- XRP sellers extend corrections as the price resonates within a falling channel pattern of the daily chart.

- Reduced distribution across top-tier wallets suggests consolidation among influential holders.

- The 50-day EMA offers immediate resistance to the XRP price.

XRP, the native cryptocurrency of the XRP Ledger, tumbled 5.8% on Monday to trade at $2.02. The selling followed broader market corrections, along with the Bitcoin price falling below $85,000. The XRP price witnessed heightened volatility pressure as the number of large wallet holders has reduced in numbers, but the remaining addresses increased their holdings. With the XRP coin nearing a key support, the price trajectory could see a notable change in the coming week.

XRP Ownership Concentrates as Whale Count Shrinks Sharply

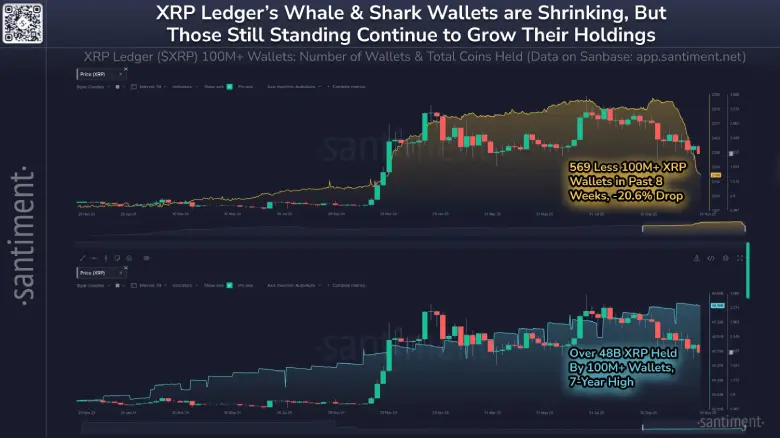

Fresh patterns have started to emerge within the XRP Ledger, which are showing a visible shift in the behavior of the big token holders over the recent weeks. Data compiled from Santiment reveals that addresses holding at least 100 million XRP have diminished significantly from what they were two months ago. The number of these high-balance wallets has shrunk by over a fifth over that period.

Even with the decline in the number of people in this category, the pool of tokens in the hands of the remaining large holders has continued to increase. Their collective balance has topped out at about 48 billion XRP, which has not been seen on-chain in almost 7 years.

The shift indicates the ownership structure is becoming concentrated in a smaller number of large players instead of becoming spread out across a greater number of addresses. While the distribution profile has tightened, activity associated with XRP derivatives has also begun to increase again after a soft patch.

Open interest tied to XRP futures contracts has recorded a notable uptick since last week. According to Coinglass data, the OI value rose from approximately $3.19 billion to $4.05 billion in that time. The increase is an increase of about 26.9%, which indicates renewed positioning by traders in the derivatives market.

XRP Price Hints at Sell-the-Bounce Sentiment

Since last week, the XRP price has witnessed a notable pullback from $2.28 to the current trading price of $2.02, accounting for an 11.54% jump. This pullback creates another lower high formation in XRP’s daily chart, signaling an intense overhead supply and intact sell-the-bounce sentiment among market participants, often observed during an established downturn.

A recent bearish crossover in the MACD (moving average convergence divergence) indicator accentuates the current bearish sentiment. With sustained selling, the coin price could tumble another 7.7% to the bottom trendline of a falling channel pattern at $1.86.

Since mid-July 2025, the chat setup has provided dynamic resistance and support to XRP traders, driving a steady correction in price. The recent history of the pattern shows that a price retest to the bottom trendline has often triggered a brief recovery in price, ideally hitting the overhead trendline.

However, the key exponential moving averages (20, 50, 100, and 200) wobbling within the channel range could create multiple resistances against buyers. Thus, a breakout from the upper boundary is needed to confirm sustainable recovery.

Read More: AAVE Price Signs of Reversal After Multicoin Capital Adds $10.9M Stake