Key Highlights

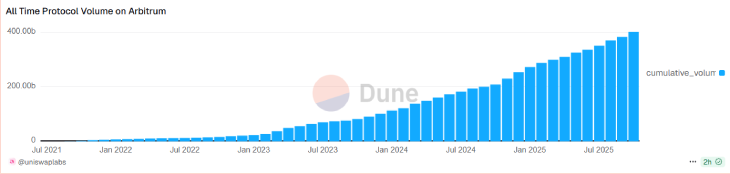

- Ethereum’s leading L2 scaling solution, Arbitrum, has crossed $400 billion in swap volume on the Uniswap Protocol

- This milestone comes after a boom in the popularity of L2

- At present, the ARB token is trading at around $0.32 with a 2.45% crash in the last 24 hours

In the latest post on X, Uniswap, the decentralized cryptocurrency exchange, has revealed that Arbitrum became the first layer 2 scaling solution to surpass $400 billion in swap volume on the Uniswap Protocol.

(Source: Dune.com)

Arbitrum’s Growth Defines L2 Scaling Solutions

While L1s are struggling to pace up their adoption, L2s like Arbitrum have emerged as a major player in the world of digital assets. As Ethereum’s premier Layer-2 solution, Arbitrum’s recent milestones show its contribution to merging traditional finance with decentralized ecosystems by improving liquidity.

Arbitrum just became the first L2 to cross $400B in swap volume on the Uniswap Protocol

Onchain history pic.twitter.com/4wMW85TesK

— Uniswap Labs 🦄 (@Uniswap) October 28, 2025

The secret spell behind its impressive growth is the boom in Real-World Assets (RWAs). By October 2025, Arbitrum’s RWA market cap doubled to over $480 million. This largely comes from the big names like BlackRock’s BUIDL Fund and Franklin Templeton offerings.

“The total RWA value is up 125% this year alone, and it keeps surging. Arbitrum, Avalanche, Polygon, and Ethereum are leading in 30-day growth. Tokenization is inevitable,” stated in the post on X.

This surge put Arbitrum as the 4th largest RWA chain by Total Value Locked (TVL), with $3.63 billion in DeFi TVL and $4.02 billion in stablecoin supply, according to DefiLlama. Tokenized U.S. and EU Treasuries now dominate, reducing reliance on single markets while enabling fractional ownership of real estate, commodities, and equities.

Its further expansion also fueled the Arbitrum Orbit. After being launched in 2023, Orbit now supports over 100 chains with 48 live on mainnet, spanning DeFi, gaming, and RWAs. Projects like Coverage Chain and gaming ventures such as TapNation exemplify specific L3 solutions that settle on Arbitrum One, which boost its interoperability and throughput.

Arbitrum (ARB) Token Witnesses Turbulence

While the entire cryptocurrency market is witnessing a steady upward trend, the ARB token is still facing a catastrophic downfall. At the time of writing, the token is trading at around $0.3260 with a 36.32% drop in a year, with a market capitalization of $1.79 billion.

However, the Arbitrum (ARB) currency is currently showing strong signals that a major price recovery could be underway. After a prolonged period of consolidation and sideways movement, the token has decisively broken past a major resistance level at $3.06. It is a key threshold that has historically pushed the price down.

This breakout suggests that the market structure has shifted from bearish to bullish, which indicates that buyer demand is finally overpowering seller pressure.

This renewed strength is clearly reflected in its recent price action.

From a technical perspective, the charts are forming a pattern of higher lows, which is a classic sign of building upward momentum. The immediate goal for these bulls is to sustain this momentum and challenge the next resistance zone between $0.35 and $0.36.

A successful break above this level could open the door for the cryptocurrency to move toward $0.40. Also, if the ARB token can maintain a base above the $0.30 support level, a much larger trend reversal could be in play with long-term price targets eventually reaching between $0.95 and $1.00, according to some experts.

Its on-chain data also shows positive growth in the recent months. The Arbitrum network has witnessed a staggering $28.8 billion in inflows over just the past three months. This massive movement of capital is showing strong confidence from institutional players and liquidity providers, particularly in the form of stablecoin USDC.