XRP, the cryptocurrency behind the global payment company, bounced around 3% during Wednesday’s U.S. trading session to trade at $2.55. The buying pressure followed the broader market recovery as Bitcoin made a new high of $111,970 and ETF-driven demand amid the launch of XRP-based futures products.

XRP Futures ETF Debuts, But Spot ETF Faces Delay

On Thursday, May 22nd, the asset management company Volatility Shares launched the first-ever XRP futures exchange-traded fund, ticker symbol XRPI, on Nasdaq. According to a filing with the Securities and Exchange Commission on May 21, the ETF will indirectly invest in Ripple-linked tokens’ futures via its Cayman Islands subsidiary.

The ETF is structured to allocate 80% of its net asset value in XRP-linked instruments, fueling both trading volume and bullish sentiment in the Ripple market.

In addition, Volatility shares plans to launch a double-leveraged XRP futures ETF, tapping into the growing demand for regulated crypto investments.

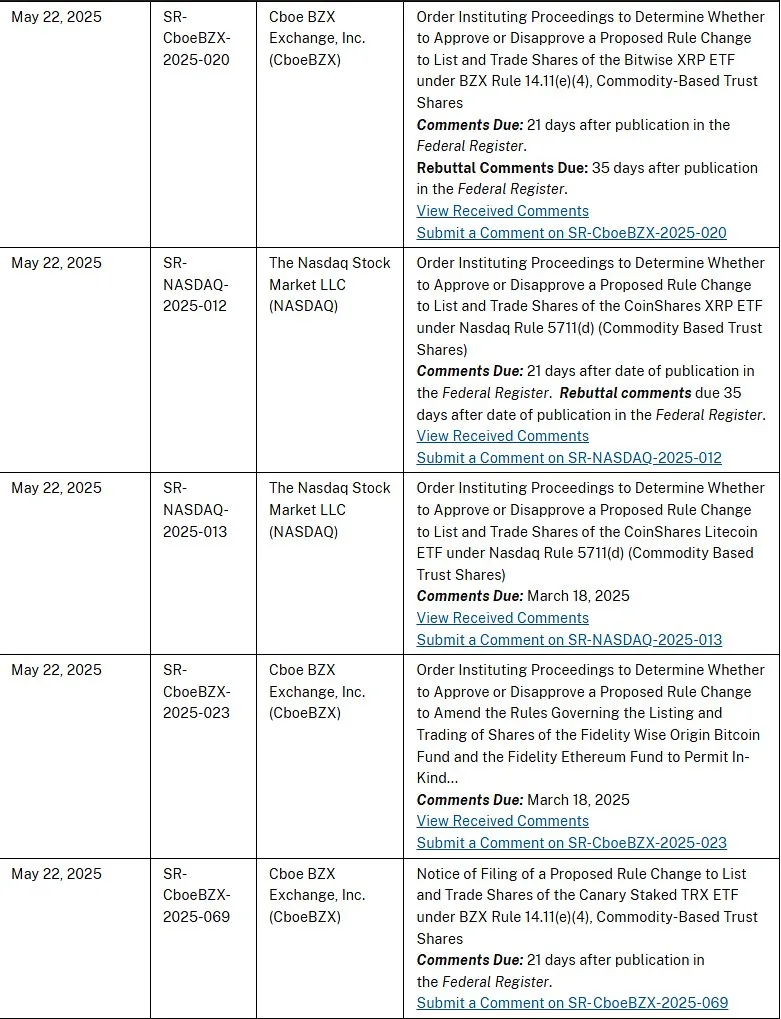

While the XRP futures gain momentum, the spot ETFs face a slight setback. According to Bloomberg ETF analyst James Seyffart, the SEC has delayed its approval of Bitwise and CoinShares’ spot XRP ETF.

Both filings are now open to public comments for 21 days and an additional 35-day rebuttal window.

XRP Price Flag Breakout Set $3 rally

In the last six weeks, the XRP price has shown a V-shaped recovery from $1.612 to $2.425, registering a 50% growth. This bullish upswing reclaimed the key daily exponential moving averages like 20, 50, 100, and 200 and provided a bullish breakout from a long-coming flag pattern.

The chart pattern theoretically offers a short-term pullback in the current recovery trend for buyers to recuperate the exhausted bullish momentum. At the time of writing, the coin price trades at $2.229 and shows its sustainability above the flag resistance.

With sustained buying, the Ripple crypto price could rally 23% to hit the psychological level of $3, followed by an extended value of $3.4.

On the contrary, if the coin price continues to consolidate in a narrow range, investors may need to watch the EMA closely, as their breakdown could signal a change in market sentiment.

Also Read: Will SUI Price Lose $3 Support After $220M Cetus Hack?