On April 6th, the XRP price plunged 2.58% as the broader market remained on edge amid the global trade tension. The selling pressure brought Ripple cryptocurrency close to a multi-month support, indicating a risk for a bearish breakdown. The recent surge in the derivative market further illustrates the potential move in this asset.

Key Highlights:

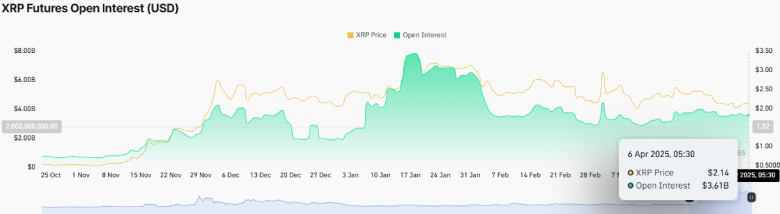

- XRP open interest surged 24% in 3 weeks to $3.61B, signaling a potential move ahead.

- Since January 2025, a downsloping trendline drives the current correction trend.

- A confluence of the 200-day EMA with the $2 psychological level creates a high-accumulation zone for buyers.

XRP Futures Spike as Traders Bet on Major Price Swing

Over the last three weeks, the XRP Futures Open Interest has bounced from $2.9 billion to the current value of $3.61 billion, marking a 24% increase. This surge highlights growing trader interest and increasing capital inflow into XRP derivatives, often signaling heightened market anticipation for a dynamic move.

While the aforementioned metric suggests a potential move, it does not indicate the price direction.

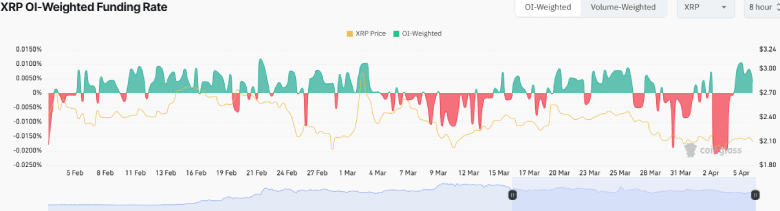

Thus, the XRP funding rate indicator comes into play, which currently stands at 0.082%. The positive value hints at a bullish sentiment among traders as buyers are paying a premium to sellers to hold this asset.

Key Resistances In Path for XRP Price Recovery

By the press time, the XRP price trades at $2.08 and holds at a market capitalization of $121.88 billion. With today’s market fall, the altcoin is less than 5% away from challenging the bottom support of $1.96, which coincides closely with the 200-day EMA.

Since December 2024, the horizontal level has acted as a major support for buyers to recuperate the bullish momentum as the previous reversal led to a 53% to 73% surge. If the daily chart shows intact demand pressure at this floor with lower price rejection, the buyers could drive over 6% and a downsloping trendline (blue) as an initial barrier.

The potential breakout will drive another 16% surge before the next significant resistance, which drives the current correction trend.

On the contrary, if the sellers force a breakdown below the $2 support with a daily candle, the XRP price could fall 17% to hit $1.56.

Also Read: Will Bitcoin Reach $80K Mark? ETF Data Shows Otherwise