- XRP price correction has plunged the supply of XRP price profit to 58.5%, signaling a significant portion of holders are witnessing unrealized loss.

- Open interest tied to XRP declined in futures to $3.61 billion, indicating the lack of speculative force to support price recovery.

- A potential bearish crossover between the 100-and 200-day EMA slopes could raise selling pressure in the market.

XRP, the native cryptocurrency of the XRP Ledger, is down 2.15% during Monday’s U.S. market hours. The loss aligns with today’s market sell-off, which liquidated around $850.81 million in the last 24 hours, while the Bitcoin price is nearing the $90,000 floor. However, the XRP price faces additional bearish momentum as its supply in profit has plunged yearly, while the derivative data show that traders are fleeing from the leverage market. Will the downtrend breach the $2 level?

XRP Profitability Hits Yearly Low as Market Correction Extends

Since last week, the XRP price has shown a V-top reversal from $2.58 to the current trading value of $2.17, registering a loss of 15.83%. Consequently, the asset market cap has plunged to $130.7 billion.

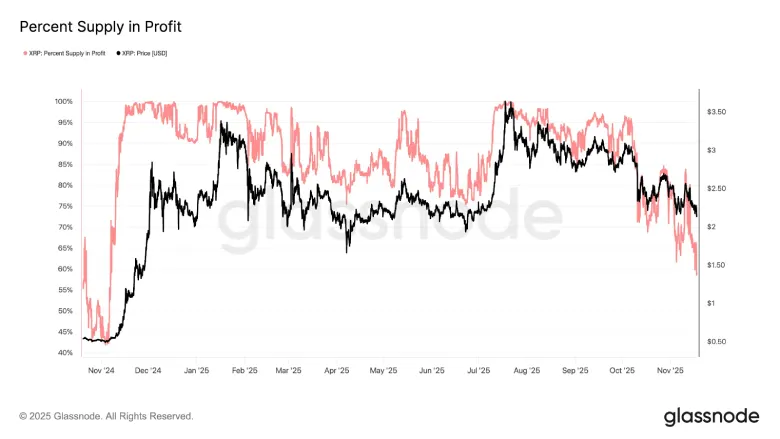

Amid this downfall, a very substantial change has emerged in the distribution of profitable supply. According to Glassnode data, the share of XRP supply in profit has fallen to 58.5%, the lowest since Nov 2024, when the price was $0.53.

Although its price is several times greater than it was during that period, there is now a significant group of holders operating at a loss. Roughly 41.5% of the total supply, estimated at around 26.5 billion tokens, is currently running at under-purchase levels.

Such a large losing cohort implies that many acquisitions have been made during up-trending phases, making the market vulnerable to sudden retracements.

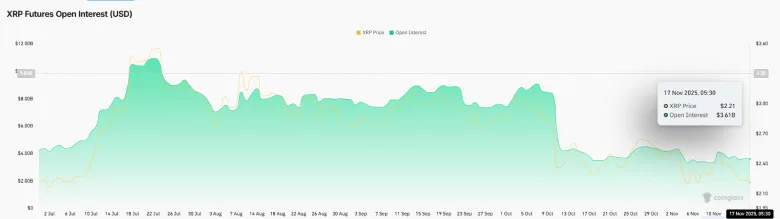

Derivatives activity has also changed. Positions associated with XRP futures have moved downward since the big wipeout on October 10. Over the past few weeks, open interest has reduced from $4.31 billion to around $3.61 billion, which is a decrease of about 16%. This shrinkage is indicative of traders continuing to reduce the amount of leveraged exposure as a result of the liquidation shock and the market reorienting itself to a lower level of participation and more tenuous positioning.

The mix of a shrinking market cap, less lucrative supply, and a tapering of futures interest sets the scene for a landscape of sellers trying to unload from high entry points and speculators hedging against the risk of prior volatility spikes.

XRP Price Correction to Extend 10% Before Hitting Suitable Support

Since mid-July 2025, the XRP price has showcased a steady correction trend resonating within the formation of a falling wedge pattern. The two parallel trends of this pattern act as dynamic resistance and support to the crypto traders.

With today’s downtick, XRP price trades at $2.15, standing just 10% away from retesting the bottom trendline. The potential retest would mark a pivot level for this altcoin, as the previous interaction has recorded dynamic changes in price.

If the buyers continue to defend this so the price could rebound and challenge the channels over it, then add $2.4. However, the potential uptrend could face headwinds from the declining slope in the exponential moving average (20, 50, 100, and 200).

Under a pessimistic situation, a bearish build-up below the bottom hurdle would accelerate the selling pressure and drive a prolonged downtrend in XRP.

Also Read: Bitcoin Falls Below $99,000 after $215M Liquidation in Hour