The crypto market is back on a bullish trend, with Bitcoin sustaining above the $93,000 mark. With a 24-hour high at $94,510, the uptrend in Bitcoin is hinting at a price run to $100,000.

Will the short-term recovery run continue as Binance traders remain in disbelief? Let’s find out.

In the daily chart, the Bitcoin price action showcases a bullish breakout of a long-standing resistance trend line. This marks an escape of BTC prices from a descending triangle pattern. The uptrend targets the immediate resistance, the 61.80% Fibonacci level near $95,000.

The recent recovery run has led to a positive crossover between the 20 and 200-day EMA lines. This reflects the short-term price action overcoming the prevailing downfall.

Furthermore, it avoids a death cross between the 50 and 200-day EMA lines. As the daily EMA lines are on the verge of reclaiming a positive alignment, the bullish recovery will likely continue.

The 61.80% Fibonacci level acts as a strong short-term supply zone, leading to a rounding bottom reversal. Based on the Fibonacci levels, the supply zone breakout will likely propel BTC to a new all-time high at the 1.272 Fibonacci level at $114,000.

Resurgence in Bitcoin ETFs Inflow Suggests Strong Uptrend

On April 21, Bitcoin ETF inflows accounted for $381 million, spiking to $936 million on April 22. ARK and 21Shares recorded $267.10 million in inflows, while Fidelity brought in $253.82 million. This marks the third consecutive day of institutional inflows and the highest recorded since January 17

Binance Traders Maintain Conservative Stand

Over the past 24 hours, the recovery run in BTC has led to a significant surge in Bitcoin derivatives. The open interest has hit $67.01 billion with an 8.8% surge. The options open interest jumped 5.96% to reach $36.96 billion.

Interestingly, over the past 24 hours, the short liquidations have accounted for $300 million, shaking out bearish traders. However, the top traders on Binance are in disbelief as traders on Binance anticipate a bullish failure in Bitcoin.

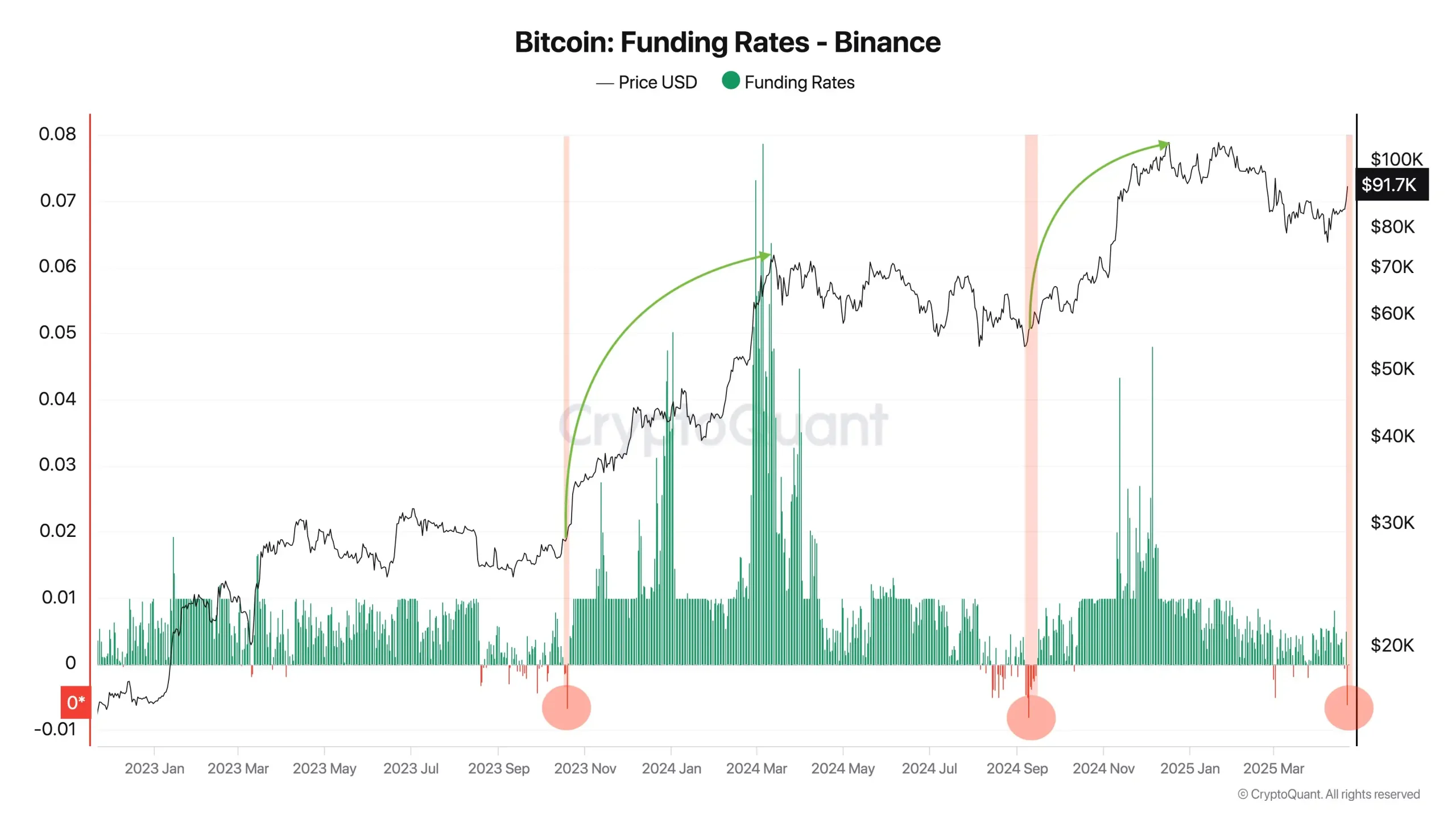

The funding rate on Binance has turned negative and is currently sitting at -0.006%. Historically, such low funding rates have led to major bull runs in BTC prices.

On October 16, 2023, BTC surged from $28k to nearly $73k. It was repeated on September 9, 2024, with the BTC price hitting $108k from a bottom of $57k.

As the funding rates are negative while the Bitcoin price surges, a potential surge to a new all-time high is highly likely.