- The Solana price gives a bearish breakdown below the support trendline of a long-coming channel.

- On Tuesday, the crypto market witnessed a sharp liquidation of over $2.03 billion among 473 traders, according to Coinglass data.

- Total value locked (TVL) across Solana’s DeFi ecosystem decreased from $11.85 billion to $9.6 billion.

SOL, the native cryptocurrency of the Solana blockchain, fell 7.13% during Tuesday’s U.S. market hours to trade at $154.12. The current sell-off aligns with a broader market pullback as the Nasdaq Composite plunged 2%, while Bitcoin tumbled over 7%. However, the Solana price faces the risk of a prolonged downtrend amid declining active addresses, TVL downturn, and a technical breakdown. Will SOL lose its $150 floor?

SOL Sinks as Network Activity and DeFi Participation Decline

Solana’s market value has suffered a massive fall in the last week, with the price dropping from $205 to almost $155 during the latest session, down by 24.3% and reducing its market capitalization to about $85.8 billion. The movement coincided with a broader downturn in the crypto sector after recent macroeconomic signals from the U.S. Federal Reserve.

Investor sentiment was dampened following comments from Chair Jerome Powell to suggest that further interest rate cuts were not guaranteed, upending expectations of near-term monetary easing. At the same time, the U.S. dollar continued the upward momentum after the recent Federal Open Market Committee’s latest meeting, with the dollar index rising 0.35% intraday to a three-month high of 99.8.

The turbulence in the market grew on Tuesday, with Solana logging a daily decrease of over 7%, which reflects the wider pressure on liquidity conditions. According to Coinglass data, this downtick triggered force closures of over $100 million in long SOL leverage positions.

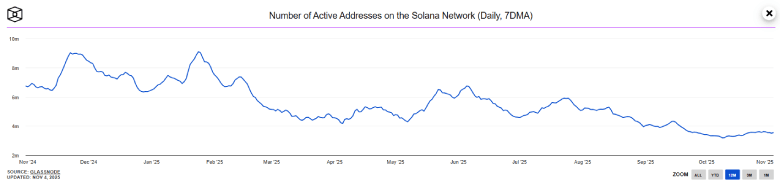

Network activity was also contracting. The number of active Solana addresses has continued to drift lower, currently sitting at an estimated amount of roughly 2.55 million. This persistent decline in active addresses suggests weakening user engagement and reduced transaction activity on Solana and points to a slowdown in network growth.

Decentralized finance indicators followed the same path as the market’s retreat. Along with the recent pullback, the total volume locked on the Solana network fell from $11.85 billion to $9.6 billion, registering a 19% drop. This decline indicates waning investor confidence and lower capital inflow, reflecting a cautious stance among liquidity providers.

Solana Price Breaks Below Major Bullish Pattern

Since March 2025, the Solana price has traveled a steady recovery trend amid the formation of a rising channel pattern. The chart setup consists of two ascending trendlines, which act as dynamic support and resistance for SOL traders.

On Monday, the Solana price gave a decisive breakdown below the pattern’s support trendline, reinforcing the bearish momentum for a prolonged downtrend. A notable downtick in the exponential moving averages 20 and 50 further accentuates the mounting bearish sentiment in price.

If the bearish momentum persists, the altcoin could shed another 19% to test the next significant support at $125.

On the contrary, the momentum indicator RSI (Relative Strength Index) has dived below the oversold territory at 28%, which typically reflects a discount opportunity for potential buyers. Thus, the Solana price could show an immediate pullback to the breached trendline at $182 and validate its suitability for lower levels.

Also Read: Bitcoin Slips Below $100,000 Amid Massive Liquidation