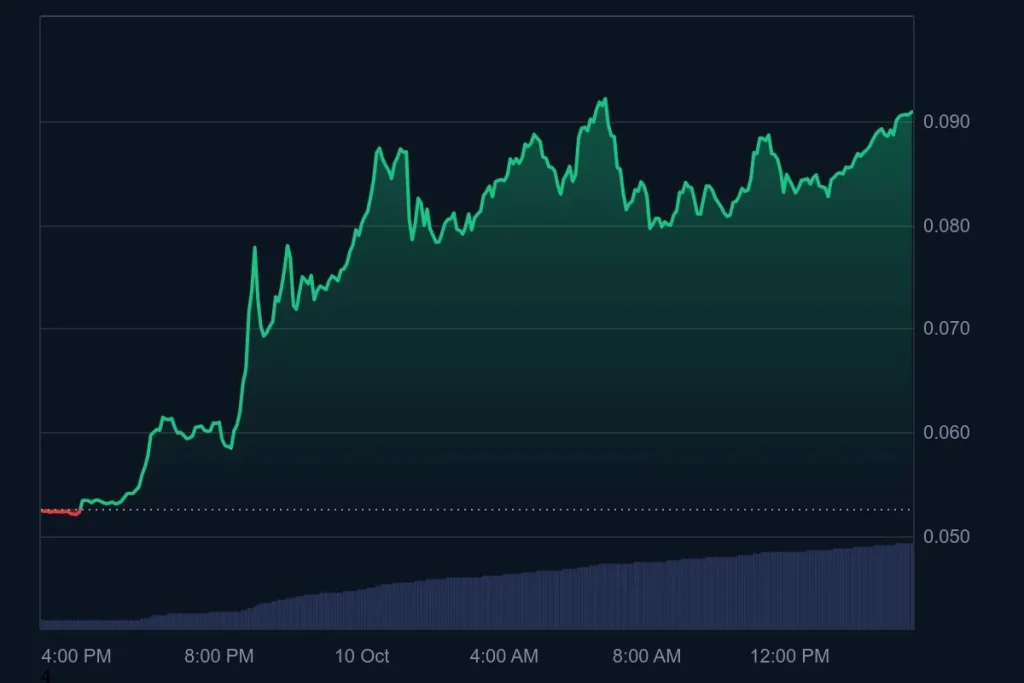

In a twist to the story, which caught most people by surprise, the Zora (ZORA) token soared following a surprise listing on retail trading platform Robinhood. The Zora coin price shot up by over 73% in a few hours, creating ripples in crypto markets. The reports indicate that ZORA crypto currently boasts the lowest market-cap asset to be added to a large brokerage.

Robinhood Listing Fires Up Surge for ZORA Crypto

The market cap of ZORA was in the range of $150 million before the listing was unveiled. The announcement of the listing seems to have caused a tidal wave of demand and valuations reached approximately $406.1 million. To emphasize the outlier nature of this move: ZORA is even less capitalized than Pengu by a significant margin, the next lowest-capitalized token on Robinhood.

$ZORA is now available to trade on Robinhood. pic.twitter.com/ggOw7i2vco

— Robinhood (@RobinhoodApp) October 9, 2025

The listing was confirmed by Robinhood through its crypto platform, and it offers a new cohort of retail access to the Zora coin. The effect of the listing was immediate: the trading volumes increased, and ZORA entered the charts among the fastest-growing altcoins.

At press time, the Zora coin price rocketed 73.6% to $0.09087 on Friday, October 10. It reached a high of $0.09222 during the day and held its value above the $0.09 level, which could lead to a further boost for the Zora network’s token.

What is ZORA Crypto?

In addition to the listing itself, Zora is placing itself in the intersection of streaming, creator economies, and social tokens. The project is also said to be in the pipeline for releasing a livestreaming feature later in October, which, according to insiders, may increase its application and adoption among content creators. That places Zora in direct rivalry with previous streaming platform coin projects, like Streamrcoin or Retake, whose rallies were brief.

Coinbase is also a part of this story: it is a stakeholder in the project, with a value of fifty-eight million dollars, and publicly promotes the vision of Zora. The institutional and retail participation could be enhanced as a result of the greater exposure associated with being listed on Robinhood.

Technical Analysis for Zora Coin Price

According to the price chart, a number of analysts refer to a prototypical technical pattern: ZORA had been trading within a falling wedge with the bottoms and the tops closing in upon each other as time progressed. The breakout followed, and it coincided with the Robinhood announcement–profiting from what appears to have been a change of direction, to an upward movement.

According to one of the last projections, it could increase by as much as 40%, and the next major step would be a strengthening resistance in the area around $0.115. The report, however, cautions that RSI (Relative Strength Index) is about to go overbought, which may trigger a short-term reversal. This analysis also identifies that a support level of $0.063 is a critical level- below this level, the bullish formation might be at risk.

Other indicators indicate the mania: trading volume increased by over 650% at one point, exceeding the market cap of the token. Meanwhile, on-chain data indicate that the large wallets (so-called whales) started to become the holders of ZORA assets in great amounts immediately after the news about the Robinhood listing was announced.

Currently, the market is uncertain regarding a planned token release of around 166.67 million ZORA tokens at a later date in the month could impose downward pressure, and more so when the holders seek to sell.

Also Read: Grayscale Stakes $3.83B in ETH via Ethereum Staking ETFs