at $90,000 signaling a sell-the-bounce sentiment intact among market participants.

BTC Recovery Stalls Near $89K as Fed Holds Rates and On-Chain Losses Rise

The cryptocurrency market witnessed a renewed recovery momentum this week, with Bitcoin price rebounded from $86,000 to $89,540, registering a 4.12% gain. However, the buying pressure slowed down on Wednesday, as the Federal Reserve decided to keep interest rates unchanged at 3.5-3.75%, aligning with market expectations.

The official FOMC statement states that economic activity remains solid, while job growth has been weak and inflation remains somewhat elevated. The Bitcoin price responded neutral to slightly bearish to FED’s decision, evidenced by the long-wick rejection and neutral body in daily charts.

Recent data tracked on-chain by CryptoQuant shows the percentage of Bitcoin currently held at unrealized losses has turned around and begun to rise again. As Bitcoin hovers around $89,000 in late January 2026, this metric is roughly around the 15-20% territory after diving lower before.

Past market downturns – in 2014 after the Mt. Gox implosion, 2018 after the 2017 bull run crest, 2022 after mass liquidations – showed a similar situation. The percentage started climbing quite a bit before the deepest price troughs, often months ahead of the cycle low.

In those instances, the figure eventually ballooned drastically, often blowing past into the 40-50%+ range, as more holders across holding periods became stuck with mounting paper losses during the time of prolonged selling pressure.

The present upturn is still small in comparison with those historical capitulation extremes, where losses swallowed far greater portions of the circulating supply. Still, the shift in direction has attracted attention because it has similarities with the prelude to prolonged weakness in previous cycles.

The 365-day smoothed average of this metric has also started to reflect this shift and pulling away from the descending path seen during stronger phases.

Analysts comment that although the absolute level remains subdued, the first such reversal is an important indicator, being a very early indication of a changing holder dynamic.

Overhead Supply May Push Bitcoin Price To $80,000

Over the past week, the Bitcoin price has wavered sideways below the $90,000 mark reflecting a broader market uncertainty. This consolidation showed price rejection from either sideways indicating lack of initiation from buyers to sellers.

Even today, the coin price showed a long-wick rejection in daily candle, indicating an intact overhead supply over BTC. The fast-moving 20-and-50-day EMAs currently positioned at $90k offers additional headwind against price recovery,

If the bearish momentum persists, the Bitcoin price could revert 5.8% down to hit $84,000 level, followed by a dip to $80,000.

On the contrary, if the coin price flips the overhead resistance into potential support, the bullish momentum will accelerate and push the asset for a sustained recovery. The breakout will also fail the previously anticipated downtrend for inverted flag pattern breakdown.

With sustained buying, the Bitcoin price could jump another 10.6% to $100,800 mark.

Also Read: Korea to Enforce $3.5M Capital Requirement for Stablecoin Issuers