Glassnode’s data has lit the fuse on what could be the next explosive phase of the crypto cycle—altseason. On July 9, their Altseason Indicator officially fired, signaling a decisive shift in market momentum.

This key signal combines three major forces: rising stablecoin liquidity, strong inflows into Bitcoin and Ethereum, and a rising tide in the altcoin market cap. Together, these trends are known to kick off one thing: altcoin outperformance.

Glassnode Signals Structural Shift to Altcoins

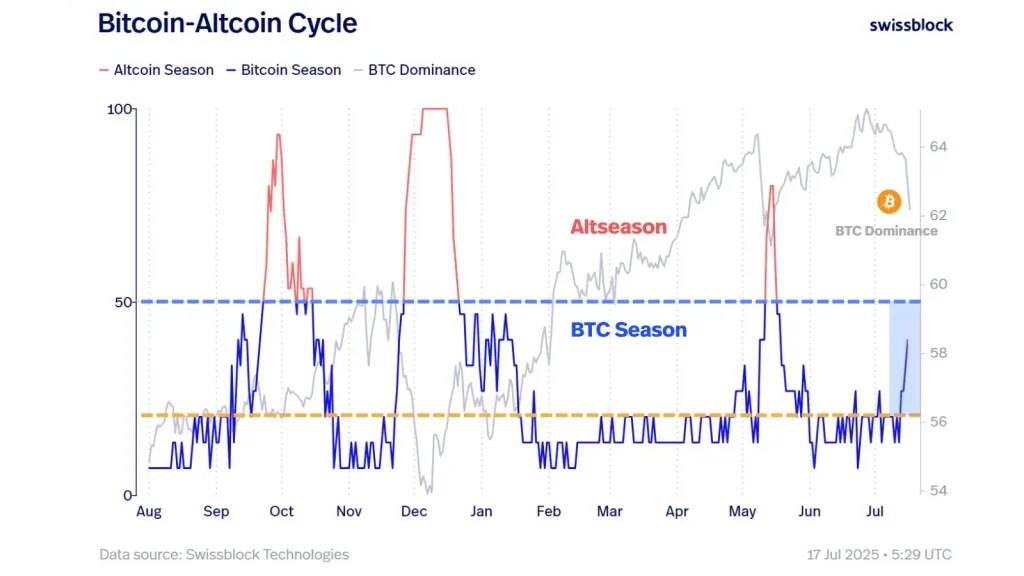

The latest data shows Bitcoin’s price outlook climbing from around $60K in August 2024 to over $120K by July 2025. But here’s where things get interesting: altcoins are heating up, too. The chart shows the altcoin market cap’s 7-day average (pink) rising above its 30-day average (blue), a classic signal of fresh money flowing into riskier tokens.

This crossover, last seen in strong rallies during late 2024 and early 2025, just happened again in early July, right in line with the Altseason Indicator’s trigger. Currently, the altcoin market cap’s 7-day average is surging past the $700 billion mark, with the orange-shaded zones on the chart (labeled “Condition 2”) confirming this breakout momentum.

Altseason Market (Source: X Post)

These shaded periods mark times when short-term altcoin strength outpaces the longer trend, often the beginning of a broader capital rotation from BTC to altcoins. According to Glassnode’s X post, the surge in stablecoins is the spark.

Historically, when stablecoin supply expands, it usually means investors are loading up capital ready to flow into crypto assets. And when that flow starts with BTC and ETH, altcoins are often next in line.

“This means stablecoin supplies are expanding, capital is flowing into $BTC and $ETH, and, simultaneously, the altcoin market cap is rising—a structural environment conducive to capital rotation,” the Glassnode tweet noted, echoing trends seen in previous market cycles.

Altseason Momentum Builds as BTC Dominance Fades

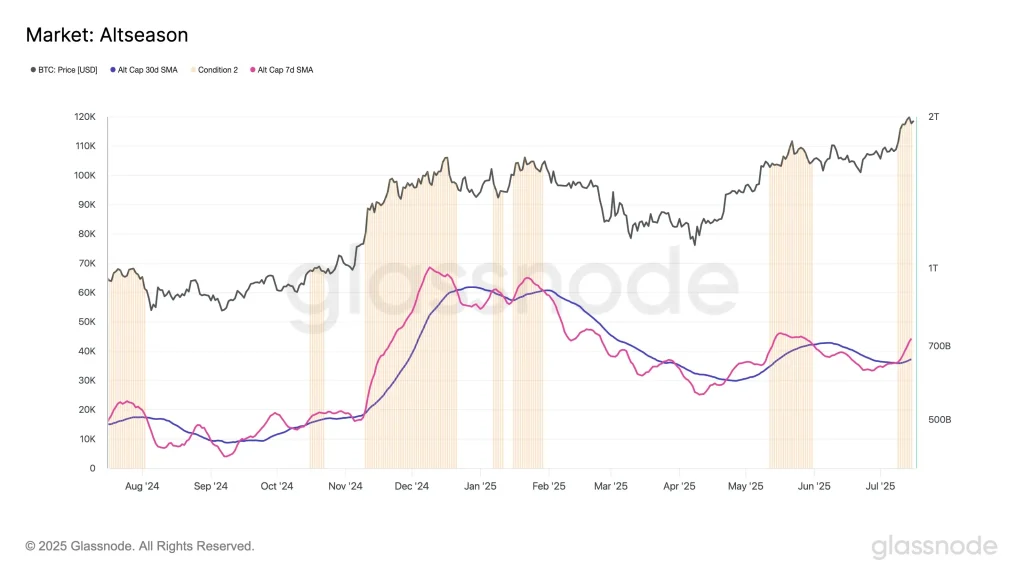

The recent chart by Swissblock is a strong follow-up to Glassnode’s altseason signal. As of mid-July 2025, a clear shift is underway: Bitcoin’s dominance, which has been strong since December 2024, has begun to decline. This decline in dominance has previously been a predictable indicator of a capital shift into altcoins.

According to Swissblock, this breakdown is occurring as the market pushes past a symbolic threshold (highlighted by the yellow line), with strength in the altcoin-to-Bitcoin rotation (blue square) increasing. The current setup mirrors previous phases where Bitcoin season cooled just before explosive altcoin rallies.

Altseason: Bitcoin-Altcoin Cycle (Source: X Post)

The chart’s red spikes—brief but sharp altseason bursts in late 2024 and May 2025—hint at what could be coming. Swissblock notes that while previous altseason flashes were short-lived, current conditions suggest this one could have more staying power, mainly if supported by compelling altcoin narratives and Ethereum’s ongoing leadership.

Known as the bridge between Bitcoin and altcoins, Ethereum is a key component in rotating capital within the market. When ETH attracts attention and investment, it frequently signals the start of broader altcoin momentum, and right now, that momentum is building.

“Previous altseason spikes (red) were short-lived—alts need stronger narratives to sustain a full rotation… $ETH is the bridge. Its rotation leads capital flow—and sets the tone for what comes next across the altcoin market,” Swissblock noted.

Meanwhile, the Bitcoin season indicator (blue line) is approaching the 50 mark, and BTC dominance (grey line) is rolling over—two classic signs that a broader rotation is underway. The market isn’t entirely in altseason territory yet, but it’s no longer firmly in Bitcoin’s hands either.

If momentum holds, this alignment of market indicators could mark the early days of a sustained altseason, fueled by structural liquidity shifts and investor appetite for higher-risk assets.