- The Bitcoin price faces selling pressure at the resistance trendline of the channel pattern, signalling another bearish cycle within this range.

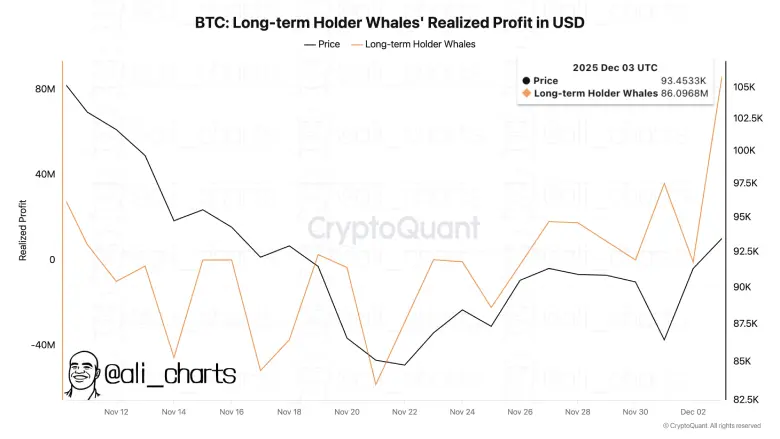

- The crypto whales booked a profit of $86 million during the recent price rebound, indiating a risk for an extended downtrend.

- Lark Davis flagged a bearish weekly MACD crossover in Tether’s market cap, signalling reduced dollar inflows into crypto markets.

The pioneer cryptocurrency, Bitcoin, plunged over 3.16% during Friday’s U.S. market hours to trade at $89,184. The pullback followed the recently released core PCE data, which strangely acted as a sell-the-news event for crypto investors. The downward trend gained additional momentum as whales used the recent rebound for profit-taking, signalling a risk of prolonged correction ahead.

Weakest Core PCE Since June Lifts December Fed Cut Expectations

In September, the core Personal Consumption Expenditures price index in the United States rose 2.8% from a year earlier, according to Commerce Department data released Friday. The figure was down from 2.9% in August and marked the weakest annual rate since June.

Economists polled ahead of the release had looked for the rate to remain unchanged at 2.9% for a third straight month. The core measure, which removes volatile food and energy costs, is the Federal Reserve’s preferred gauge for underlying inflation trends.

Month-over-month, the prices of core PCEs increased 0.2%, which is in line with the median forecast. Headline PCE—which includes food and energy—advanced 2.3% on the year and was also below expectations of 2.4 percent.

The lower-than-expected 2.8% core PCE print in September, which was lower than the expected 2.9% print and the weakest in three months, has led to the probability of a 25 bps Fed rate cut at the December 9-10 meeting to 86% in the fed funds futures market.

This cooler-than-expected inflation measure, coupled with the fact that the labor market is softening (4.4% unemployment and a slowing job growth rate), gives the FOMC leeway to continue the easing cycle started in September.

However, the latest on-chain data shows that a crypto whale has used the recent rebound in Bitcoin price to lock in more than $86 million in profits, according to a shared X post from analyst Ali Martinez.

Historically, whale selling has often coincided with major market tops and accelerated correction in price, signalling a risk of continued correction in price.

Bitcoin Price Faces Supply Pressure at Channel Resistance

In the last two days, the Bitcoin price has shown a bearish pullback from $94,000 to the current trading price of $89,333, accounting for 5% loss. With this reversal, the sellers managed to reclaim the 20-day exponential moving average under their grip, bolstering the price for further downtrend.

The supply pressure is positioned close to the resistance trend of a falling channel pattern in the daily chart. The chart setup is characterized by two parallel down-sloping trendlines acting as dynamic resistance and support.

The recent history of the pattern shows that a reversal from the overhead trendline has often renewed the market selling pressure and pushed a sharp pullback towards the bottom trendline. The coin price trading below the key exponential moving averages 20, 50, 100, and 200 is sensitive to the fact that the path of least resistance is downward.

If materialized, the Bitcoin price could plunge another 23% before seeking support at $67,500.

On the contrary, a potential breakout from the pattern’s overhead trendline would bolster a positive change in market dynamics.

Also Read: BitMine Adds Nearly $130M in ETH As Ethereum Price Holds $3k