- The Ethereum price correction could extend another 17% before buyers retest the major support zone at $1,650.

- The ETH’s MVRV Z-Score falling to -0.42 reflects growing financial stress among coin holders

- The sharp downtick in daily exponential moving averages (20, 50, 100, and 200) indicate the broader trend is strongly bearish.

Ethereum, the second largest cryptocurrency by market cap, is down 5% on Tuesday, February 10th. The downtick reflects the current uncertainty in market sentiment as investors whether the recent rebound reflects temporary relief really or reversal for strong growth. The latest on-chain data hints that the Ethereum price correction had pushed holders to capitulation zone, but the risk for further downside persistence.

ETH Struggles Above $2,000 as Capitulation Builds Slowly

Since last month, the Ethereum price has witnessed a notable correction from $3,400 to $2,049, registering a loss of 48.8%. While the coin price witnessed a short relief rally last weekend, the buyers are struggling to hold above $2,000.

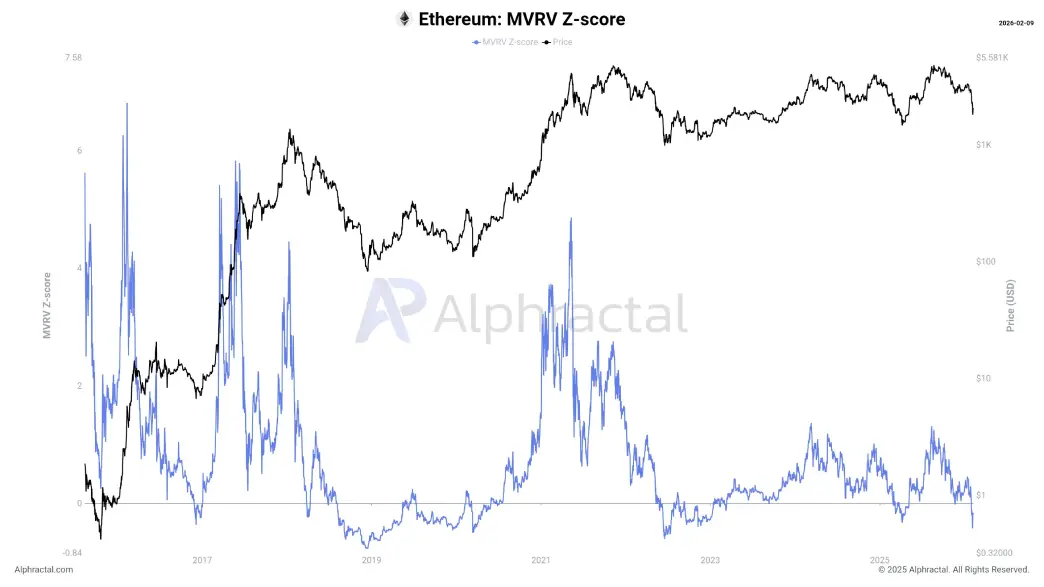

Amid the recent market correction, Ethereum’s MVRV Z-Score has fallen into negative territory, recently hitting a low of -0.42 as of early February, 2026.

This puts the metric into a range that is commonly associated with market capitulation, where the holders are facing increasing losses and selling pressure accumulates. Data from on-chain analytics indicates the current reading represents a great deal of stress on the network’s valuation relative to the realized value.

Historically, the indicator reached its lowest level of -0.76 in December 2018, which was one of the deepest bear phases for the asset. The 2022 downturn also had comparably extreme lows, indicating more severe exhaustion in participants. By contrast, the current level, although negative, is less extreme than those extremes in the past.

The chart shows the fluctuations of the Z-Score as well as the price of Ethereum, which has trended lower in recent periods, in accordance with weakness in the broader market that has been observed in early 2026. Negative values indicate the market cap has plunged below the average cost basis at which ETH was last moved, indicating broader unrealised loss from holders.

Analysts monitoring this data believe that capitulation phases occur over long periods of time rather than abruptly, and are characterized by repeated failed rallies and attrition of participants.

Ethereum Price Poised for 17% Drop Before Testing Key Support

Following a short consolidation on Weekend, the Ethereum price shows a bearish pullback of 5% today, current trading at $2,000. This downtick indicates an intact overhead supply at the resistance of $2,150.

This immediate barrier could bolster selling pressure and recoup the exhausted bearish momentum for the next dip. The momentum indicator RSI back to 29% accentuated strong bearish momentum but the asset entered the oversold region.

Thus, the downside potential exists but the already overextend correction could limit a major divergence from current value before the price stabilizes at this level. Thus, with sustained selling, the Ethereum price is poised for another 17% drop and retest the long-coming support at $1,650.

This trendline has acted as a strong accumulation zone for buyers during major downtrend and suitable bottom floor for reversal. If the ETH price shows sustainability at this floor, the ongoing correction could show a change in direction.

Also Read: France AMF Warns Crypto Firms MiCA License Mandate by July