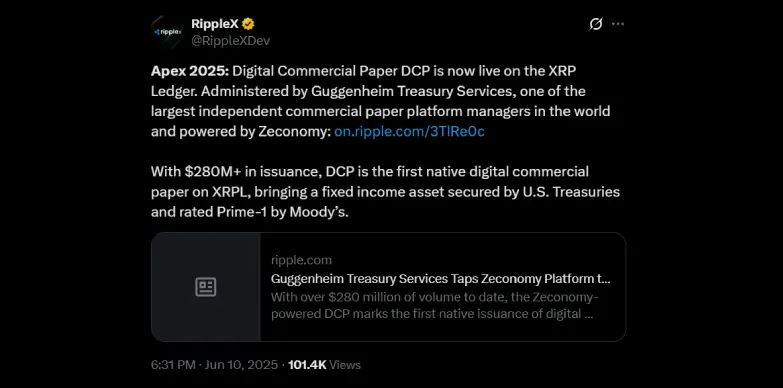

Zeconomy’s Digital Commercial Paper (DCP) is live on the XRP Ledger as announced through a press release by Ripple today, June 10, 2025. It is the first time that a native digital commercial paper has been issued on XRPL. This move will now open doors for broader institutional access and modernize how these fixed income assets are managed.

DCP: A New Asset on Ripple’s XRP

DCP is not just another token but it is a fixed income asset secured by the U.S. Treasuries and carries a Prime-1 rating from Moody’s, the highest available for short-term debt. Since its initial launch in September 2024, DCP has already seen more than $280 million in issuance volume. Now with this recent expansion to XRPL, DCP is ready to offer even more efficient, fast settlements and around the clock accessibility for institutional clients.

Administered by Guggenheim Treasury Services, a major player in the commercial paper market, DCP is issued through a bankruptcy-remote SPV (Great Bridge Capital Company) and managed on the Zeconomy platform. This setup ensures strong investor protections and robust digital asset governance. Maturity-matched U.S. Treasury securities fully back DCP, and institutions can customize maturities up to 397 days, providing flexibility which is hard to find in traditional markets.

Modernizing Global Treasury

Bringing DCP to XRPL means institutions can integrate this asset into their existing treasury management and cross-border payment systems. The days of waiting for settlements and dealing with high operational overhead could soon be behind us. With DCP, corporations can lower costs, speed up settlements, and increase transparency for their global supplier network.

Ripple Invests in Real-World Assets

Industry leaders are taking notice. Markus Infanger, Senior Vice President of RippleX, points out that tokenization is quickly moving from trial runs to real-world production. “Institutions are no longer asking if blockchain technology can support regulated financial products, they’re asking how they can deploy them at scale.” he said. The XRPL, with its track record of over 3.3 billion transactions and zero security breaches since 2012, stands ready to support these needs.

The market for tokenized real-world assets is expected to skyrocket, from $600 million in 2025 to nearly $19 trillion by 2033, according to a Ripple and BCG report. DCP is already showing how regulated, yield-bearing assets can thrive on public blockchains, offering digital traders a new way to use on chain assets as collateral. Currently, DCP is available exclusively to Qualified Institutional Buyers (QIBs) and Qualified Purchasers (QPs).

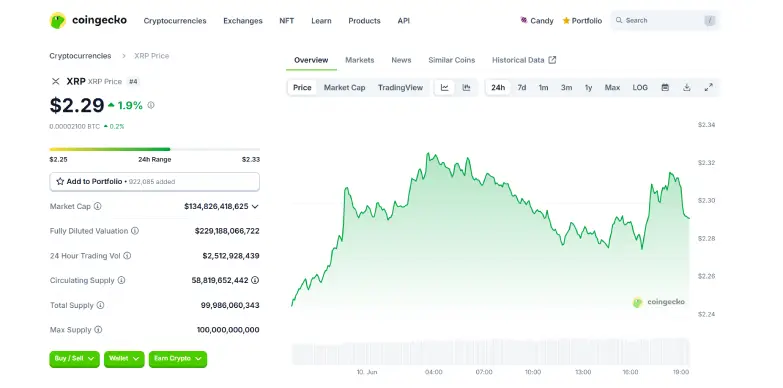

Meanwhile, Ripple’s native cryptocurrency XRP has seen a 1.9% uptick in the last 24 hours as per CoinGecko. This indicates growing optimism around the recent developments.

Also Read: Crypto.com Unveils New Credit Card with Uncapped Crypto Rewards for US Users