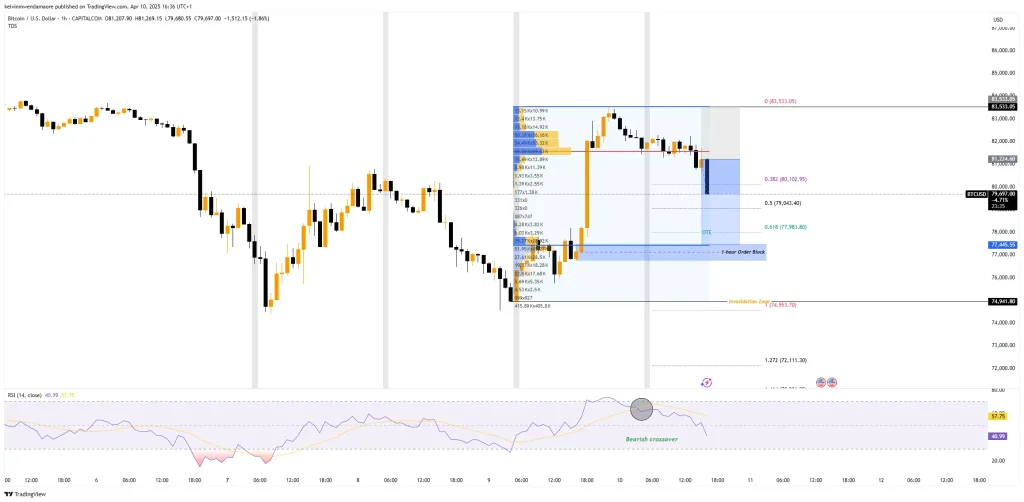

Bitcoin reserves on Binance have witnessed a sharp increase of 22,106 BTC tokens as investors respond to rising market uncertainty. This surge, stretching from March 28 to April 9, coincides with the anticipated release of key macroeconomic data—the Consumer Price Index (CPI) announcement.

Bitcoin: Exchange Reserves (Source: CryptoQuant)

Experts consider these fund transfers into the exchange strategic, driven by traders deploying assets to position themselves before the significant market-changing news event. Besides, the reserve levels at Binance demonstrate investor wariness regarding economic conditions, as they expanded from 568,768 BTC to 590,874 BTC.

CPI Data Defies Expectations, Eases to 2.4% in March

The latest Bureau of Labor Statistics report showed consumer price inflation slowed more than expected in March. In particular, the Consumer Price Index (CPI), which tracks the cost of goods and services in the U.S., dropped by a seasonally adjusted 0.1%, bringing the 12-month inflation rate down to 2.4% from 2.8% in February.

This unexpected dip may represent some economic relief and could indicate a possible shift in the inflationary pressure pause. Besides, when excluding food and energy, core inflation rose 0.1% for the month, pushing the annual rate to 2.8%. This was the lowest level of core inflation since March 2021, offering a ray of hope that inflation was stabilizing.

This report coincided with President Donald Trump’s announcement that he would put off some of the tariffs that had been scheduled to kick in. A day before the CPI report, Trump announced that he was temporarily suspending some of the harshest tariffs on multiple countries.

However, a 10% blanket levy on all imports exists, and the administration has set 90 days to reach a more comprehensive tariff plan. The move arrives as Trump continues the battle to tame inflation, a central part of his economic plan. Despite some progress, rising prices were modestly tamed in early 2025.

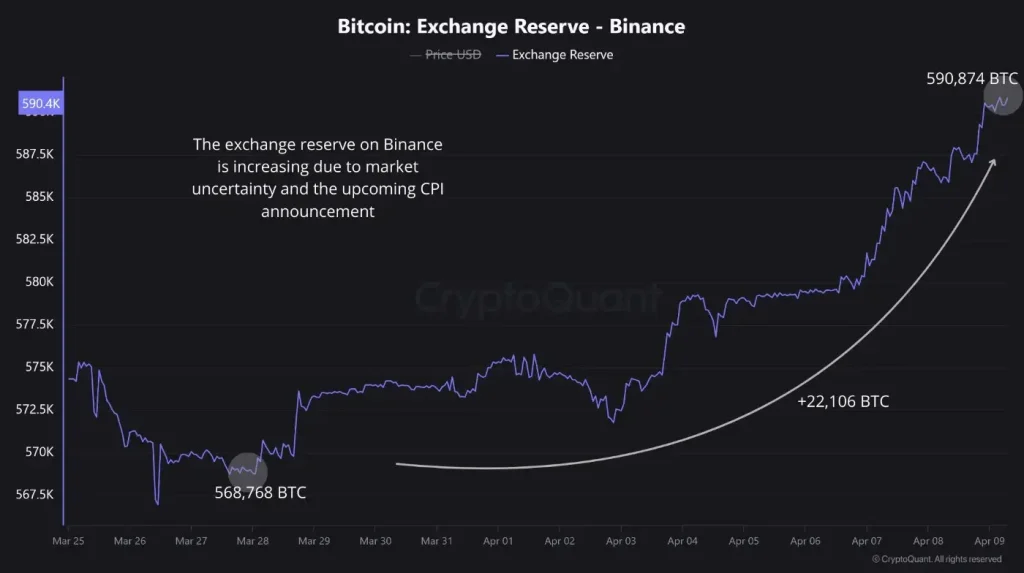

BTC Downtrend: Key Levels to Watch for Reversal

At press time, Bitcoin (BTC) observes a distinct bearish trend as intense downward pressure increases across its price chart. The price has tugged downwards from the $83.5K resistance and is moving toward crucial support levels. In particular, the 1-hour order block, positioned between $77,512.75 and $76,765.85, is under the token’s radar as it generates significant volume-based data that warrants attention.

BTC/USD 1-Hour Chart (Source: TradingView)

Bitcoin shows the potential to initiate an upward rally when support occurs at this particular point. However, the cryptocurrency’s price action and RSI indicators hint at bearish control over the short-term market direction. The RSI shows a bearish crossover, indicating that momentum is weakening and further downside may be on the horizon.

As the price nears the order block, Bitcoin could either stabilize for a potential bounce or continue its downward trajectory if it fails to hold at these levels. Key levels to watch:

- Support Zone: The order block between $77,512.75 and $76,765.85 could act as support. If this zone holds, there may be a chance for a bounce, possibly leading to a minor bullish rally.

- Invalidation Zone: A break below $74,553.70 would signal a strong downtrend continuation. If this level is breached, bearish momentum could accelerate, pushing Bitcoin further down.

Also Read: Avalanche Targets $30 Rebound as VanEck Files Avalanche ETF with Nasdaq