On Thursday, September 4th, the AAVE price fell over 5.5% to reach its current trading value of $309. The sell-off aligns with a broader crypto market pullback as Bitcoin fails to reclaim the $112,000. The continued correction in AAVE price signals the formation of a falling wedge pattern, highlighting a risk of major breakdown.

However, the recent on-chain data highlights an opportunity for a bullish turnaround as institutional investors are accumulating this altcoin at a dip. The AAVE crypto price stands 2% short of challenging the resistance trendline of a falling wedge pattern.

- Recent data from Arkham Intelligence shows that some institutional wallets accumulated 128,905 AAVE ($40.83 million) from multiple centralized exchanges (CEXs) in the last four days.

- The AAVE crypto price drives a steady uptrend, resonating within the formation of a rising channel pattern in the daily chart.

- The coin price positioned above the 100-and-200-day exponential moving average indicates the broader market trend is bullish, supporting an opportunity for a bullish rebound.

Whales Accumulate $61M Amid Market Pullback

In the last two weeks, the AAVE price witnessed a significant pullback from $386 to its current trading value of $308, registering a 20% loss. The correction followed a broader market pullback as the Bitcoin price broke down below the $110,000 mark.

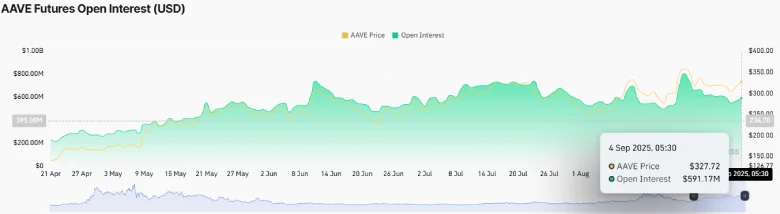

Along with the price pullback, the AAVE futures open interest takes a sharp dive from $805.53 million to $591.3 million, projecting 26%. Typically, this decline indicates that derivatives traders are getting liquidated with the recent dump or expiring their open position due to market uncertainty.

It generally indicates dampening traders’ sentiment in AAVE crypto and reduced speculative force in the market. If the trend resumes, the price correction could extend to a deeper level.

Despite the risk of continued correction, the on-chain data shows some institutions have accumulated up to 191,000 $AAVE (worth approximately $61.03 million) through multiple CEXs in the past three weeks.

According to a recent share by EmberCN, these large investors have withdrawn 128,905 AAVE ($40.83 million) from Binance and OKX in the last four days. Interestingly, their latest transaction was recorded during the Asian market hours today, despite the intraday sell-off in AAVE.

This action accumulation signals a buy-the-dip sentiment among these investors, signaling their conviction in the asset’s long-term trend. Such whale/institutional accumulation has often coincided with major price upswings, signaling a potential for a bullish rebound.

AAVE Price Nearing Major Support Test

The daily chart analysis of the AAVE coin price shows the recent correction acting as a bear cycle within the formation of a rising channel pattern. Since April 2025, the coin price has bounced thrice from the upper resistance trendline and twice from the bottom trendline, indicating its reliability to influence price movement.

With today’s price pullback, the AAVE crypto is just 5% short of retesting the pattern’s bottom trendline around the $322.97 mark.

The bottom trendline has consistently served as a strong accumulation zone, allowing buyers to regain strength after phases of exhausted momentum. Historically, recoveries from this level have ranged between 57% and 185%, highlighting its role as a critical support area.

In support of the bullish outlook, the 100-day exponential moving average is coinciding closely with the bottom trendline, offering additional support for buyers to counter bearish momentum. Amid the aforementioned institutional buying, the AAVE price could likely reverse and rechallenge the $331.8 resistance.

A breakout above this barrier is crucial to restore recovery potential.

On the contrary, note that if the coin price fails to hold above the bottom trendline, the sellers could push for a bearish breakdown and drive a prolonged correction.

Also Read: Ethereum Foundation Pauses ESP Grants, Shifts to Strategic Funding Model Ahead