SOL, the native cryptocurrency of the Solana network, fell 6.5% during Thursday’s U.S. trading session. This downturn followed a broader market sell-off as the trade conflict between China and the United States continue to escalate.

While the market sentiment supports further downfall, the large-scale investors show confidence in SOL’s potential growth, reinforcing the price behavior for a bullish breakout.

A Veteran Solana Whale Makes a Bullish Comeback

In the last four days, the Solana price bounced from $95.2 to $111.12, its current trading value, registering a growth of 16.7%. While this relief rally is yet to confirm its potential to transform into a full-fledged recovery, the on-chain data highlights a renewed accumulation from smart-money investors.

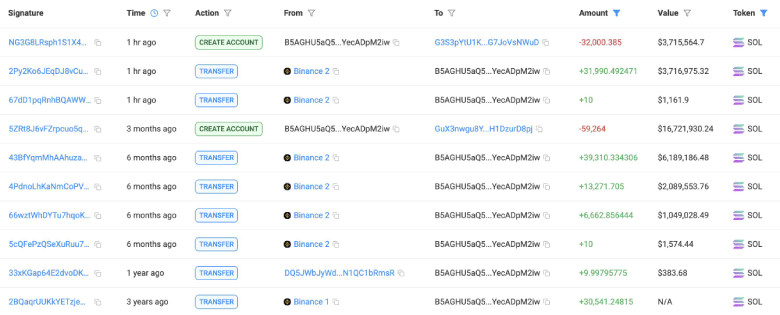

A notable crypto whale has returned to the SOL scene after a six-month hiatus, scooping up 32,000 SOL worth approximately $3.72 million.

According to blockchain analytics firm Lookonchain, this investor purchased 30,541 SOL for $6.61 million at the peak of $216 per token three years ago — and never sold, even when the asset price plummeted below $10.

Such strong conviction from deep pockets could bolster stability in SOL price support for a bullish recovery.

Fake Breakdown Set SOL For Bullish Breakout

On April 6th, the Solana price gave a bearish breakdown from the yearly support of $112 and 50% retracement level. Losing this accumulation zone signals an accelerating bearish momentum for SOL and a prolonged correction ahead.

However, the price action showed a lack of follow-up on the downside, indicating weakness in sellers’ conviction. In addition, the daily chart analysis shows the asset is mainly following the path led by the falling wedge pattern.

Since November 2024, the price action has been actively resonating within two converging trendlines, driving a high-momentum correction. With the fake breakdown of $112 support, renewing bullish momentum for SOL, the buyers are poised to breach the pattern’s resistance trendline.

A successful flip of overhead resistance into potential support will signal an early change in market sentiment and drive a rally past $180.

Also Read: Avalanche Targets $30 Rebound as VanEck Files Avalanche ETF with Nasdaq