The crypto market regained its optimism in June’s second week as Bitcoin bounced back to $108,000. This upswing bolstered a majority of major altcoins, including SOL, to resume prevailing recovery. However, certain setbacks in Solana’s network activity and trading volume hint that the price action may dip again before a leap to a $200 breakout.

Solana Price Surge Faces Setbacks Amid Declining Network Activity

Over the last four days, the Solana coin has bounced from its $144 support to the current trading price of $158, representing a 9.6% surge. The buying pressure likely mimicked Bitcoin’s momentum as the geopolitical tension eased after the United States and China initiated trade talks in London.

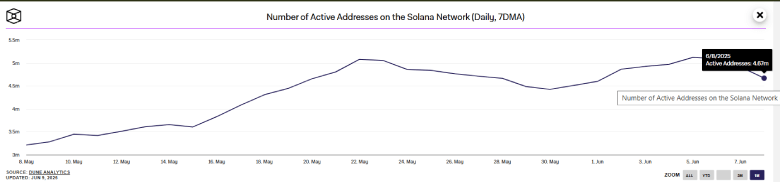

Defying the price surge, the number of Solana’s active addresses plummeted from 5.12 million to 4.67 million, representing an 8.7% decline. A recent Solana news highlights this drop, signaling that the price action may not be fully supported by user engagement on-chain.

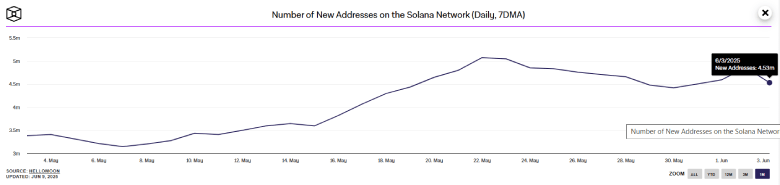

Additionally, the number of new addresses on Solana decreased from $4.8 million to $4.53 million, representing a 6% decline.

The decline in both active addresses and new addresses on Solana suggests a potential weakening of user engagement and a slowdown in the network’s adoption, despite the recent price surge.

However, SOL’s daily chart shows the current recovery is backed by diminishing volume action, indicating the lack of conviction from buyers. Therefore, if the broader market support is lifted, buyers could lose their hold and plunge to the immediate support of $140.

SOL to Counterattack with This Reversal Pattern

Despite the potential pullback in Solana’s price, the daily chart analysis reveals a retained bullish reversal pattern known as an inverted head and shoulders. The chart setup is commonly spotted at a major market bottom and consists of three troughs: the middle (head) dives deeper to a lower level and is surrounded by two shallow dips (shoulders).

Currently, the SOL price trades at the $160 mark, standing 12% up from the pullback support of $140. Interestingly, this upswing in price materialized despite the daily RSI slope falling below the 40% mark.

This indicates the seller’s attempt to drive prolonged correction was countered by strong support and intact demand pressure. Thus, with sustained buying, the coin price is likely to surge 18% to challenge the neckline resistance of the InH&S pattern.

A potential breakout will accelerate buying pressure and push SOL past the $200 resistance.

However, the $188 stands as a strong barrier against buyers that could shift the current recovery momentum sideways.

Also Read: Bitcoin Price Defies Bearish Pattern Amid Accumulation Trend: New High Loading?