The cryptocurrency market witnessed a notable sell-off during the Asian trading hours. As of Friday, July 25th. However, a majority of major assets, including XRP, quickly rebounded during the U.S. market and halted their current correction momentum. A long wick rejection candle at the $3 psychological support level accentuates the intact demand pressure. Recent on-chain data further accentuates the active accumulation from whales during this price pullback, reinforcing the potential for a bullish rebound.

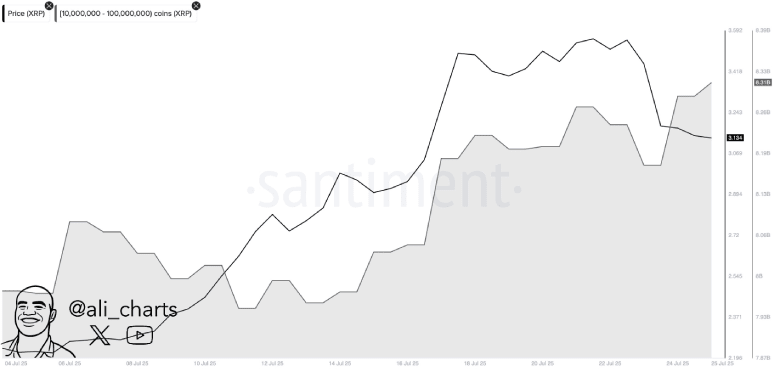

Whales Buy the XRP Dip as Price Hits $3

In the last five days, the XRP price has shown a notable pullback from $3.65 to the current trading price of $3.112, registering a 14.4% loss. This reversal aligns with a broader market pullback as the majority of major cryptocurrencies plunged to recoup the exhausted bullish momentum.

However, the correction trend loses momentum at the $3 support level, as evidenced by the long-wick rejection candles in the daily chart. However, the buying pressure is not just from retail investors but also from high-net-worth individuals, according to recent on-chain data.

In a recent tweet, market analyst Ali Martinez highlighted that the crypto whales have bought over 130 million XRP tokens in the last 24 hours. The increasing buying pressure during pullbacks indicates a buy-the-dip sentiment in the market, which bolsters the price to hold major support and drive a bullish rebound.

If the trend persists, the XRP price could rebound from the $3 floor and re-challenge the recent swing high of $3.65.

Key Support and Resistance To Watch In XRP Price Correction

The daily chart analysis of XRP reveals that the $3 psychological support is reinforced by the 20-day exponential moving average and the 38.2% Fibonacci retracement level. The confluence of this technical level creates a high area of interest (AOI) for the Ripple crypto to counter market selling pressure.

Historically, these two levels have acted as favorable pullback support for buyers to recoup their exhausted bullish momentum before the next leap. However, the potential upswing in this altcoin could face two major resistances: the 23.6% Fibonacci level at $3.24, followed by the mid-January peak of $3.40.

If the coin buyers manage to reclaim these levels, the price would likely rechallenge the $3.65 high and attempt to chase the all-time high barrier of $3.85.

On the contrary, if the price falls below the $3 threshold, buyers still have a strong line of defense in the form of a 50% retracement at $2.75. That said, a breakdown below this level would start reflecting weakness in the buyers’ conviction.