- XRP price continues its correction trend within the formation of falling channels.

- Amid the intraday sell-off, the XRP long traders faced a liquidation of $28.75 million.

- Open interest tied to XRP futures remains stagnant around $4 billion, suggesting a lack of speculative forces.

XRP, the native cryptocurrency of the XRP Ledger, is down 9.12% during U.S. market hours on Monday to trade at $2.29. This sell-off aligns with a wide-market correction and notable liquidation, which also pushed Bitcoin below the $110,000 mark. However, the XRP price is facing additional pressure as large investors have been actively selling since last week, increasing the risk of a prolonged correction.

Cooling Speculation and Whale Activity Drag XRP Lower

Since last week, the XRP price has plunged from $2.68 to $2.3, registering a 14.37% loss. The pullback gained momentum when U.S. Federal Reserve Chair Jerome Powell projected a hawkish tone regarding the December rate cut.

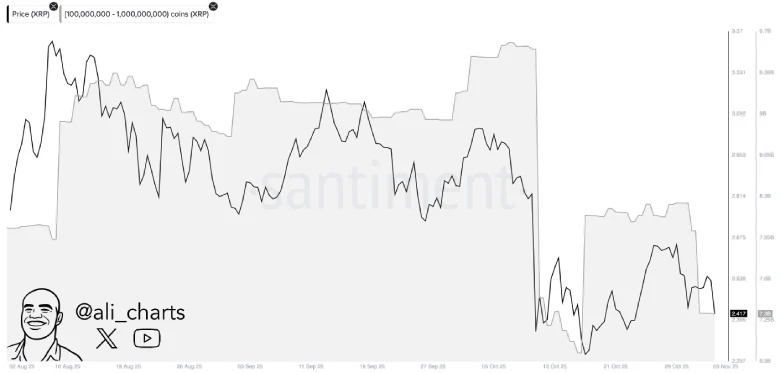

Along with a wide-market correction, the XRP price faced additional bearish momentum as large investors showed renewed selling pressure. In a recent tweet, market analyst Ali Martinez highlighted that over 900,000 XRP were sold by crypto whales in the last five days. Movement from these high-net-worth individuals has often influenced the price trajectory for the short-term to long-term.

In addition, the derivative shows a cooling period in a speculative environment. According to Coinglass data, the open interest tied to XRP futures has been wavering around $4 billion since the October 10th liquidation cascade in the crypto market. This stagnant trend hints that there is low interest from speculative forces in the market.

However, a potential catalyst is developing on the regulatory side. Both Bitwise Asset Management and Canary Capital Group have furthered their filings for spot-XRP exchange-traded funds in the United States, which indicates that approval may be imminent.

Bitwise just filed a S-1 registration update, called Amendment No. 4, which confirms the good news when it comes to the proposed ETF listing on the New York Stock Exchange (NYSE) and its 0.34% management fee (usually the final step before approval).

Meanwhile, Canary Capital has updated its own S-1 for the “Canary XRP Trust,” with the significant change of removing the delaying amendment, which had previously put the SEC in control of the timing of when the registration becomes effective.

This procedural change will make the filing effective by default after 20 days, meaning the potential effective launch date will be approximately November 13, 2025, if there are no SEC objections and the exchange clears.

If these developments come to pass, XRP might experience a resurgence in market sentiment.

XRP Price Heading For Major Support Test

Since mid-July 2025, the XRP price has recorded a steady downtrend within the formation of a falling channel pattern. The chart setup is characterized by two parallel trend lines acting as a dynamic resistance and support for its traders.

Following the sudden sell-off today, the coin price is just 12% short of retesting the lower trend line at $2.01. The bottom trendline remains a key pivot level for investors.

A recent history of the pattern shows that a retest of the bottom trendline has often recuperated the exhausted bullish momentum. If buyers manage to defend this trendline, the price could rebound for the next leap.

On the contrary, if the XRP price breaks below the bottom trendline, the ceiling pressure would intensify and drive the prolonged downtrend.