The US Federal Reserve’s interest rate decision today is expected to have far-reaching implications on the crypto market, especially tokens like HYPE. This anticipation is bolstered by a whale’s big bet on Hyperliquid’s HYPE, sparking speculations of a possible sell-off. The whale may be looking to capitalize on the crypto’s potential gains following the Fed’s much-awaited interest rate cut.

Notably, this substantial investment and its timely nature have garnered the attention of investors and experts alike. This invokes a fresh wave of excitement and speculation about the whale’s intention and the move’s potential implications on the token price. With the Fed’s decision looming and analysts remaining bullish about its positive influence on the HYPE price, the whale is likely holding out for the crypto market surge to cash out his investment at a peak price point.

HYPE Whale Makes Massive Investment

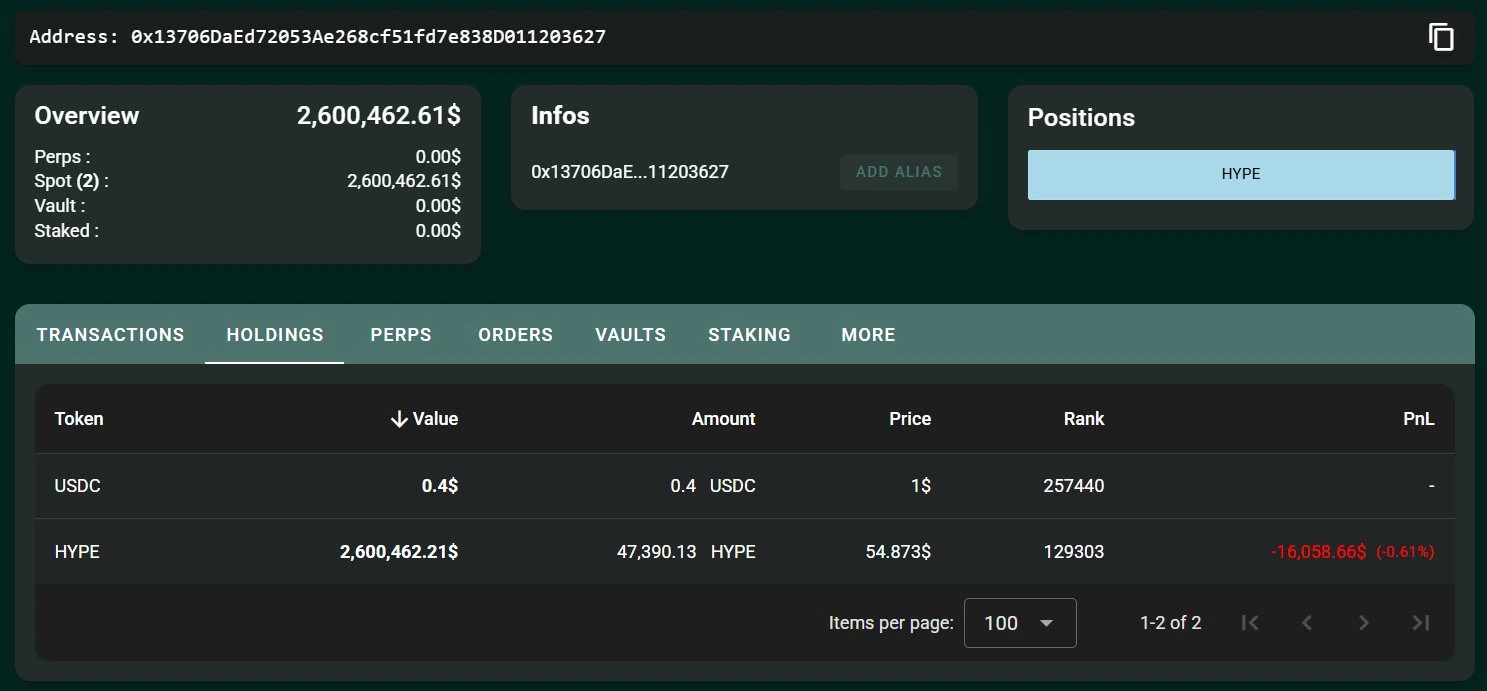

In a pivotal move that has caught the attention of the crypto community, a large investor, often called a whale, has made a bold crypto purchase. In an X post, Onchain Lens revealed this massive HYPE token purchase worth $2.616 million.

The whale, who had been dormant for three months, suddenly sprang into action, depositing a staggering $2.616 million USDC into Hyperliquid. This substantial influx of capital was then used to purchase a large quantity of HYPE token, with the whale acquiring 47,390 tokens at a rate of $55.20 each.

This strategic investment and its timing have sparked intense interest in the whale’s motivations and expectations for the token’s performance. Particularly in light of the upcoming interest rate decision from the Fed, experts believe that the investment may follow a massive sell-off, capitalizing on the potential rally.

Fed To Cut Interest Rates

The crypto market is bracing for a potential rollercoaster ride as the Fed’s FOMC meeting gets underway, with investors anxiously awaiting the central bank’s interest rate decision. A possible 25-basis-point rate cut is on the cards, and many are betting on a massive rally in the crypto market. This possible reduction that brings the federal funds rate to a range of about 4.00% to 4.25% will be the first cut since December 2024.

Hyperliquid (HYPE) Price Continues to Surge

The Hyperliquid price is currently riding a positive track, having swiftly recovered from a brief consolidation phase in the latter part of August. The token experienced a sharp rise in early September, and this upward momentum has been sustained, with the asset maintaining its gains.

At press time, HYPE token is trading at $55.26, up 5.23% in a day and 1.48% in a week. Over the past month, the token has experienced a more notable uptick of 27%, fueling more bullish anticipations. Driven by this bullish momentum, traders and whales are largely attracted to the token, which is evident from the 20% increase in its 24-hour trading volume, at $318 million. With a market cap of $18.45 billion, the crypto is ranked 11th on CoinMarketCap.

Recently, the cryptocurrency saw a notable surge when VanEck CEO Jan Van Eck expressed his bullish beliefs on HYPE. He said,

“We are bullish on Hyperliquid. We are owners (and have been for several months). This statement shows his strong confidence in this decentralized platform.”

This prevailing positive trend is expected to persist, fueled by anticipation of the Federal Reserve’s interest rate cut. As the market awaits the Fed’s move, analysts believe that Hyperliquid will attract even more attention, possibly leading to increased demand and further price appreciation.

Interestingly, crypto enthusiasts on the X platform predict that assets like HYPE could see a price breakout if the Federal Reserve gives a “positive outcome” today. With the whale’s massive crypto move serving as a vote of confidence, the stage appears set for HYPE token to continue its upward trajectory, at least in the short term.