XRP, the native cryptocurrency of the XRP ledger, plunged over 3% during Thursday’s U.S. market hours to trade at $2.11. The sharp downtick comes as a slowdown in the broader market recovery and continued geopolitical tension in the Middle East. As the derivative market continues to show weak conviction from crypto buyers, the price action suggests a major breakdown is looming.

XRP Futures Open Interest Decline Signals Reduced Trader Confidence

Over the past six weeks, the XRP price showcased a slow yet steady correction from $2.65 to $2.11, the current trading value, accounting for a 20% loss. The geopolitical tension in the Middle East was a primary reason behind this correction, accelerating the bearish momentum in the market.

Along with the price decline, XRP Futures Open Interest plummeted from $5.52 billion to $3.98 billion, representing a 30% loss. This decline indicates that traders are exiting the derivative market or reducing their leverage positions due to current market uncertainty. The loss of speculative volume could weaken the bullish momentum and drive a sluggish, sideways-to-downward trend.

Thus, renewed movement in OI data could signal the potential upswing in XRP.

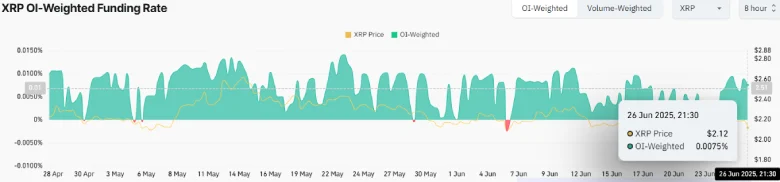

On the contrary, the XRP OI-weighted funded rate has shifted to the positive region at 0.0089%, indicating that buyers are paying a premium to hold their long position. The increasing demand for long orders could reinforce the expectation of further price appreciation.

Key Level To Watch In XRP Price Correction

With an internal loss of 3%, the XRP price shows an evening start reversal pattern at the 50-and 100-day exponential moving average. With sustained selling, the coin price could plunge another 12% and rest at a multi-month downsloping trendline at the $1.88 mark.

Since early December 2024, this trendline has served as a key area of interest (AOI) for traders, highlighting notable reversals and breakouts in the price.

In the daily chart, this dynamic support/resistance acts as a midline for the flag pattern formation. Until the price is above the aforementioned slope, the selling pressure is moderate, and buyers have an opportunity for an upside breakout.

However, if the price breaks below the midline slope, the seller’s dominance will strengthen, and the price could drop to the $1.35 mark.

Also Read: Judge Denies Ripple-SEC Joint Motion for Indicative Ruling