- XRP price witnessed bearish momentum reversal at the resistance trendline of a falling channel pattern, signaling a fresh correction cycle ahead.

- The XRP Ledger has recorded a dramatic surge in high-value transactions over the past few days.

- Open interest tied to XRP futures contracts recorded a 38% increase since last week to reach $4.55 billion, indicating a rise in speculative force.

XRP, the native cryptocurrency of the XRP Ledger, plunged roughly 5.5% on Wednesday, January 7th, to reach $2.1. The sudden drop came as renewed selling pressure after a week-long recovery in the crypto market. Along with price rejection the on-chain data shows a sudden spike in whale activity, suggesting a risk of highlighting volatility ahead.

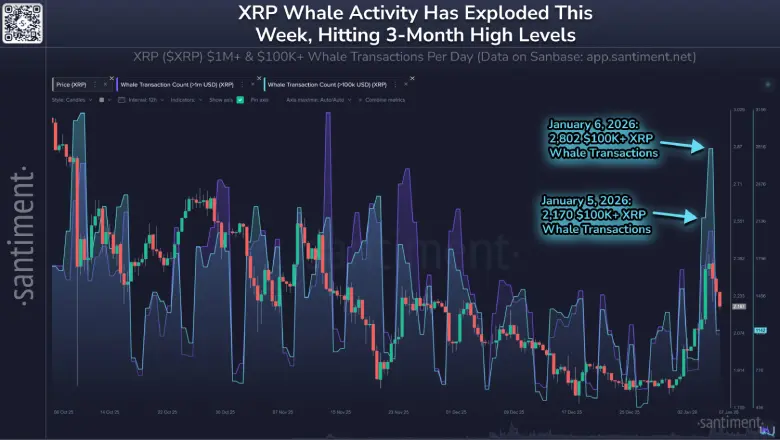

XRP Whale Transfers Hit 3-Month Peak in Early January

In the last 48 hours, the XRP price witnessed a sharp pullback from $2.41 to $2.17, registering a 10% loss. The selling pressure aligns with broader market pullback as Bitcoin price reversed from the $95,000 mark, stalling recovery momentum in the majority of major assets.

Recent data from the XRP Ledger shows a significant surge in large-scale transfers during volatile market conditions. Transactions over $100,000 in value have been up significantly in the past few days. The network registered 2,170 such moves on January 5, 2026, followed by a high of 2,802 on January 6, the highest level in three months.

This spike is in line with a noticeable retreat in price of XRP as evidenced in on-chain metrics tracked by Santiment. The chart shows overlapping trends when whale transaction volumes both for $100,000+ and $1 million+ categories have amplified in conjunction with daily price candles. These patterns indicate the amplified movement between major holders, driving up network activity.

The period ranges from October 2025 until the beginning of January 2026, with the last days excelling for their increased counts. Such dynamics indicate greater involvement of important entities at this time.

In addition, the XRP’s derivative market witnessed a notable spike in open interest tied to its futures contracts. According to Coinglass data, the OI value has bounced from $3.27 billion to $4.51 billion at present, registering a 38% increase.

This surge indicates that the future trades are positional themselves for potential movement in XRP price.

XRP Price Risks Fresh Bear Cycle Within this Pattern

In the first seven days of 2026, the XRP price witnessed a significant recovery from $1.82 to $2.42, registering a gain of 33.55%. However, the recovery trend hits a strong fall at $2.35, a level coinciding with the 200-day exponential moving average and resistance trendline driving a falling channel pattern.

As a result, the price reverted immediately to the current trading value of $2.17, sparking a fresh reversal with the channel. Since July 2025, the coin price has been resonating within the formation of a falling channel pattern.

The pattern’s trendlines act as dynamic resistance and support to drive a steady downtrend in price. Historically, a reversal from the upper boundary of pattern has often accelerated the market selling pressure and drove a downtrend to the bottom trendline.

If materialized, the coin price could plunge over 26% and breach the $1.5 support zone.

The XRP price showcasing sustainability below the 200-day EMA, reinforcing the bearish narrative in the market.

Until the pattern is intact, the current correction could extend to sub-2 level.