- The Bitcoin price is poised for a short rebound from $75,000 to $82,600 amid oversold RSI and retail buying.

- Addresses holding 10–10,000 BTC (67% of supply) sold 50,181 BTC in 14 days.

- BTC’s fear and greed index plunged to 14% indicating a market sentiment of extreme fear.

Bitcoin, the largest cryptocurrency by market capitalization slipped another 5% on Tuesday, February 3rd, dropping below the $75,000 floor. The selling pressure accelerated with large holders sending BTC to spot exchanges and long liquidation triggered in the derivative market. Amid a breakdown below major technical support, the Bitcoin price faces risk of prolonged correction to sub-$70k levels.

Whale Selling Pushes BTC Toward a Bear Cycle Channel

Bitcoin has just dipped below the $75,000 level, last seen since the tariff policy downturn on April 7, 2025. Future movements – possibly dipping to under $60,000 or moving up over $90,000 – depend on major players deciding to build positions or continuing to reduce.

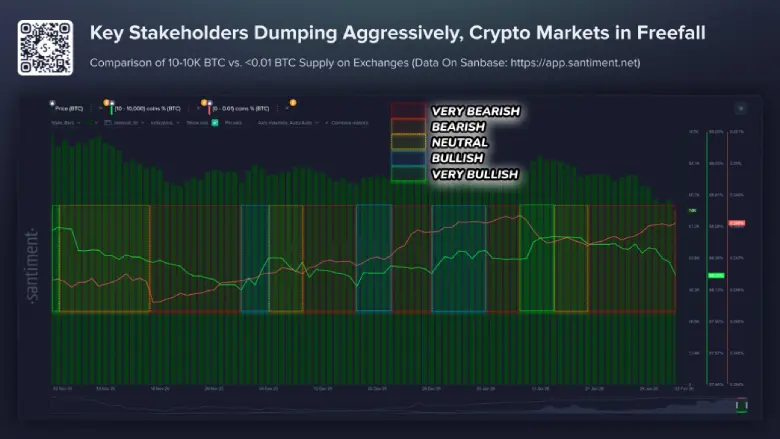

On-chain record shows that addresses holding between 10 to 10,000 BTC which correspond to 67% of the overall supply, offloaded 50,181 units in the last 14 days. Meanwhile, small addresses less than 0.01 BTC are gobbling up coins during declines in the hopes of a turnaround.

Santiment’s exchange supply comparison for these groups makes use of shaded bars and trend lines to show the shifts, with data pulled from their platform.

Scenarios include large addresses selling off at the same time that the small ones are stocking up, which is a sign of deep negativity.

- Large sales with erratic small activity is indicative of moderate negativity.

- Balanced or flat moves from both are suggestive of even ground.

- Large builds with mixed small actions are a sign of positivity.

- Large gains against small sales is a very positive sign.

Right now, the combination of large reductions with small increases supports continuing negative trends.

Earlier in January, patterns flipped briefly with large accumulations of 36,322 BTC in nine days, but recent activity reverted. Whale transactions spiked to more than 102,900 above $100,000 weekly in November, a combination of sales and buys. Supply on exchanges declined 403,200 BTC per year, limiting sell-off risks. Volatility is high enough that recent values hover around $76,000 following lows of about $74,600.

Bitcoin Price Gains Bearish Momentum Amid a Bear Cycle of Channel Pattern

In the last three weeks, the Bitcoin price witnessed a significant correction from $98,000 to current trading price of $75,000, registering a 23% loss. This pullback aligns with broader market correction amid macroeconomic uncertainty, cascading liquidation, and geopolitical tension.

Last Saturday, the following Bitcoin price gave a decisive breakdown from the support channel of a traditional reversal pattern called head and shoulders. The chart setup reflects a bearish shift in market trend as the price formation displays a transition from higher high and higher low to lower high and lower low in respective time frames.

Currently, the Bitcoin price seeks stability above the $0.75,000 psychological level, while the momentum indicator RSI has plunged to the oversold region at 26%. Historical data from the past few years indicates that when RSI dropped below the 30% threshold, the coin price often gained 10%.

If history repeats, the Bitcoin price could rebound to $82,650 in the coming week and retest the breached neckline of H&S pattern as potential resistance. With sustained selling, the post-retest fall could extend the prevailing correction to $66,670, followed by a deeper dive to $60,000.

Alternatively, if the BTC price hops above the neckline floor, the buyers could recoup their bullish momentum for a higher recovery.

Also Read: Crypto.com Launches OG, a CFTC-Regulated U.S. Prediction Market App