- Aster’s rapid early adoption was fueled by high-profile endorsements from figures like Changpeng Zhao and YouTuber MrBeast..

- The long-wick rejection candle at $2 resistance signals intact overhead support at supply.

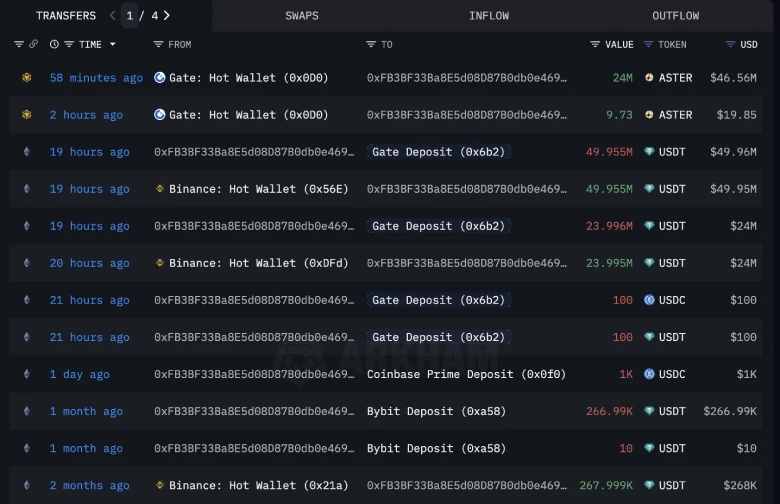

- A crypto whale accumulated over 24 million ASTER today, while another opened a 3x long position on 8.05 million ASTER tokens.

On September 23rd, the cryptocurrency market continued to face selling pressure, pushing the pioneer cryptocurrency, Bitcoin, below $112,000. A majority of major altcoins followed the momentum and extended their downfall, but not the native token of the decentralized perpetual exchange, Aster. On Tuesday, the Aster price jumped nearly 20%, challenging the psychological level of $2. Will price manage to breach overhead resistance, or is a potential correction looming?

Whales Pour Millions Into ASTER as Price Retests $2

The native currency of the decentralized perpetual trading platform, Aster, has been in the focus of attention with notable volatility in its prices since its launch in the market. The token was issued at an estimated price of about $0.02 and it quickly rose to almost $2 within the first week, which is an incredible rise of approximately 9,900 percent and gave it a temporary market cap of about $3.3 billion. dollars.

The spotlight has also been added amidst the celebrity endorsements. The early performance was touted by Binance’s former CEO, Changpeng Zhao, and YouTube personality MrBeast allegedly bought more than $100,000 worth soon after its launch. After the meteoric upsurge, ASTER was pulled back to the region of $1.2 due partly to centralization issues in the Aster platform, and then Aster made another attempt to break the level of $2.

While the price volatility may create concern among retailers, the smart money continues to build its position in Aster. Lookonchain highlights that a crypto whale 0x328B opened a 3x long position on 8.05 million ASTER tokens worth about $17 million, currently sitting at a profit of $5.4M.

Other movements highlight huge participation by key accounts. Earlier today, Whale 0xFB3B deposited 73.95 million USDT to Gate.io only to withdraw 24 million ASTER an hour later, which indicates that the accumulation and active trading of high-net-worth investors continue.

Aster Price Challenges Key Resistance at $2

Today, the Aster price showcased a sharp rebound from its intraday low of $1.46 to $1.95, registering a 33% The price jump was backed by heightened interest from traders as Aster has surpassed Hyperliquid in 24-hour perpetual trading volume, currently positioned at $11.2 billion.

Amid this surge, the coin price teases a bullish breakout from the $2 psychological level.

The coin price showed several failed attempts to breach this resistance, evidenced by long-wick rejections in the 4-hour candle, indicating overhead supply. If buyers flip this resistance into potential support, the buying momentum will accelerate the drive higher.

The momentum indicator RSI surged to 74%, highlighting strong bullish momentum and a high potential for a resistance breakout. According to traditional pivots, the post-breakout rally could chase $2.75, followed by $3.50.

On the contrary, if the seller continues to defend the $2 resistance, the coin price could enter another correction. A bearish pullback from this resistance needs to breach the immediate support of $1.75 to regain bearish momentum.

If materialized, the 4-hour chart pattern could develop a bearish reversal pattern called a double-top. Following the pattern, the coin price could be as low as $1.27 with a prolonged risk of correction ahead.

Also Read: Avalanche Jumps 14% as Scaramucci Backs $700M AVAX Treasury Pivot