Key Highlights:

- 21Shares finalizes major agreements which includes BitGo custody, prime brokerage and marketing agent arrangements.

- Legal opinion from Dechert LLP and auditor consent also added.

- Revision to trust agreements align with operational changes, positioning the Solana spot ETF for a potential SEC approval expected as regulators advance crypto ETF standards and reviews.

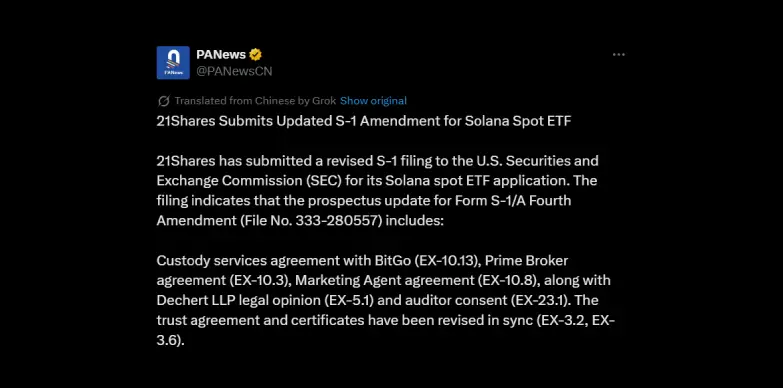

21Shares, a well-known global issuer of cryptocurrency exchange-traded products (ETPs), has submitted an important revised S-1 filing amendment with the U.S. Securities and Exchange Commission (SEC) for its Solana spot exchange-traded fund (ETF). Filed as Form S-1/A Fourth Amendment (File No. 333-280557), this update includes important operational and legal revisions that are necessary for addressing regulatory requirements.

Overview of the Filing Update

With the current changes, 21Shares is planning to bring the Solana spot ETF closer to approval. With all these changes, the firm is making sure that there is an alignment with the SEC guidelines and investor protection standards.

The timing is said to be perfect because the SEC recently indicated its efforts to streamline the review process for crypto ETFs and improve regulatory transparency, potentially creating a more acceptable environment for digital asset investment products.

Custody Services Agreement with BitGo (EX-10.13)

In this amendment, one key update is a new agreement with BitGo, a well-known digital asset trust company that safely stores digital assets. According to this change, BitGo will hold the Solana tokens that back the ETF and will make sure that these assets are secure and protected. This step is important because it reflects that the assets are being looked after by a trusted and regulated custodian with a solid track record.

Prime Broker Agreement (EX-10.3)

The filing now adds a contract with a prime broker to handle trading and settlement. This makes it easier and faster to buy, sell, and clear traders. All of this helps the funds run smoothly. It is important for the easy creation and redemption of ETF shares.

Marketing Agent Agreement (EX-10.8)

With this agreement, a dedicated marketing team that will handle all the promotion, advertising, investor outreach for the said ETF. By adding this role, 21Shares is trying to show its commitment to reaching more and more investors. Along with this move, the firm is also planning to increase awareness amongst investors and expand the fund’s presence in the market.

Dechert LLP Legal Opinion (EX-5.1)

The updated filing now also includes a legal opinion. This legal opinion will be provided by a global law firm known as Dechert LLP. The firm will be confirming that the ETF’s trust structure follows all the federal securities laws. This will add a legal strength to the offering and will help reassure the regulators, along with the investors, about its compliance and reliability.

Auditor Consent (EX-23.1)

The independent auditor has also approved the latest amendments, which confirm that all audits and reports are up to date and match the filing’s changes. This highlights the transparency the firm is trying to maintain and how it is following proper financial accountability.

Revision to Trust Agreement and Certificates (EX-3.2 and EX-3.6)

The filing also updates the trust documents to match the new custody, brokerage, and marketing agreements. These changes make the roles and responsibilities of the trustees and partners clearer, helping them strengthen the overall structure of the ETF.

From the above points, it is clear that the fourth amendments move from broad plans to finalize operations with formal custody, brokerage, and marketing agreements now in place. Updated legal and audit approvals reinforce compliance, while BitGo’s role as custodian addresses one of the biggest hurdles to crypto ETF approvals.

Regulatory And Market Context

The SEC is introducing new rules to speed up crypto ETF approvals, especially for altcoins like Solana. With Bitcoin and Ethereum ETFs already approved, managers are now focusing on altcoins. Trusted custodians like BitGo and finalized agreements make approval more likely.

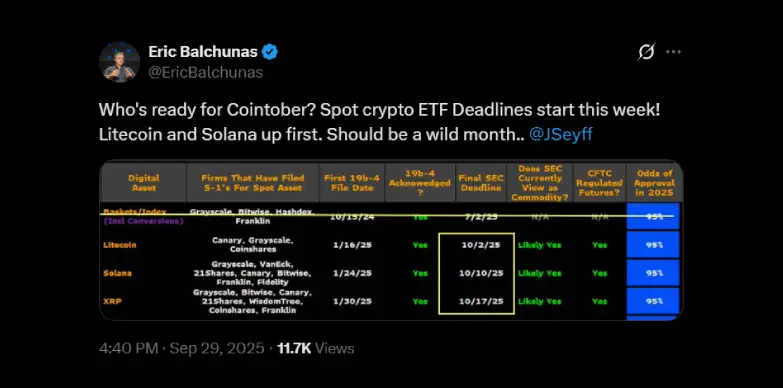

Bloomberg senior ETF analyst Eric Balchunas called October “Cointober,” noting that spot ETF decisions for Litecoin and Solana are coming soon, making it an important month for crypto ETFs.

Also Read: Binance to List Swarm Network (TRUTH) Token on October 1st, 2025