- XRP Spot ETF approval could significantly boost investor participation.

- Technical breakout above $3.50 may trigger rally toward $4.00.

- SEC decision by October crucial for XRP’s short-term momentum.

Ripple’s chief executive, Brad Garlinghouse, has voiced strong confidence that the United States Securities and Exchange Commission (SEC) will approve an XRP Spot ETF.

He stated that the company expects the decision to be made by October 2025, which is the official deadline set for the SEC’s ruling. Should the approval be granted, trading could begin shortly afterward, marking a pivotal moment for the cryptocurrency.

XRP Spot ETF Could Spark Significant Market Movement

The suspense of the XRP Spot ETF approval has been accumulating over several months and the traders and the analysts were wondering its impressions. The optimism of the part of Garlinghouse makes us think that Ripple is confident in the fact that the regulation situation is becoming more favorable towards digital assets.

⚡️RIPPLE CEO: XRP SPOT ETF IS COMING SOON!

Brad Garlinghouse says he’s confident the US SEC will approve an #XRP Spot ETF — with trading expected to start soon. Decision deadline: October 2025.

Will this be an $XRP breakout moment? pic.twitter.com/oxBC6gaI1G

— Coin Bureau (@coinbureau) August 15, 2025

Should it be approved, the ETF would give traditional investors access to XRP with reduced complexity of holding the token, which would possibly further adoption and liquidity.

The analysts are questioning whether such a development can help launch a significant rally, at least when the markets become corrected to overall crypto sector expansion.

As the October 2025 deadline nears, it all now remains to see what the SEC would do next and the extent to which XRP may have a breakout moment on the market.

Will XRP Price Hit $4 After XRP Spot ETF Win?

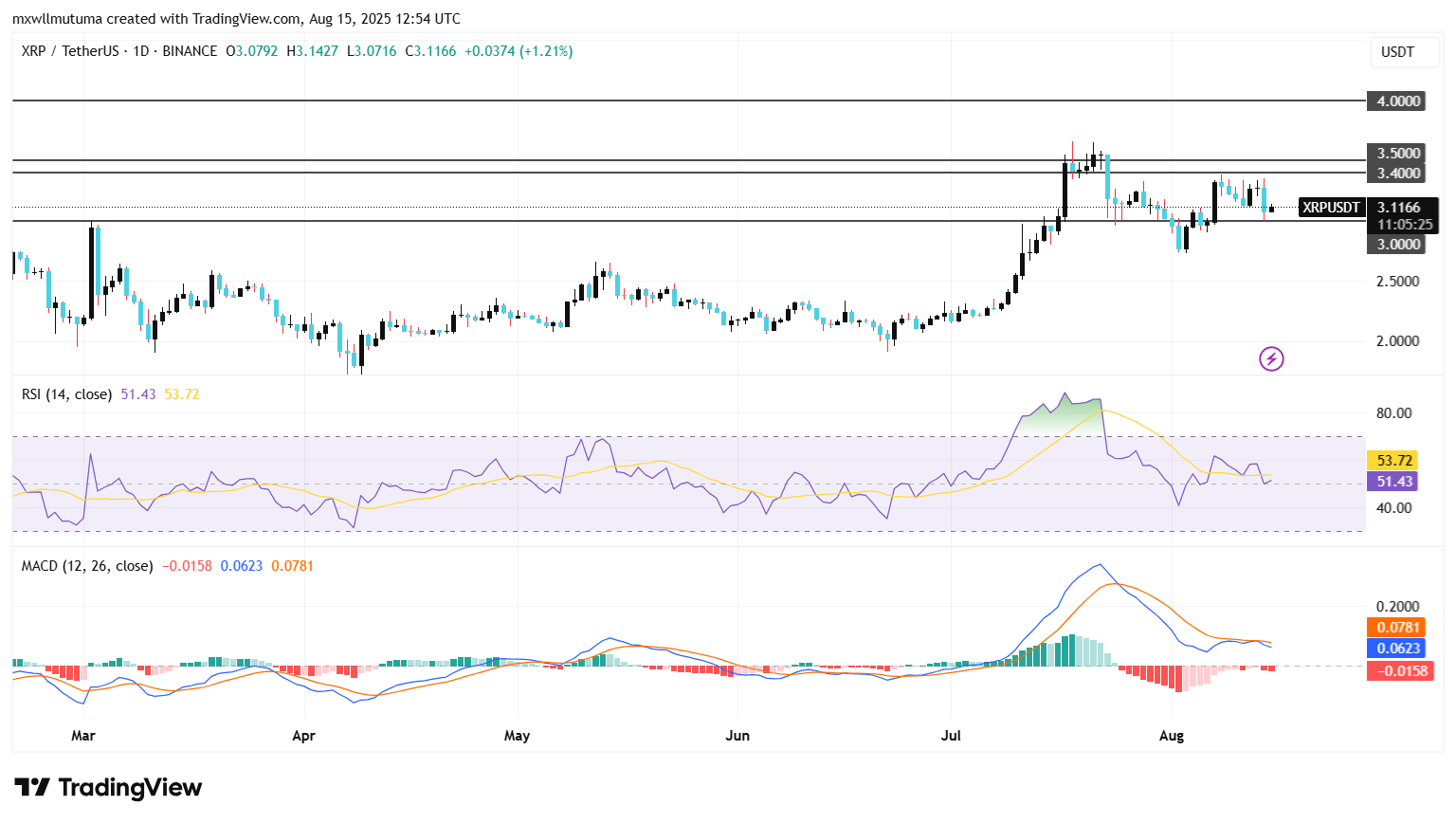

At the time of writing, the XRP price is trading at $3.11, marking a daily gain of 1.03%. The cryptocurrency has been moving sideways over recent sessions, consolidating near the $3.00 support area after several failed attempts to break higher.

Relative Strength Index (RSI) value is resting at 51.21, and that prompts a balanced market environment, with no visible overbought or oversold market.

The Moving Average Convergence Divergence (MACD) also indicates a picture of hesitation. The MACD line is less compared to the signal line, but the distance is small. This indicates some bullish pressure which is not yet sufficiently represented by a robust upward thrust.

Technically, a breakout over the resistance level of $3.50 will be a big bullish indicator. This action may lead to a long rally to the level of approximately $4.00, with the forecast that the XRP Spot ETF is likely to get an approval by October.

On the other hand, a failure of the $3.00 price to support itself would place additional selling pressure on the XRP price. The following possible area to support is the one around $2.80 where the buyers can also take another chance. A fall below this will intensify the correction and subdue short-term bullish sentiments.