Key Highlights:

- XRP token gained as Bitwise announced launch of XRP ETF today, November 20, 2025.

- Bitwise is waiving off the management fee for the first month on up to $500 million in assets.

- Crypto analyst emphasizes that the XRP ETF launches will not cause immediate price jumps.

Bitwise, a well-known crypto asset manager, announced today, November 20, 2025, the launch of XRP ETF through social media platform X. This announcement has generated a considerable buzz within the crypto industry and has affected the price of the XRP token. As the number of XRP ETF products is increasing, it shows that the institutions are finally seeing XRP as a trusted and useful asset to invest in.

Big news: The Bitwise XRP ETF is set to begin trading on NYSE tomorrow with the ticker $XRP.

It has a management fee of 0.34%, which is waived for the first month on the first $500M in assets. This product brings investors spot exposure to XRP, the crypto asset that aims to… pic.twitter.com/0GLR37NnuI

— Bitwise (@BitwiseInvest) November 19, 2025

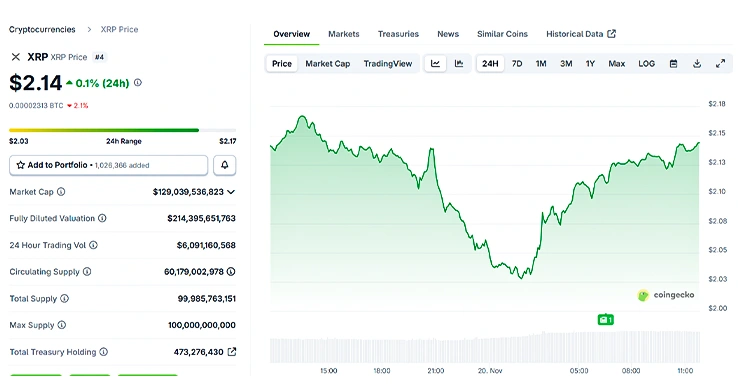

Before Bitwise made the announcement, the price of the XRP token was dropping and it was hovering around the $2.09 mark and as of now, the price of the token stands at 2.14 with an increase of 0.1% in the last 24 hours as per CoinGecko. From $2.09 to $2.14 indicates an increase of 2.4% in the price of the token.

Introduction: A Historic Moment for XRP and Crypto Markets

The launch of Bitwise XRP ETF on NYSE Arca is a big moment for XRP Army and the broader crypto industry, even though it is not the first spot XRP ETF in the United States. The first was launched by Canary Capital on Nasdaq under the ticker XRPC.

The entry of Bitwise is significant as it is the first large-scale, institution-focused XRP ETF to list on the NYSE. The increase in XRP ETF product being launched indicates rising confidence in XRP as a mainstream digital asset.

Moreover, the rise in XRP ETF application is also linked to the end of the Ripple vs SEC lawsuit. As the case was settled, uncertainty around XRP were reduced, institutions finally felt confident enough to file for and launch XRP-backed ETFs.

Moreover, Grayscale has also teased users by posting on X stating that its XRP Trust ETF ($GXRP) is on the way, indicating that an official launch could follow soon.

Grayscale XRP Trust ETF (ticker: $GXRP) is coming. pic.twitter.com/SGIWuRwCMC

— Grayscale (@Grayscale) November 19, 2025

James Seyffart, ETF Research Analyst at Bloomberg, stated that Grayscale’s XRP ETF, Grayscale Dogecoin ETF and Franklin Templeton’s XRP are all expected to start trading on Monday the 24th.

Our base case is that @Grayscale‘s XRP ETF will go live on Monday the 24th. So will the Grayscale Dogecoin ETF.

And I think the @FTI_US XRP ETF could go live on Monday the 24th as well. Lots happening next week. https://t.co/TkA6EE0D6T

— James Seyffart (@JSeyff) November 19, 2025

Details of the Bitwise ETF Launch

Bitwise’s XRP ETF will carry a management fee of 0.34% which has been waived for the first month on the first $500 million in assets. This fee waiver is aimed to attract early investors and maximize initial inflows during the fund’s initial phase.

The ETF holds spot XRP tokens, and offers the investors a direct exposure to the fourth largest crypto by market capitalization, with a goal of capturing a share of the $250 trillion global cross-border payment market.

ETFs are Live but Price Action Needs Time

Crypto analyst on X named Arthur with his post, reminded XRP holders not to expect an instant jump in the price of the XRP token after the ETF launches. According to him, it might take weeks or months to show a significant change in the price of the token as the ETF inflow and institutional will take time and any short-term volatility is just noise. He urges people to not panic and be patient till the market settles.

Also Read: Solana, XRP, LTC, HBAR ETFs See Weak Inflows & Price Drops