PEPE, the frog-themed memecoin, plunged over 3% during Friday’s U.S. market session to reach the $0.0000111 mark. The selling pressure can be attributed to heightened geopolitical tension in the Middle East, triggering a widespread risk-off sentiment among investors. The latest on-chain data on whale selling supports the bearish narrative and prolongs the correction for PEPE coin in the near term. Do buyers have an opportunity to counterattack?

PEPE Coin Slumps Amid Geopolitical Fear and Whale Selling

Over the last three days, the Pepe coin has declined from $0.0000136 to $0.000011, its current trading price, resulting in an 18.4% loss. This downtick was initiated with Bitcoin’s reversal from $110,000 and escalated along with the Middle East conflict between Israel and Iran.

This geopolitical tension has had an external impact on speculative assets, such as meme cryptocurrencies, as they are more sensitive to market volatility than fundamentally driven projects.

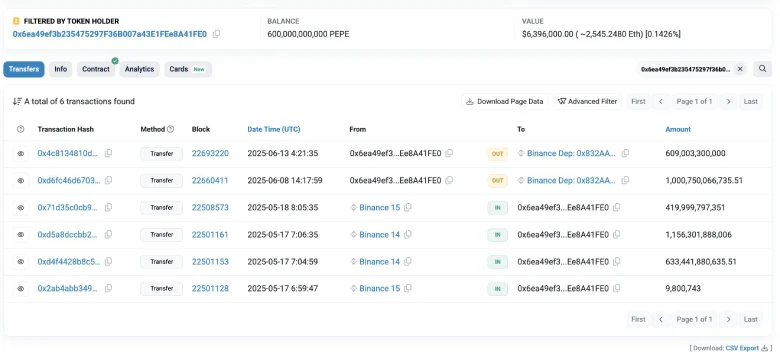

Adding to the bearish narrative, a crypto whale deposited 609 billion PEPE coins, worth approximately $6.43 million, into the Binance Exchange earlier today. Between May 17 and 18, this investor accumulated approximately 2.209 trillion PEPE, worth $27.68 million, from Binance. However, over the past five days, the whale has offloaded over 1.6090 PEPE (valued at $18.08 million). This aggressive repositioning strongly suggests an intention to liquidate additional holdings under current market conditions.

According to Spotonchain, the whale is left with 600 billion PEPE with an estimated loss stands at $3.2 billion, or 11.6%.

Historically, such heavy whale selling has resulted in increased bearish momentum and prolonged corrections in coin prices.

Bull Flag Pattern Sets Buyers’ Counterattack

Amid a broader market correction, the PEPE coin price is likely to plunge another 12% and test the support trendline at $0.00000978.

The bottom trendline is part of a traditional continuation pattern known as a bull flag. Since late May 2025, the coin price has been actively resonating between the two converging trendlines of this pattern. Theoretically, this downswing is temporary, allowing buyers to recuperate from their exhausted bullish momentum.

If the pattern holds, this memecoin price is likely to rebound fast and re-challenge the overhead resistance trendline around $0.00115. A successful breakout will accelerate the bullish momentum and push the asset to $0.00001645.

On the contrary, if sellers continue to defend the downsloping trendline, the price will prolong its current correction.

Also Read: Bitcoin Risks Double Top Breakdown to $92,000 as Whales Start Selling