Key Highlights

- A bipartisan group of U.S. lawmakers is urging regulators to allow cryptocurrencies to be included as an investment option within the $12.5 trillion 401(k) retirement savings market

- This revelation is expected to implement President Trump’s recent order to “democratize access” to alternative assets like crypto in retirement plans

- If approved, some experts believe that it could attract hundreds of billions of dollars into crypto

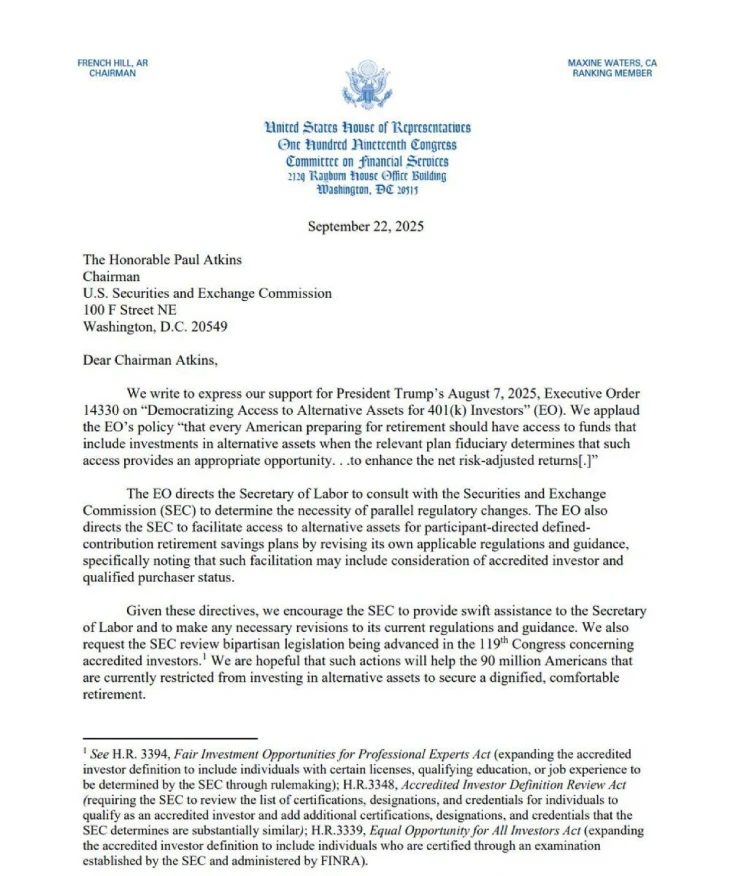

A bipartisan group of Congress members has formally requested that the Securities and Exchange Commission implement President Donald Trump’s executive order aimed at expanding investment options in 401(k) retirement plans.

JUST IN: 🇺🇸 U.S. lawmakers ask SEC to implement President Trump’s executive order opening the $12.5 trillion 401k retirement market to crypto. pic.twitter.com/KcM4GqDZ4C

— Whale Insider (@WhaleInsider) September 22, 2025

The order, signed in August 2025, directs financial regulators to create guidelines that would permit including alternative assets like digital currencies in retirement portfolios that currently hold traditional investments like stocks and bonds.

U.S. lawmakers want crypto to Go Mainstream

American lawmakers are advocating for a huge change that would allow crypto investments in retirement savings accounts, potentially opening up a $12.5 trillion market to digital assets.

(Source: financialservices.house.gov)

The initiative is being led by House Financial Services Committee Chairman French Hill and supported by both Republican and Democratic lawmakers.

They argue that allowing digital asset investments in retirement accounts would provide millions of Americans with more diverse investment options and the potential for higher returns, according to the official document.

Currently, only about 25% of Americans invest in digital assets directly, but retirement accounts cover approximately 60 million workers who could potentially access these assets through their existing savings plans.

The proposal comes with important safeguards. Initial digital asset allocations in retirement accounts would likely be limited to 5-10% of the total portfolio value to manage risk.

Retirement plan administrators would receive legal protections when offering digital asset options. This can address concerns that have previously prevented many from including digital assets in their investment offerings.

Supporters of the measure point to the growing acceptance of digital assets as a legitimate asset class. Major financial institutions like BlackRock and Fidelity already offer Bitcoin exchange-traded funds (ETFs), which could serve as the initial vehicle for retirement plan investments.

These regulated products provide exposure to digital asset prices without requiring investors to manage digital wallets or private keys directly.

Critics, including Senator Elizabeth Warren, have expressed concerns about cryptocurrency’s volatility and potential risks to retirement savings.

They note that digital assets can experience dramatic price swings, with declines of 50% or more occurring during market downturns. Opponents argue that retirement savings should prioritize stability over potential high returns.

Trump Administration’s Legislative Efforts for Crypto Space

The push for cryptocurrency in retirement accounts is part of a broader shift in U.S. policy toward digital assets. Since the beginning of 2025, the current administration has taken several steps to create a more favorable regulatory environment for cryptocurrencies.

These include establishing clearer guidelines for stablecoins and creating a working group focused on digital asset markets.

Financial analysts estimate that if cryptocurrency options become available in retirement accounts, they could attract hundreds of billions of dollars in new investment over the next two years.

This potential inflow has contributed to recent price increases in major cryptocurrencies like Bitcoin and Ethereum, with the total cryptocurrency market value recently approaching $4 trillion.

The Securities and Exchange Commission, now led by Paul Atkins, is expected to move quickly on implementing the executive order. Guidance for retirement plan administrators could be issued as early as the fourth quarter of 2025, though the exact timeline remains uncertain.

This development represents a milestone in digital assets’ journey toward mainstream financial acceptance. By potentially gaining access to retirement savings markets, digital assets would become available to a much broader investor base beyond current cryptocurrency enthusiasts.

However, financial advisors warn that investors should carefully consider their risk tolerance and investment timeline before allocating retirement savings to volatile assets like cryptocurrencies.

Also Read: Trump to Sign Executive Order Allowing Crypto in 401(k) Plans